There have been two times in my life when I have been extremely hopeful and optimistic about the future of India.

The first was in 1984 when Rajiv Gandhi became Prime Minister, and the whole of India was electrified at the notion of a young, tech-savvy, person leading the country into a new era of prosperity.

Gandhi delivered early on that promise, except that the liberalisation that he brought in took several years to deliver, as big moves typically take. Today, a large number of fruits that Indians enjoy came as the direct results of the liberalisation Gandhi ushered in.

However, that liberalisation was incomplete. It wasn’t rounded. It liberalised imports, but didn't do something similar to the capital account.

As a result, India's current account deficits shot up in the Eighties. As there was no opening up of the economy to foreign investments in a significant manner, the balance of payment deficit ballooned to unsustainable proportions by the end of the Eighties and the beginning of the Nineties — and that is what led to the cataclysmic economic events of the period.

It was during the VP Singh government’s tenure that the infamous statement about India’s financial condition that “the coffers are empty” was made. While that was indeed the reality because India had roughly three weeks’ of foreign exchange left to fund imports, the statement in effect was telling the world that India was bust. This set off a sharp fall in the Indian Rupee, and led to a downgrade by international credit rating agencies.

I was in my twenties and had just started a business in early 1990 when these events started to unfold. It goes without saying that it was a very scary time to see that there is a high chance of your country defaulting on its obligations. In 1991, India was forced to airlift its gold reserves in order to secure around $600 million of emergency funding. That event left scars on everybody, including me.

It was around this time that I went to a famous astrologer who was visiting Bombay. He asked me what question I had about my future. I told him, “Sir, it is not my future that I have come to ask about. I want to know what the future of the country is and whether we will survive.”

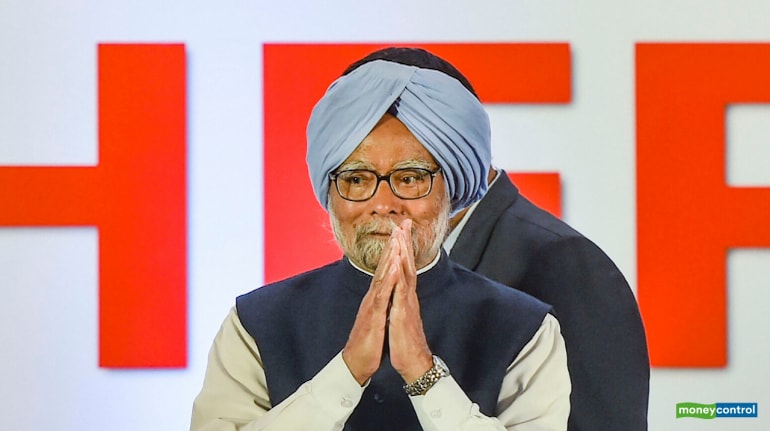

The PV Narsimha Rao government came to power in June 1991, and the best decision was to appoint Manmohan Singh as Finance Minister. Manmohan Singh went to work almost immediately, and one of the first things he did was to devalue the Indian Rupee twice (on July 1 and July 3) in 1991. India also took an IMF loan to tide over the balance of payments crisis.

Then, on July 24, 1991, Manmohan Singh presented his Union Budget that we all remember till date. He concluded his speech with the immortal lines of Victor Hugo, “no power on earth can stop an idea whose time has come.”

I remember sitting in my office, watching the speech on the television along with many other brokers and traders. Devina (my wife and co-founder of First Global) was also there. Everybody had goose bumps, and the stock market took off vertically.

On the way back home that night, Devina remarked, “What a great feeling Dr Singh would be having tonight: to be able to write the destiny of a large country like India is just simply such a golden moment in a finance minister's life. What must he be feeling?”

Timing is everything in life. By sheer luck, I was in my mid-twenties when India's second, and more robust, phase of liberalisation started. When a country changes its course the way India did in 1991 and thereafter, and you have just entered your prime earning years, all you need to do, to paraphrase Woody Allen, is to just show up. In the months and years following the budget speech, the whole country transformed.

Because one of the conditions of the IMF loan was lowering of India's high tariffs, it forced Indian companies to become extremely efficient and agile. For example, in the early nineties, steel produced in India was among the costliest. From there Indian companies turned around and soon became some of the most cost-efficient producers of steel.

Industry-after-industry transformed, and India’s technology sector, which was Rajiv Gandhi’s brainchild, started to stand on its own feet, and later went on to become global giants.

India started to attract billions of dollars of foreign capital both from direct investment as well as from institutional investors. The entire Indian financial services landscape was transformed because of the governance and transparency demanded by foreign investors. Indian companies were forced to become more investor-friendly and transparent.

The Indian stock markets seamlessly adopted technology and the National Stock Exchange (NSE) became one of the world's most-advanced stock markets.

For me personally, and for my contemporaries, it is a bittersweet realisation that had it not been for the 1991 economic crisis which forced India to liberalise, India’s economic trajectory would have been different.

Whatever be the reasons, from being a foreign exchange deficient economy, to becoming one of the world's largest owners of foreign exchange, and one of the largest economies, is something that was near impossible to foresee when India had just few hundred million dollars in its coffers.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.