Saurabh Mukherjea and Rakshit Ranjan

Great lenders benefit significantly in the aftermath of a financial crisis. This is because (a) when the competition struggles to raise funds during and after a crisis, great lenders have access to adequate liquidity and (b) as the competition’s ability to lend reduces, great lenders can pick and choose quality borrowers, leading to better net interest margins (NIMs), higher loan book growth, lower NPAs (non-performing assets) and hence, better RoE (return on equity).

However, it is also worth bearing in mind that as the crisis intensifies, great lenders might witness some short-term moderation in loan book growth -- which then leads to a temporary rise in NPA ratios -- as it is always prudent to maintain discipline while selecting borrowers during a deteriorating macro environment.

“What is certainly clear is that again and again, countries, banks, individuals, and firms take on excessive debt in good times without enough awareness of the risks that will follow when the inevitable recession hits. This time may seem different, but all too often a deeper look shows it is not... More money has been lost because of four words than at the point of a gun. Those words are ‘This time is different’.” – Carmen Reinhart and Kenneth Rogoff, ‘This Time Is Different: Eight Centuries of Financial Folly’ (2009)

Lessons from historical financial crises

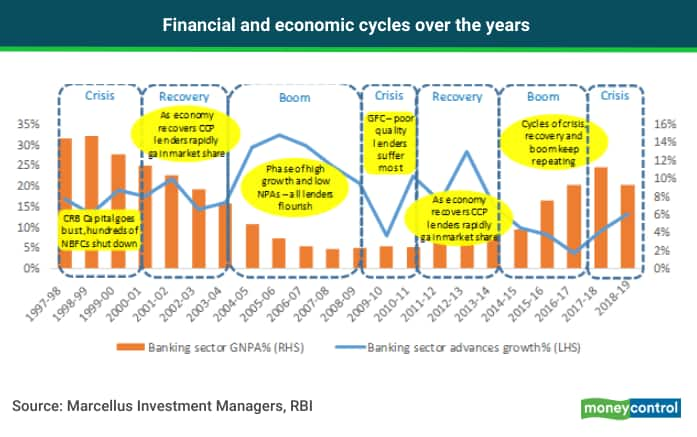

As highlighted in the exhibit above, a few years of high loan book growth, low NPAs and economic boom are inevitably followed by low credit growth, high NPAs and recessionary fears. Good quality banks and NBFCs (non-banking financial companies) manoeuvre through these economic and financial cycles with razor-sharp focus on capital allocation, execution and underwriting and they do not get swayed by the emotions of greed and fear. Having said that, it is worth noting that how loan book growth, NIMs, NPAs and P/E (price-to-earnings) multiples of good quality lenders move during and after a crisis.

Given the current environment of gloom and doom for the lending stocks, in the next section, we analyse how great lenders emerged as winners from such crises in the past – HDFC Ltd from the NBFC crisis of the late 1990s and HDFC Bank from the global financial crisis of 2008-09.

HDFC Ltd during the NBFC crisis of the late 1990s and early 2000s

The Indian NBFC crisis in the 1990s was marred by fraudulent behaviour of large NBFCs, changing regulations, and eventually a shakeout in the NBFC sector. In 1997-98, CRB Capital, a financial Services conglomerate with a net worth of over Rs 400 crore and an asset base of Rs 1,000 crore (this was as big as ~15 percent of HDFC Limited’s loan book size then), which was even granted a provisional banking licence, duped millions of small investors of their investments in its mutual fund and fixed deposits.

Even though CRB had AAA credit rating -- just like IL&FS had before the ongoing crisis started -- the auditors never pointed to any problems and CRB had 133 subsidiaries before the crisis. As the crisis deepened, the government infused Rs 2,550 crore into three public sector banks, IFCI had to be bailed out with a Rs 1,000 crore package, NPAs of IDBI increased to 18 percent and Global Trust Bank’s net worth turned negative (it had to be eventually merged with the Oriental Bank of Commerce). Subsequently, as the RBI tightened NBFC regulations, the number of NBFCs dropped to 7,855 in March 1999 from 55,995 in March, 1995 i.e. over 80 percent of the NBFCs were shut down.

