Jitendra Kumar Gupta

Moneycontrol Research

Engineers India, which suffered in the past because of the poor activity in the hydrocarbon sector, is upbeat about its prospects over the next two years. The company is expecting significant improvement in its order book as some of the large orders are on the verge of finalization led by increasing spending by state-run oil PSUs. The revenue visibility is far greater today compared to the past.

Decent Backlog

About two years ago, the company had an order book of about Rs 5000 crore, which was less than three times its sales. Today, the order book has grown to about Rs 7700 crore on sales of Rs 1480 crore, thereby increasing the revenue visibility to 5.2 times of FY17 sales.

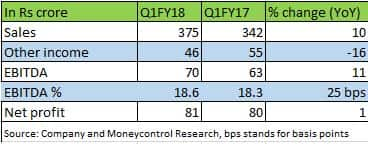

This is good news as the company now expects the pace of execution to improve. This was reflected in the June quarter result, where the company reported 10 percent increase in revenue to Rs 375 crore. This was largely driven by consulting business, which accounts for 86 percent of the revenue and grew by 21 percent on a year-on-year basis.

Turnkey project business, however, witnessed 30 percent drop in sales to Rs 50.88 crore largely on account of slow progress in recently bagged projects. It is expected that in the initial phase of the project cycle, the consultancy business revenues might remain elevated but as the projects reach a certain scale and stage the turnkey business will start contributing more.

Consultancy business lifts margin

Nevertheless, consultancy business which is high margin and low capital intensive, had a positive impact on margins due to its higher share in the revenue. The company reported an EBITDA margin of 18.6 percent up by 25 basis points.

Incidentally, the turnkey business has a very high operating leverage because of its fixed expenditures. Once revenues go up, as envisaged by the management, there is huge scope for margin expansion. To put it in perspective, at the peak of the cycle, in the year 2013 and 2014, the company enjoyed operating margin of close to 40 percent.

Strong visibility

Higher revenue visibility also means better earnings growth. Considering the order back log, it is expected that earnings might grow at about 20 percent annually over the next two years contributed by both higher revenues and better margins. However, at current market price of Rs 149 a share, some of the upsides are already factored in. The company with a market capitalisation of over Rs 10,060 crore, is currently valued at 20 times its FY19 projected earnings.

Should one pay a premium?

It is expensive, but if one is comfortable paying little higher valuation there is reason to do so. The fact remains that Engineers India is one of the quality plays in this space having strong margins, return ratios and zero debt in the books. In fact, the company is sitting on a cash and cash equivalent of Rs 2500 crore, which is about 25 percent of its current market capitalisation. Moreover, the growth might surprise on the upside given the huge capex lined up by the oil PSUs. Post reforms in the oil & gas sector, the oil PSUs are now flush with cash and they are willing to take large capex to expand capacity, reach and efficiencies, which in the long run will augur well for companies like Engineers India.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.