India will need medical devices worth $50 billion by 2030. If the domestic industry does not expand due to technology or policy constraints, the space will be occupied by large-scale imports. It's time for India to harness its capabilities, bolster domestic manufacturing, and solidify its position as a medical device industry leader. The National Medical Devices Policy, 2023 marks a significant step, yet the challenges of import dependence and underutilized domestic potential persist.

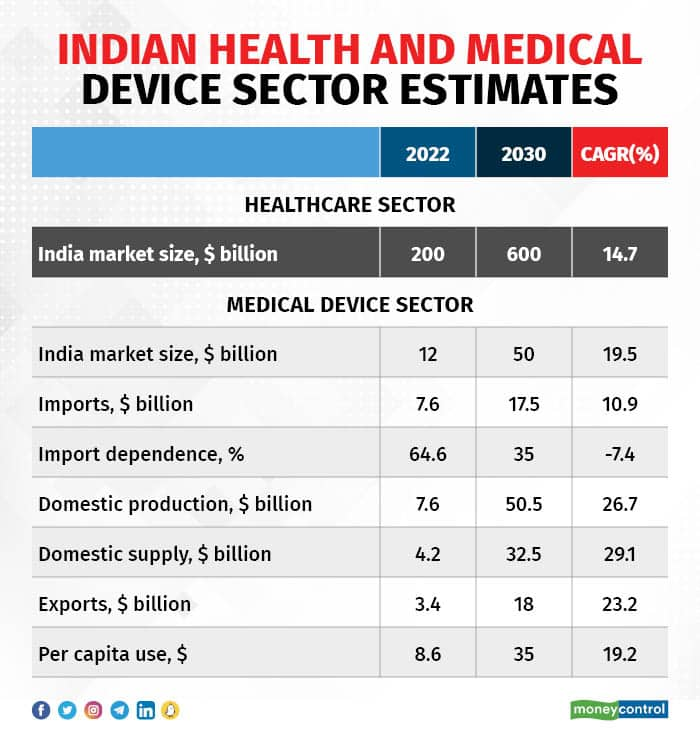

India produces around $7.6 billion worth of medical devices, of which $3.4 billion is exported, and the remaining $4.2 billion is used domestically. However, the annual demand for medical devices in India is valued at $11.8 billion, of which imports total $7.6 billion. Thus, imports account for 65 percent while local firms fulfil just 35 percent of the needs of the Indian market.

The sector could expand from about $12 billion currently to $50 billion by 2030. Growth in India’s medical devices industry will cut the country's dependence on imports from 64.6 percent to 35 percent and increase exports from 3.4 billion to 18 billion by 2030. It could generate over 1.5 million jobs in medical device manufacturing and healthcare services like hospitals and labs.

Ready For Turnaround

India has 1,200 local companies and multinational corporations (MNCs) that manufacture a wide range of devices. The medical device sector showcased its capabilities during the Covid-19 pandemic by swiftly scaling up the production of essential items like ventilators, rapid antigen test kits, RT-PCR kits, infra-red thermometers, PPE kits, and N-95 masks for both domestic and global use.

India is among the global top ten manufacturers of a range of medical products such as syringes, needles, IV cannulas, surgical blades, surgical gloves, contraceptives, intraocular lenses, orthopaedic trauma implants, stents, ventilators and X-ray equipment. It produces many high-end and critical equipment including heart valves, joint implants, robotic-assisted surgical systems, radiotherapy equipment, ophthalmic excimer laser, and high-end operating microscopes.

The medical device market remains more underpenetrated. Against the global per capita spending of $75 on medical devices, spending in India is a low $8.6. But this is projected to rise to $35 per capita as India's healthcare industry expands from around $200 billion currently to about $600 billion by 2030. Growth will be driven by significant investments from corporate hospitals, telemedicine and medical tourism. Expanding global trade in medical devices from the current $450 billion to $800 billion by 2030 will also help.

Policy Intervention

Achieving the full potential of the sector will require further support from the government as the sector faces 15 percent cost disability due to among other factors the high cost of power and supply chain inefficiencies. Here are some suggestions for the government.

Adjust customs duty: Raise basic customs duty from the current 0-7.5 percent to 15-20 percent for devices not covered under Information Technology Agreement (ITA 1). This approach is World Trade Organization (WTO) compatible, as bound duties stand at 40 percent. Initial duty hike should apply to products with demonstrated quality production and exports of around Rs 20 crore. A successful precedent exists with mobile phones, where a 20 percent duty spurred manufacturing and exports. Global import duties for medical devices vary – it is at 14 percent in Brazil, 0-15 percent in Russia, 3.3-17 percent in China and 0-20 percent in South Africa.

Restrict input tax credit: The government should not allow input tax credit (ITC) for the integrated GST (IGST) paid on the import of items where the basic customs duty is zero. The duty could be at zero due to India’s commitments in ITA1 and free trade agreements (FTAs). Before GST was implemented, domestic producers enjoyed better treatment as importers paid 6 percent countervailing duties and 4 percent special additional duties on imports without the benefit of tax credits. Now, importers get full ITC for the IGST paid and have better margins, driving many local manufacturers to shut units and turn importers.

Ban used/refurbished imports: A ministry of environment, forest and climate change order of June 19, 2023 allows import of used/refurbished discarded medical devices. The order helps developed countries dump used/old technology devices on India as they move to newer and better technology devices. This needs to stop. Developed countries and China does not allow the import of used products. Old devices are 30-40 percent cheaper than the new ones and have the potential to kill all government initiatives and throw the domestic sector out of production. Such orders confuse firms that have been investing in manufacturing in the last few years. For most devices in the list, India has world-class production facilities.

Also, old devices used for magnetic resonance imaging or ultrasound scanning, X-rays and mammography may provide faulty prognoses and threaten lives. Many old devices are at risk of spreading harmful contaminants like depleted uranium. This may have undesirable effects on the environment.

Introduce PLI plus scheme and promote local sourcing: The government needs to introduce a performance-linked incentive (PLI) plus scheme for high import-intensive products, such as diagnostic reagent kits, surgical instruments and other medical devices. It should offer incentives to companies that add significant value in India rather than just assembling imported components. The government should also encourage local sourcing for essential "Make in India" products, particularly during crises like the Covid-19 pandemic. It should ensure that Indian manufacturers can compete effectively with foreign imports for vital supplies in government tenders and critical healthcare scenarios.

That apart, there is a need to identify industry and research bodies influenced by foreign lobbies and guard against foreign interests dictating policy outcomes reports of such bodies.

The future of India's medical devices industry is at a pivotal juncture. With the potential to grow from $12 billion to $50 billion by 2030, the sector holds immense promise to not only reduce reliance on imports but also create a robust job market, accelerate technological advancement, and ensure India's self-reliance in critical healthcare supplies. We must do it.

Ajay Srivastava is founder, Global Trade Research Initiative, a research group on trade and climate technology issues. Views are personal, and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.