One quick thing: Eruditus bags $150 million, eyes AI future

In today’s newsletter:

- Zomato, Swiggy orders may get costlier in Karnataka

- RBI ban on Navi, NBFCs leaves fintechs worried

- Top 4 IT firms add 8,400 employees in Q2FY25

Was this newsletter forwarded to you? You can sign up for Tech3 here

Top 3 stories

Top 3 stories

Zomato, Swiggy orders may get costlier in Karnataka

If you use aggregator apps like Zomato, Swiggy, or Amazon in Karnataka, you may soon be paying slightly higher prices!

Driving the news

The Karnataka government is likely to introduce a 1-2% transaction fee on aggregator platforms, impacting a wide range of sectors from ride-sharing to food delivery.

- The move aims to fund welfare programmes for gig workers

Who's affected?

The proposed fee will apply to all transactions on aggregator platforms, including Zomato, Swiggy, Flipkart, Amazon, Ola, Uber, and more.

- This means that consumers using these platforms will likely see a slight increase in their final bills

Authorities had earlier debated whether they should levy a fee on every transaction or simply collect a certain amount based on a company's turnover from Karnataka, sources told us.

Yes, but why?

The Karnataka government's goal is to provide better social security and welfare benefits to gig workers.

- The collected fees will be transferred directly to a welfare board dedicated to supporting gig workers

This follows the government's move in June earlier this year, when it unveiled the draft Platform-Based Gig Workers (Social Security and Welfare) Bill, 2024.

- The bill is scheduled for discussion by the state cabinet on October 24, with plans to table it in the winter assembly session in December.

Concerns and support

While the bill aims to provide social security for gig workers, industry stakeholders have voiced concerns.

- NASSCOM has highlighted potential negative impacts on aggregator businesses

- IAMAI flagged the impact it may have on Karnataka's ease of doing business ranking

Meanwhile, the Indian Federation of App-based Transport Workers (IFAT) and the Vidhi Centre for Legal Policy have welcomed the proposed bill.

Find out more

Picture credit: GPT 4o

RBI ban on Navi, NBFCs leaves fintechs worried

Tell me more

The Reserve Bank of India's (RBI) ban on Sachin Bansal-backed Navi Finserv and three more Non-Banking Financial Companies (NBFCs) from issuing loans has stirred significant concern in the fintech industry.

- RBI’s action on Navi was prompted by violations of regulatory norms like high interest rates, poor borrower assessment, and questionable loan practices

- While some call the outright ban a "growth stifler," others support the RBI’s move to rein in the "growth at all costs" mindset

While regulation is necessary, overly harsh restrictions could push borrowers towards informal moneylenders, especially in rural and underserved areas, they argue.

Experts weigh in

The RBI's warning follows its October 9 monetary policy statement cautioning against unsustainable NBFC expansion strategies.

- Experts warn that rapid expansion without risk management sets the industry up for long-term trouble

NBFCs should rethink their target-driven compensation models, which may incentivise risky lending and unsustainable growth, experts said.

"Some NBFCs, including MFIs and HFCs, chase excessive returns on equity due to substantial capital inflows from investors, leading to high interest rates, processing fees, and penalties on borrowers," experts say.

What next?

The RBI’s crackdown is expected to slow down lending, especially in unsecured and high-risk segments.

- Co-lending arrangements between banks and fintechs could face increased scrutiny, affecting future partnerships

Go deeper

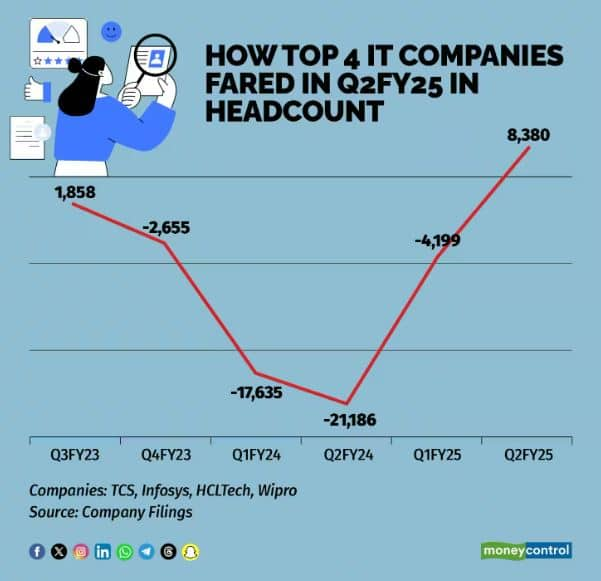

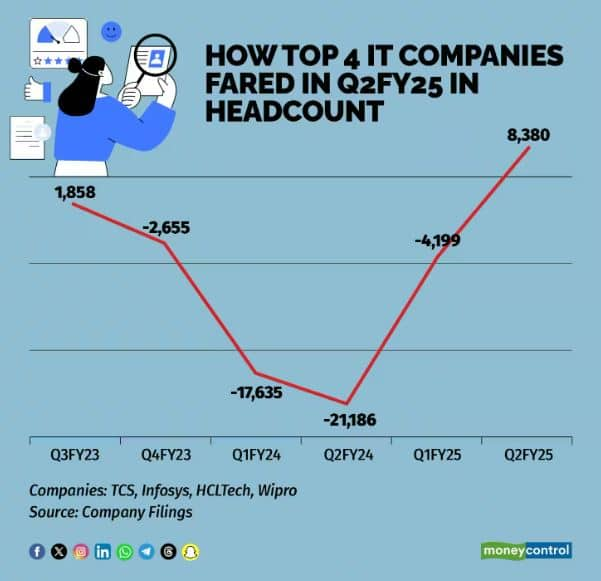

Top 4 IT firms add 8,400 employees in Q2FY25

While the Indian IT sector is not entirely out of the woods yet, there's one metric that seems to indicate a promising sign of recovery.

Driving the news

The top four Indian IT services giants —TCS, Infosys, Wipro, and HCLTech—added around 8,380 employees in the quarter ended September 30 (Q2).

Hiring fell drastically in FY24 as was evident from the fact it was a first in at least five years.

Tell me more

In Q1, the top IT companies said they would hire about 90,000 people.

- While the number may not be that huge, it suggests a broader increase in demand for tech talent, which could also lead to increased hiring by startups

We previously reported that Indian tech companies and startups are back on a talent hunt after nearly 12 to 18 months, with a 20-month high of 168,000 active job openings.

A pitfall

Many IT companies have postponed annual salary increments to defend their margins in Q2.

- However, analysts point out that when the demand situation improves, employees may be lured away by startups offering higher salaries

As one analyst put it: “When growth returns, they will start losing talent.”

Dig deeper