At the dawn of 2023, Wall Street's prevailing sentiment foretold doom with an economic recession, a fall in US stock prices, flat-to-falling interest rates urging a cautious shift to Treasuries and a rebound in Chinese stocks.

The only part of the consensus we were on board with was a likely economic recession in the US.

As for the equity markets, after 2022 which was probably the worst year in a century (no exaggeration!), I had said clearly on every forum that there was almost no likelihood of 2023 being a down year.

It was equally clear to us that the tightening by the Fed would continue for a while because once inflation is that high, it takes years, not quarters, to come down to anywhere close to the target of 2 percent.

As it turned out, this consensus veered off course on every front.

The US did not fall into a recession. The Federal Reserve hiked rates by a further 1 percentage point. And, there was a phenomenal surge that unfolded in the equity markets, leaving many financial pundits scratching their heads in disbelief. Plus, the Chinese market continued to plunge.

The scorecard? Zero out of 4 to the consensus. 3 out of 4 to First Global.

Let's go into all that transpired in this roller coaster year across asset classes globally:

The one thing that is clear from this is that the dominant reds in 2022 were replaced by greens in 2023. Asset markets rebounded, rather resoundingly so, after a disastrous year.

In a mirror image of 2022, the only major index that declined had to do with oil and gas.

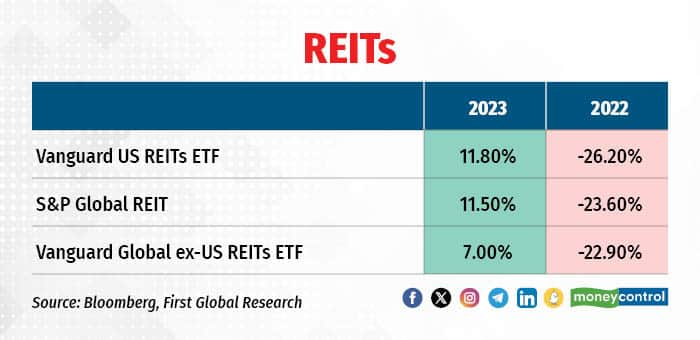

Equity markets, bonds, REITs, and Precious metals within commodities finished the year on a high note, exhibiting gains of approximately 6-55 percent, a stark contrast to 2022's widespread declines of 15-30 percent.

As often happens, the worst-performing markets of 2022, such as Nasdaq, Sri Lanka, and Taiwan, turned out to be the best performers in 2023 (See the rank columns in the table above).

Major global equity benchmarks saw strong double-digit returns in 2023, driven by factors like easing global inflation, a weakening dollar, falling crude prices, and heightened expectations of rate cuts by central banks.

China, experiencing unexpected deflation and a deteriorating property crisis, stood as the sole exception among major markets, declining by 12 percent in addition to the 23 percent drop witnessed in 2022. It is now down 55 percent from its peak in February 2021!

The MSCI World Index, tracking 47 countries, surged over 20 percent for the year, while the S&P 500, a broad measure of US stocks, achieved a remarkable 25 percent gain in 2023, reaching a record high.

So all hunky-dory? Not quite - this is not the complete picture!

While headline indexes did well, the same was not the case once you drill down to the stocks.

Also Read: Hindustan Unilever: A tough road ahead to regain volume growth

In 2023, the market movement was notably concentrated, especially in the US, with nearly three-fourths of S&P 500 stocks underperforming the index, and approximately one-third declining in 2023. The skew was even more in the first 10 months of the year when 90 percent of the S&P 500 move was due to just 7 tech stocks.

Unsurprisingly, the same “Magnificent Seven” – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla - led the 55 percent move in the tech-focused Nasdaq Composite.

On the global front as well, the technology sector contributed 10 percentage points to the global equity index, ACWI’s 22 percent return.

Semiconductor shares soared 80 percent in their most successful year in over a decade. This notable performance was led by companies like Nvidia Corp., which soared to a trillion-dollar-plus market cap with rising sales due to the demand for chips essential for AI computations.

Apart from the US, all major regional equities such as those of the Eurozone, ex-US developed markets, Emerging Markets (EM) ex-China, Japan and India logged also gains of 17 percent to 23 percent in a banner year. The Bloomberg Latin America Index zoomed 35 percent on the year after falling the least in 2022 i.e. just 1.3 percent. Frontier markets lagged with just a 7 percent gain.

Also Read: Sebi probing mule accounts, faulty IPO applications, 3 cases under scanner, says Buch

Fixed Income & Currencies

Meanwhile, fixed-income markets started their carnival in October of 2023 after getting whipsawed throughout the first three quarters by multiple events such as the bank bailouts in the US, recession in Germany, a surge in US treasury issuance and some geopolitical upheavals.

In 2023, the Bloomberg Global Aggregate Total Return Index (for bonds) rebounded by 5.7 percent, achieving its best two-month run since 1990 with a nearly 10 percent rise in November and December.

Traders are anticipating approximately 150 basis points (bps) or 1.5 percentage points of rate cuts in the US and UK, along with around 170 bps in the Eurozone. Investor confidence is growing, believing that central banks have successfully tackled inflation through aggressive rate-hiking cycles. Even though some rate-cut expectations have been tempered in January, we still think the cuts being priced in by the market are too aggressive.

