FMCG major HUL’s reported numbers looked decent. However, the details weren’t exciting, seen in the context of the lofty valuations. The results from other FMCG companies appear to suggest that earnings are on a slow lane. With the new disruptor, Baba Ramdev’s Patanjali, upping the ante, how long will these companies sustain their fancy valuations?

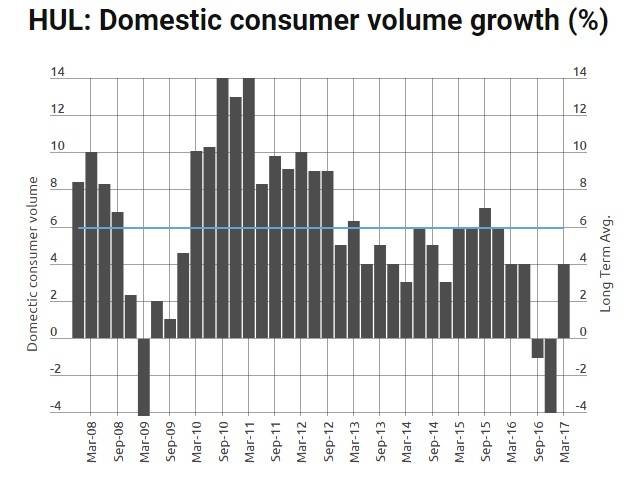

After HUL’s quarterly results reported yesterday, we take stock of the numbers from the sector. HUL’s reported quarterly numbers were ahead of expectations aided by the volume growth of 4%. Company management underlined margin expansion particularly in the home care segment due to premiumization and lower advertising cost.

However, looking at the full financial year result, it does reveal that the biggest segment – personal care (hair care, oral care, personal wash) – constituting 63% of operating profit, has had a flattish year-on-year performance.

Some of the niche segments like oral care and mass detergent products continued to report subdued growth on account of competitive pressures. This brought a couple of concerns to the fore – the wholesale inventory line has still not normalised post-demonetisation, and rural consumption growth is at best fragile. Over the longer term, we take note of the intense competitive pressure for the sector and would wait for valuations to cool down before turning positive.

Source: Company Reports

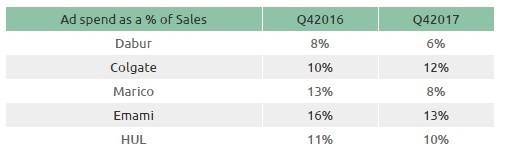

There may have been competitive headwinds, but the FMCG sector did benefit from a softening of crude and derivative prices and a rural economy boost after last year’s good rains. For about 7-8 quarters, the gross margin expansion was on account of lower input prices including polymer packaging material due to subdued oil prices. With the rebound in oil prices, much of the margin cushion has evaporated and FMCG companies are resorting to price hikes on one hand, and cost control on the other, to protect profitability. Interestingly, moderation in advertising costs for most of the companies (Colgate was the exception) was one of the highlights of this quarter. Additionally, the lacklustre demand environment and competitive pressure is evident in the lower single-digit volume growth (except for Marico’s Parachute and Safola).

Source: Company Reports

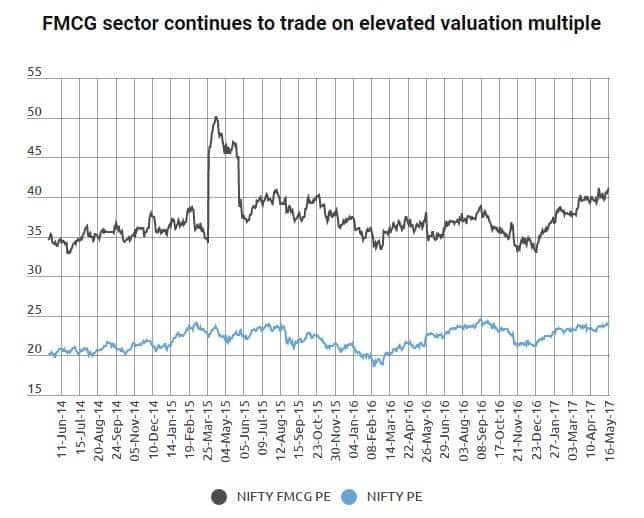

From the valuation perspective, in last three years FMCG sector has witnessed valuation expansion on absolute basis (NIFTY FMCG PE: 41 vs. 34 in May 2014) and continues to enjoy valuation premium to the Nifty benchmark (PE: 24.2 vs. 20.2 in May 2014). In the case of HUL, it is interesting to note that the company commanded a PE valuation of 51x in 2015 when the volume growth was in the range of 6-7%; the premium has sustained although the volume growth hasn’t reverted to that level.

