Anubhav Sahu Moneycontrol research

US President Donald Trump is continuously challenging his country’s politico-economic status quo with partner countries to negotiate a better deal. The recent use of trade tariffs as a lever possibly has far-reaching implications for geopolitics than economics.

Trade tariffs – Hunting for a bargain

Trade tariff talks have been in focus over the last few weeks after the US raised import tariffs on steel and aluminium. During Trump’s tenure, such bullying tactics have had the desired effect on occasion.

Trump’s campaign rhetoric of declaring China a currency manipulator, and criticism of China’s trade and foreign policy later (read North Korea), put the dragon on the backfoot to an extent.

Import tariffs on metals, similarly, is not necessarily a spanner in the works. Canada and Mexico have already been given an exemption on import duties (possibly contingent on a deal on NAFTA). UK’s International Trade Secretary Liam Fox is seeking the same. The key here is what the US is hoping to gain in return for softening its stance on import tariffs. The benefits could range from military to trade cooperation.

As Peter Navarro, director of the White House National Trade Council, says, the US can institute tariffs on foreign goods without starting a global trade war or violating World Trade Organisation rules. While US’s partners are accusing it of protectionism, Trump & co are merely tweaking trade tariffs in lieu of preferential treatment on other fronts.

Long seen as a cheerleader of globalization, the US is harping on bilateral negotiations in trade/service/politics/economics and in the process, undermining the role of multilateral organizations like WTO.

Trade balance debate on China

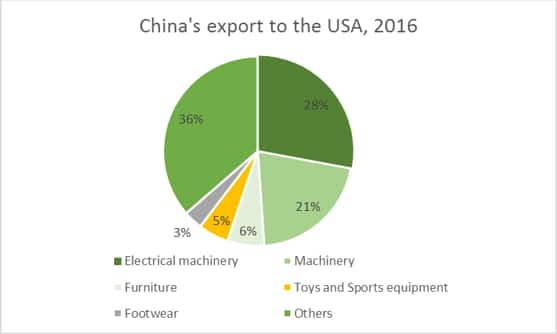

A substantial chunk of the US trade deficit is on account of China (USD 375 billion out of the USD 566 billion trade deficit in 2017). The US wants China to cut its (China’s) surplus by USD 100 billion. Additionally, as a part of investigation on China’s practices on intellectual property, tariffs on Chinese information technology, telecom and consumer products are likely.

A substantial reduction in China’s trade surplus with the US appears to be nearly impossible. In fact, one possible corollary is that US manufactures (importers of Chinese machinery) could shift their base elsewhere to avail lower cost of imported inputs, which would negate the objective of job creation in the US.

Economic benefit debatable but “political mandate first”

A study by the Peterson Institute for International Economics shows that in 2009, when the Obama administration levied tariffs on Chinese tires, it helped generate 1,200 jobs in the tire industry, but at a cost of USD 900,000 per job due to higher prices.

So, a direct economic benefit by erecting trade barriers is not a given. However, there could be indirect economic benefits in other areas.

More importantly, such a move also helps Trump shore up his political capital, given the promises he had made to working class voters.

Cabinet shuffle

In this politico-economic context, the recent departure of Secretary of State Rex Tillerson and Gary Cohn, and talks of a another cabinet reshuffle do not come as a surprise. In an environment where political and economic stances are bold as well as flexible, President Trump may not want uncertainty in policy communication.

Open criticism of his policies by his aides may result in undermining of authority, and miscommunication with global power centers in general and Trump’s loyal vote bank in particular. So it may not be surprising if news of more of such exits appear in the future. Investors should not attach too much economic significance to such developments as these economic/policy announcements have deeper geopolitical implications than what meets the eye.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.