Moneycontrol research Anubhav Sahu

The result of Himadri Chemicals Q3FY18 reflected a sequentially jump in earnings guided by continued strong pricing trends for the carbon products leading to higher gross margin along with lower finance cost and operating leverage benefits.

Company guided to further increase in capacity expansion plan for carbon black which adds to the company’s preparedness to meet steady demand increase in the end market.

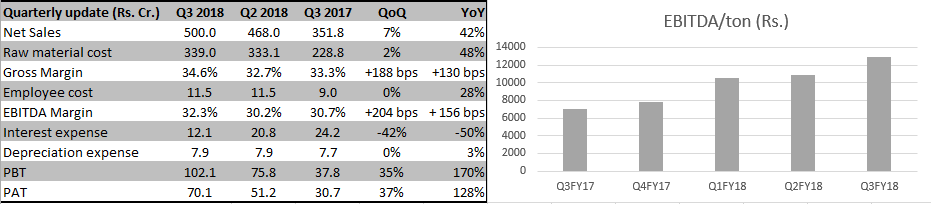

Quarterly update

Himdari’s Q3 sales 2018 were up 42 percent YoY mainly backed by pricing gains partially offset by a tad lower volume. Though raw material cost surged, EBITDA/ton was sharply up by 84 percent YoY on account better pricing trends for carbon black and CTP (Coal Tar Pitch).

EBITDA margin expanded by 156 bps YoY (204 bps QoQ) reflecting healthy operating leverage. Moderate increase in depreciation and Other Expense helped net profit growth of 128% YoY.

Revised capacity expansion plan

While company reiterated setting up 20,000 MT capacity for advance carbon material in West Bengal, it revised its capacity expansion plan for carbon black. Instead of 30,000 MT capacity expansion earlier announced, it is now looking for 60,000 MT additional capacity. This would take its total carbon black capacity to 180,000 MT. For the new capacity expansion plans (Carbon black & Advanced carbon material), funding requirement would be Rs 780 crore.

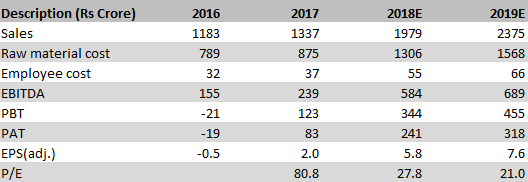

Financial projections

Based on the quarterly results which indicate sustained level of product pricing trends, we revise our near terms sales growth expectations (33 percent sales CAGR 2017-19E). Stock is currently trading at a price multiple of 21x 2019e earnings with the rerating mainly guided by growth visibility in the end markets. We pencil in 96 percent earnings CAGR 2017-19E on account of better capacity utilization (currently 64 percent) and price realization for the existing carbon products the company is manufacturing.

Having said that, we have not included earnings potential due to new capacity expansion plans including that for advance carbon material. We expect a high margin contribution out of this opportunity.

For more research articles, visit our Moneycontrol Research Page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.