Amol Agrawal

The high-profile Bimal Jalan committee submitted its report to the RBI after much wait and anticipation. After accepting and applying the committee’s recommendations, the RBI transferred Rs 1.76 lakh crore to the government.

This amount comprises RBI’s annual profit of Rs 1.23 lakh crore and Rs 52,637 crore excess reserves/provisions written back. It is surprising that most of the Rs 1.76 lakh crore bonanza came not from recommendations of the Jalan panel, but from RBI’s treasury operations.

This piece focuses on excess reserve, which again is no small amount as it is larger than the entire surplus of Rs 50,000 crore transferred last year. But before getting into further details, let us understand what these reserves and surplus mean by way of an illustrative example.

Primer

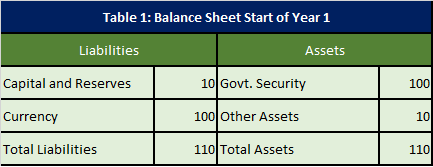

Say, the government establishes the RBI at start of year 1 with capital and reserves of Rs 10 (equity) and estimates demand for currency at Rs 100. The government issues government securities – typically, the RBI holds a mix of gold, foreign and domestic bonds -- worth Rs 100, and Rs 10 is other assets (office space etc).

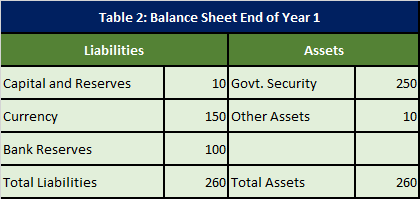

In the first year of operations, banks avail of daily liquidity worth Rs 100 from the RBI and give Rs 100 of G-secs as collateral. The demand for currency also increases by Rs 50, which is funded via an increase in G-secs. The balance sheet at end of year is as follows:

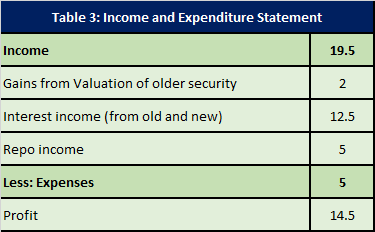

However, this does not account for profits and this is where things get interesting. Say, the value of the earlier security increases to Rs 102. That means there is a profit of Rs 2 -- we could revalue new securities as well, but let’s skip that to keep things simple.

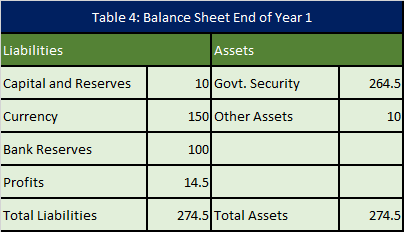

The RBI also earns interest on both old and new securities – at 5 percent, that is Rs 12.5. The central bank also gets paid by banks for providing them liquidity – at 5 percent interest -- This is nothing but the repo rate. That is another Rs 5 in income. The Reserve Bank will also have some expenses such as cost of printing of notes and wages (say Rs 5). This leads us to RBI’s Income and Expenditure Statement (Table 3), which shows a profit of Rs 14.5 and accordingly, balance sheet (Table 4) also changes.

How does the RBI distribute the Rs 14.5 profits or surplus? Just like there are profits today, there could be losses tomorrow and the apex bank (like all banks) should have a cushion to absorb the negative shock. For instance, we have not included forex assets in the tables and the RBI holds a larger share of forex assets. The forex assets are prone to sudden changes, given volatility in exchange rate markets.

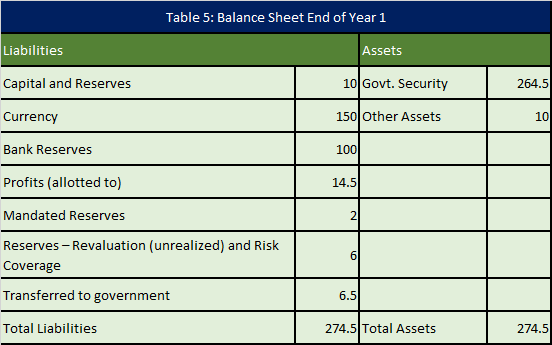

Typically, this surplus is divided into three broad heads: 1) mandated reserves, 2) reserves comprising revaluation and risks coverage, and 3) surplus transferrable amount to the government. The RBI board, which decides on the allocation of these profits, decides to distribute them as in Table 5.

