The RBI delivered a surprise with its off-cycle rate-hike of 40 bps earlier this month. Taking cues from this startling move, a high inflation print to the tune of 7.4-7.5 percent was being built into the expectations.

However, India’s CPI for April 2022 of 7.79 percent came in still higher than anticipated. To put this figure into perspective, it’s the highest inflation faced by India in 8 years, second only to 8.33 percent in May 2014.

Domestic impact of exogenous factorsThese rising prices can be explained almost entirely by rising crude and the ongoing conflict between Russia and Ukraine. While OPEC’s slow ramp-up in production and supply-chain constraints have led to high crude prices, vegetable and oil prices remained under pressure as Ukraine accounts for significant exports of sunflower oil and fertilizers to India.

This is to say that India’s soaring inflation is being driven primarily by exogenous factors. However, its manifestation in the Indian economy is being shaped by the fact that domestic demand has not picked up pace yet, especially in the rural and low-income segments – IIP (Index of industrial production) grew by a meagre 1.9 percent in March. In effect, producers are unable to pass the rising costs on to consumers without causing a dent to the sales volumes. So, quite understandably, many listed companies are getting clobbered in the stock markets.

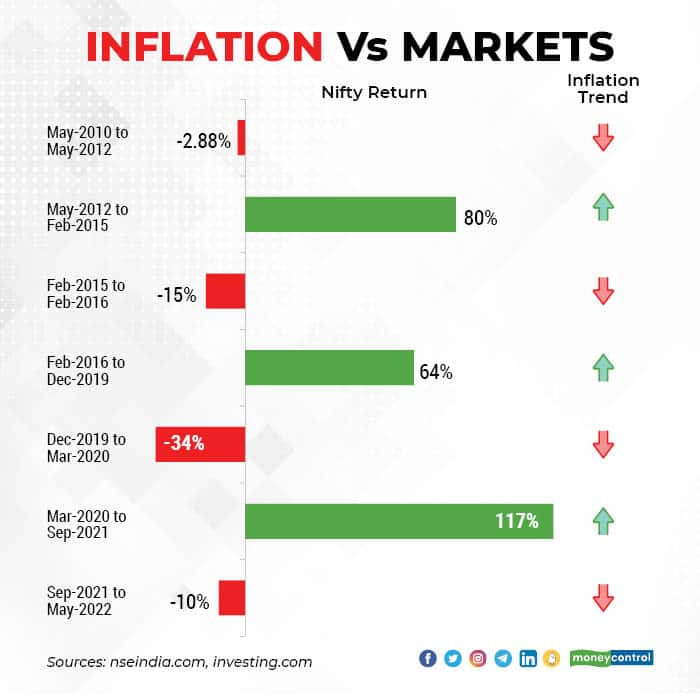

Historical “relationship” between inflation and stock marketsHowever, if we look back at the last decade, the relationship between inflation and stock markets has not been straight-forward to say the least. In fact, in two of the last four instances of correction in the Nifty, inflation was on a downtrend. On the other hand, inflation was also on a downtrend in two of the last three instances of upswings in the Nifty.

So, inflation as a standalone factor has not been a good indicator of the stock markets. This empirical finding is corroborated by fundamentals as well—if inflation is rising as a result of escalating demand, it’s good news for the economy and consequently, the stock markets. But, if inflation is spiraling upwards due to supply constraints, despite low demand, as is happening now, it spells bad news for the economy unless demand is able to play catch-up.

Other macroeconomic factors at playHaving established that inflation alone cannot be used to form expectations for the stock markets, let’s look at which other macroeconomic factors play a role.

First on the block is crude. India imports 85 percent of its crude requirements. In fact, among major economies, India is the most dependent on crude as crude accounts for nearly one-third of its total imports. To be fair, crude is only a part of rising inflation. But Indian stock markets track crude much more closely than they do overall inflation. This has proven especially true since the fuel price deregulation.

Crude has followed a generally upward trend, just like stock markets have. However, unlike stock markets, crude has a tolerance cap of $100/bbl beyond which it starts unsettling equities. This has happened only a handful of times in the past, and in all those instances, the consumers were protected—at least partial regulation of domestic fuel prices meant that consumers did not have to bear the full brunt of spikes in crude price. This time, however, that’s not the case. Barring a few lags due to political considerations, domestic fuel prices and thereby, stock markets have been closely mirroring the vagaries of crude.

The next macroeconomic factors are yields and FII flows. The Indian economy has been among the fastest growing major economies, and thus, makes for an attractive investment destination for FIIs. While this makes it easier for Indian companies to raise funds and opens new avenues for their growth, on the flip side, it makes Indian stock markets particularly sensitive to movements in the yield spread. When yield spreads widen, Indian investments are rendered more attractive for FIIs.

On the other hand, in times like today, when compared to India, the US is on a much steeper rate-hike curve so as to combat its decades high inflation, yield spreads with India have been narrowing down. This leads to FII outflows, which unless countered by equally strong DII and retail inflows, leads to market corrections. In fact, the ongoing market correction has been driven by month after month of FII exodus.

What can we expect going ahead?The RBI has already embarked on its rate hike cycle, while the US has indicated that it may be looking at multiple 50bps rate hikes in the coming months. This indicates that the yield spreads may soon widen. However, it should be noted that the government plans on borrowing in order to support India’s nascent recovery amidst rising inflation. To keep the government’s borrowing costs in check, the RBI is expected to undertake Operation Twist which would bring down long term yields. So, longer term foreign funds are expected to remain at bay until domestic demand picks up and is no longer dependent on government spending.

Even apart from FII flows, quite a lot hinges on domestic demand. The wide gap between WPI and CPI inflation has been eroding company margins for a while now. This has reflected in their stock returns as well, and can be reversed only if demand strengthens enough to be able to effectively absorb price hikes.

Finally, developments along the geopolitical and pandemic dimensions remain key monitorables for the foreseeable future.

Ananya Roy is a fund manager. Twitter: @ananyaroycfa. Views are personal, and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.