Market participants have had an experience akin to a horror film for the last three-four months; it is usually the unexpected twists which can be very petrifying, both in a film and in the capital market. Expectations of a US Fed pivot quickly turned to a much more aggressive and hawkish Fed which was willing to tolerate higher unemployment and much slower growth in its quest to anchor inflationary expectations.

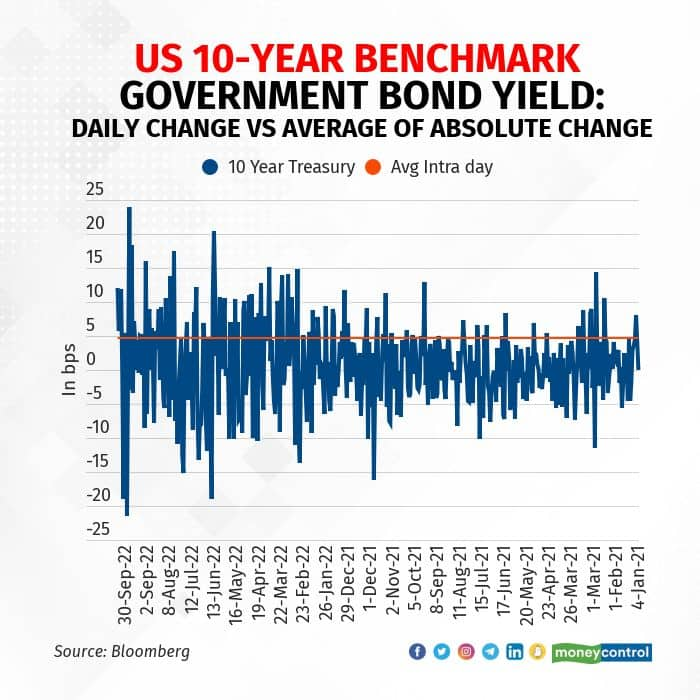

Although interest rates have been rising since December, and investors were broadly prepared for the ‘normalisation of rates’, it is the significant spike in volatility amplified by firm central banks, declining balance sheets, and escalating geopolitical tensions which have led to anxiety among market participants. There has been substantial pressure on bond yields and appreciation of the US Dollar to its multi-year highs not only with respect to emerging market (EM) currencies but also reserve currencies stoking balance of payments (BoP) pressures, especially in economies with low real rates, or high import intensity.

While a more frontloaded rate-hiking cycle in advanced economies will have spillover effects on EMs including India, we expect barring an exceptional geopolitical or a currency crisis, our view of a terminal policy rate up to 6.5 percent should not get materially tested for the following reasons.

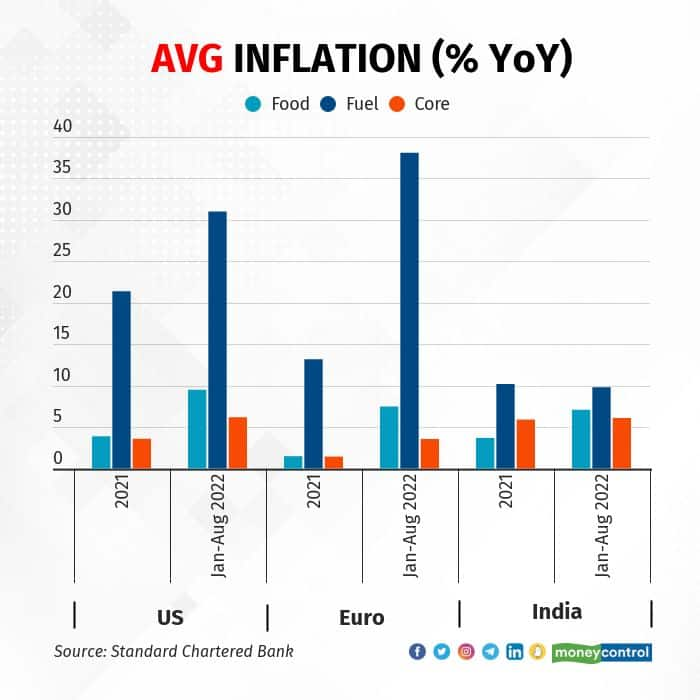

As can be seen in the graph above, US inflation is much more broad-based due to a significant fiscal stimulus in response to the pandemic, and an extremely tight labour market, while Europe is suffering from the scarring effects of the energy shock. While core inflation is likely to be sticky in India, stable food prices and base effects could help inflation move towards the Reserve Bank of India (RBI)’s 5 percent CPI target in Q1FY24, and also lower household expectations next year.

Growth HeadwindsAggressive monetary actions from advanced economy (AE) central banks create growth headwinds. Exports form a reasonable component of our GDP (+20 percent). Export and investment cycles tend to be correlated, and an export slowdown could also result in a slowdown in the capex cycle, especially if uncertainty and tighter financial conditions remain in the fray. Weak exports can also spill over into weaker job markets with a lag, and can also impact domestic consumption.

Leveraged Balance Sheets Leveraged government balance sheets make it difficult for AE central banks to keep extremely high policy rates for longer. Given the significant amount of build-up in sovereign debt since the 1980s, the AE central banks cannot keep on aggressively hiking rates without damaging something, especially given the massive pace of change of their bond yields in the past year.

While markets may continue to behave erratically in the near term, a more frontloaded and aggressive rate hiking cycle in the AEs increases the probability of inadvertent systemic error, downside risks to growth, and, thereby, cyclical disinflation for India over the medium term. We continue to expect more measured tightening by the RBI, unlike the large moves by the US Fed and the European Central Bank (ECB) unless there is a meaningful change in inflation/external account drivers.

We were running duration across the majority of our funds at the lower ends of their duration spectrum for some time as we believed that it was a bit early to factor in the peak in inflation and subsequent monetary moderation, given the lack of slowdown in inflation momentum which was needed for the pivot trade to work which hasn’t really materialised given the tight labour market.

However, the current volatility in the bond market and especially on the short end of the yield curve (1-5 years) is driven more by capitulation, and extreme risk aversion. This presents a great opportunity for patient investors who can tolerate intermittent volatility.

We believe investors with tolerance for intermittent volatility, and 6-12 months horizon may consider allocation towards the money market, and low-duration strategies given the significant correction while investors having more than two years horizon may consider actively managed high-quality short-term or corporate bond strategies.

Investors with more than three years of investment horizon may consider a staggered allocation towards roll-down strategies to lock in the current high levels.

Anurag Mittal is Deputy Head - Fixed Income, UTI Asset Management Company Limited. Views are personal, and do not represent the stand of this publication.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.