The board decides on whether to realise the revalued assets or keep them unrealised. This decision of what to realise and what to keep as unrealised is based on the accounting norms followed by central banks, which are mostly conservative, and hence remain unrealised. Over time, these unrealised reserves become very large and become the source of contention between the central bank and the government.

Based on the above, highly simplified example, we get some idea of how the central bank’s balance sheet changes.

Conflict

One important takeaway is that each rupee set aside towards risk management means one rupee less of surplus to the government. In India, the reserves comprising both the risk overage and revaluation became a bone of contention between the RBI and the government. Over time, the share of revaluation reserves has increased to about Rs 9.6 lakh crore, or 27 percent of RBI’s balance sheet in 2017-18 (Pls see history of RBI reserves). The government, which runs a fiscal deficit of about Rs 6 lakh crore annually, eyed some of these reserves. The RBI under former governor Urjit Patel resisted.

This is not a unique conflict. It has led to some governments – for example, in Sweden and Germany -- to define the rules of distribution (Pls see earlier piece). Even if there are rules, the provisions could grow, leading to questions over whether the provisions are excessive as seen in the case of India.

In India, there were no specified rules. The RBI board, the main governing body of the central bank, decided on the amount of transferrable surplus each year. There have been attempts in the past to make rules for this distribution, but were not deemed enough. Now, that has changed with the Jalan committee suggesting a revised framework.

The panel in its report has first asked for simplification of the several RBI reserves based on two categories of risk and revaluation. The committee has reclassified the first category of risk reserves as Contingent Risk Buffer (CRB) and specified that it should be around 5.5 -6.5 percent of RBI’s balance sheet. The RBI estimated that at the end of June 30, 2019, this contingency buffer stood at around 6.8 percent of its balance sheet. The board decided to maintain the CRB at 5.5 percent and transferred the remaining, which stands at Rs 52,637 crore, to the government.

As far as revaluation reserves are concerned, the committee has not included these in the transfer. It noted that in another cross-country survey of 57 central banks, 42 do not transfer revaluation gains. It is generally not a good practice to transfer these revaluation gains as market conditions could turn adverse very quickly leading to a position of losses. Thus, it is better to leave those reserves untouched. This is a big relief to the RBI watchers as it is these reserves which constitute the largest part of reserves -- around 19 percent -- and there were concerns that these would be transferred to the government becoming a big windfall.

The committee has further suggested that the board looks at the ‘realised equity’ of the central bank to decide surplus distribution. The realised equity comprises both capital and risk reserves. If the actual realised equity is greater than upper bound of the desired equity, the entire income of the RBI should be transferred, or else provisions have to be made. The best thing here is that the committee has said there should be no transfer of unrealised revaluation balances. The committee has also suggested review of the RBI’s capital framework in every five years, given the dynamics of changing economic and financial environment.

Overall, one has mixed feelings about the whole episode. It is hardly the case that reserves belong only to the RBI and that the government is forcing the central bank to part with it. Whether one likes it or not, they do belong to the government as part of the larger public sector balance sheet. It was not a question of whether the committee will recommend transfers of the reserves, but what will be the mechanism of these transfers. Based on the suggestions of the committee, the RBI board has done a one-time transfer of the reserves.

The government had already budgeted nearly Rs 1.06 lakh as dividends from the RBI and financial institutions. It has got much more than desired and will help lower fiscal concerns. The bonanza could have been much more had the panel suggested transfer of reserves under the revaluation category, which were much larger in nature. Hence, it is not as bad as people thought it to be.

Having said that, India joins the list of some other countries such as Austria, Turkey, Italy and so on, where similar episodes of government demanding higher share of the pie from the central bank are being seen. These countries, especially Italy and Turkey, are going through a political and economic crisis and are examples of bad governance. Italy is part of the European System of Central Banks and it may not be easy for the government. But Turkey recently saw forced ouster of the Governor followed by the central bank paying interim dividend to the government.

India is trying to present another image compared to these two countries, yet doing the same things as them. The RBI has also paid interim dividends in two consecutive years (Pls see earlier piece) and seen resignations of key officials who opposed these transfers. The Jalan panel has said interim dividends should be resorted to only in extreme cases, but the definition of extreme lies with the government.

The ball finally remains in the government’s court and it should have handled the affairs in a much better manner. The Jalan panel has laid a framework and it is up to the authorities to ensure it is followed.

Amol Agrawal is faculty at Ahmedabad University. Views expressed are personal.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.