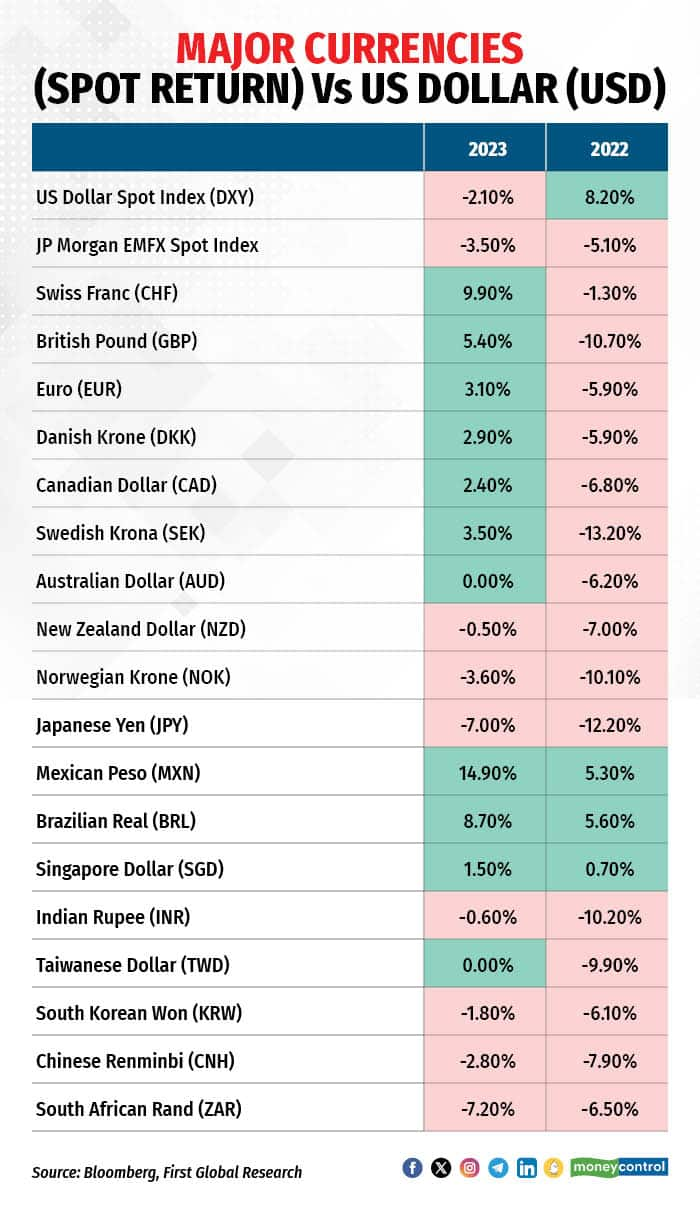

The decline in bond yields contributed to a weaker US dollar, leading global currencies to reach multi-month highs. The euro (+3 percent) and pound (+5 percent) are at their strongest levels in at least four months, while the Swiss franc (+10 percent) is at its highest since 2015. Expectations of the Bank of Japan raising interest rates for the first time since 2007 boosted the Japanese currency.

Also Read: 68% HNIs, 43% retail investors flip IPO trades in first week, says Sebi chair Madhabi Buch

Furthermore, 10-year US Treasury yields, a global benchmark, traded in a wide range of 3.3 percent to 5 percent in 2023. They dropped over 110 bps since October to settle unchanged on the year.

High-yield bonds jumped 14 percent as a tightening in spreads contributed to credit outperforming government debt. Emerging market bonds also shone with a 9 percent total return as central banks across Chile, Peru, Brazil, Hungary, Czech Republic, and Poland slashed interest rates by 25 to 300 bps.

Commodities

The turnaround in bonds and a faster-than-expected decline in inflation was also helped by falling commodity prices.

In another turn of the Giant Wheel, the Bloomberg Commodity Index slumped 7 percent, after surging almost 70 percent over the prior two years.

Brent oil fell below $75 a barrel despite multiple voluntary production cuts by the OPEC+. Supply growth outside of the group dominated this year. US & European natural gas prices plunged 40 percent to 60 percent owing to persistently low demand and healthy gas reserves.

London Metal Exchange's indicator for six metals dropped 5.6 percent, marking a second consecutive annual decline. Nickel, crucial for stainless steel and EV batteries, saw a 45 percent drop, the largest since 2008, in contrast to copper's 2.2 percent gain and iron ore's 20 percent rise in Singapore.

In agriculture, corn futures fell by 31 percent, and US wheat contracts dropped by 21 percent, marking their most significant yearly declines since 2013. This was driven by abundant crops in key suppliers like Brazil, the US, and Russia.

On the flip side, soft commodity prices, including cocoa, sugar, coffee, and orange juice, rose 3 percent to 70 percent due to poor production levels, partially offsetting the benefits of cheaper grains for food costs.

Cryptocurrencies

After a lackluster performance in 2022, cryptocurrency-related equities made a strong comeback in 2023. The Valkyrie Bitcoin Miners ETF (ticker WGMI) surged over 370 percent, potentially making it the best-performing ETF in a single year, excluding leverage. Bitcoin experienced gains exceeding 150 percent, while Ethereum's price rose nearly 100 percent. Despite these increases, both cryptocurrencies still trade at about 35 percent to 50 percent below their all-time highs set in November 2021.

(Devina Mehra is the Founder, Chairperson and Managing Director of First Global, an Indian and global quant Asset Manager. She tweets at @devinamehra. The website is www.firstglobalsec.com)(Harsh Shivlani also contributed to this article.)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.