We feel that valuation multiples are ahead of the fundamentals for the sector amidst the competitive dynamics.

Halo of Baba Ramdev brand gulping some existing brands more than others

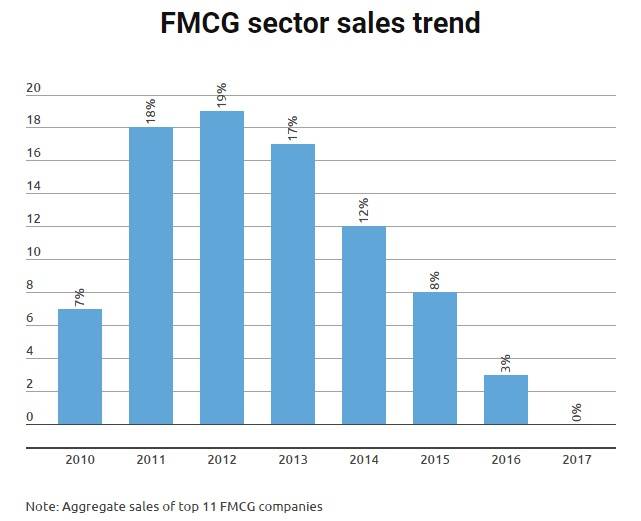

Halo of Baba Ramdev brand gulping some existing brands more than othersAnalysis of slightly longer-term data suggests that sales growth of the top 11 FMCG companies fell to 5.5 percent CAGR for last five years (vs 17 percent CAGR over the period 2008-12) much below the growth of real GDP growth rate trend. Operating earnings growth has also averaged around 7.6 percent in last five years. Competition from newer brands, local and regional players could have played their part.

In this context, it may be pertinent to look at the latest byte from the unlisted FMCG major – Patanjali. Patanjali recently announced that it is looking to double its turnover to Rs 20,000 cr in FY 2018 backed by a five-fold increase in headcount, a doubling of distributor strength and capex to the tune of Rs 5000 crore (for 5 new plants) by the end of FY18. Though reaching the milestone of Rs 20,000 cr turnover in a short period may not be feasible, one can’t deny the impact of brand Ramdev/ayurveda on almost every product in the FMCG universe.

Take the case of the hair care segment. The estimated size of this category is around Rs 15,800 crore as per Bajaj Corp’s investor’s presentation. Patanjali, with a revenue of Rs 825 cr for in the hair care segment (Kesh Kanti), controls close to 5% of the market. Even though this is quite low compared to what it claims, it is nevertheless higher than the revenue of few of the niche players like Bajaj Corp.

Interestingly, this is also one of the segments where we have seen slippages in market share or lower sales for some of Patanjali’s competitors like Dabur and Bajaj Corp.

Dental care is another segment where Pantanjali has made its mark by challenging the market leader Colgate, which is facing erosion in its market share (at 55.1% from 57.4% two years back). Detergents is also another category where we think Pantanjali can up the ante fairly quickly.

The threat posed by Patanjali has forced FMCG companies to respond through innovative product mixes, working on cost dynamics, increasing rural exposure and moving up the value chain through premiumisation. In our opinion, the tug of war for market share in the Indian FMCG mass market has a way to go: Brace for lot of churning. In the interim, we expect market leadership to undergo changes. Companies could also be staring at incremental margin pressure in the medium term.

While GST could bring long-term benefits for the organized universe, shorter-term disruptions can’t be ruled out. A large part of the expectations on volume recovery hinges on rural revival and good monsoon. With so many moving parts, can the sector continue to command such a premium?

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.