The exhibit below shows how HDFC reported an increase in GNPAs (Gross NPAs) by ~50 percent i.e. from 0.7 percent in 1997-98 to 1 percent in 1998-99. Growth in PAT and loan book moderated and the P/E ratio compressed by ~40 percent in 1998-99. However, after the crisis, HDFC’s loan book growth accelerated from 18 percent in 1998-99 to 31 percent in FY01 and 30 percent in FY02, and its PAT growth went back to over 20 percent CAGR after the crisis, from as low as 14 percent during the crisis. As a result, despite a 40 percent cut in its P/E multiple in FY99, over the five year period from March 1998 to March 2003, HDFC delivered a share price CAGR of +16 percent while the Sensex delivered a -5 percent CAGR during the same period.

HDFC Bank during the 2008-09 global financial crisis

During the 2008-09 crisis, Indian NBFCs had a massive ALM (asset-liability-management) mismatch -- over 50 percent of the NBFCs had borrowings which matured within one year while average asset duration was 3 years. Disbursements for several NBFCs were down by 50-70 percent due to lack of funds. In September 2008, NBFCs’ borrowings from mutual funds had increased to 45 percent of total borrowings vs 30 percent in March 2006. ICICI Bank, the largest private sector bank at that point, saw large delinquencies on its retail book - GNPAs for ICICI Bank rose 100 bps from 3.3 percent in FY08 to 4.3 percent in FY09. Immediately after the Lehman crisis subsided, as part of its attempt to deal with inflation, the RBI changed the policy rate a record 13 times between April 2010 and October 2011, increasing it from 3.25 percent to 8.50 percent during the period.

In an uncertain and volatile environment with the lending system afflicted by rising NPAs, HDFC Bank continued to cautiously grow its retail loan book. HDFC Bank suffered the same fate as HDFC Ltd in the previous crisis: its NPAs as a percentage of loan book increased by ~50 percent and P/E ratio compressed by ~40 percent in FY09 (see Exhibit 5 below). Then, in the years following the crisis, HDFC Bank was able to rapidly gain market share and its asset quality became better than the pre-crisis years. As competition reduced, yields increased and HDFC Bank was able to offset the asset quality risk with better pricing. PAT growth was sustained at ~30 percent CAGR (compound annual growth rate) both before as well as after the crisis. As a result, despite a 40 percent cut in its P/E multiple in FY09, over the five-year period of March 2008 to March 2013, HDFC Bank delivered a share price CAGR of +26 percent while the Sensex delivered a +4 percent CAGR during the same period.

What differentiates the lending stocks which we hold in our clients’ portfolios, from their competitors?

“With little differentiation in finished products (loans and services) and no aspirational value attached to these products, low raw material cost (as measured by the cost of funds) and superior execution are the only two key competitive advantages for a top-quality retail bank. Moreover, a hugely leveraged balance sheet (10x leverage is normal for banks) means that below-par credit selection usually has a disproportionately large adverse impact on the bank’s profitability.” - ‘The Unusual Billionaires’ by Saurabh Mukherjea (2016) – see chapter 7 on HDFC Bank.

Apart from having their own individual strengths, the commonalities that differentiate HDFC Bank, Kotak Mahindra Bank and Bajaj Finance from their competitors are:

Investment implications

History may not repeat itself, but it does rhyme. We believe that the ongoing financial crisis will turn out to be a big positive for these three lenders in Marcellus’ Consistent Compounders Portfolio. As was also witnessed recently, HDFC Bank, Kotak Bank and Bajaj Finance emerged largely unscathed from the IL&FS debacle -- The only impact they suffered was a short-term de-rating of multiples while business continued as usual for these companies.

Saurabh Mukherjea and Rakshit Ranjan are the authors of ‘Coffee Can Investing: the Low Risk Route to Stupendous Wealth’. They are also Founders of Marcellus Investment Managers (www.marcellus.in). This article is an adapted version of one previosly published on Marcellus’s web site.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.