Anubhav Sahu Moneycontrol research

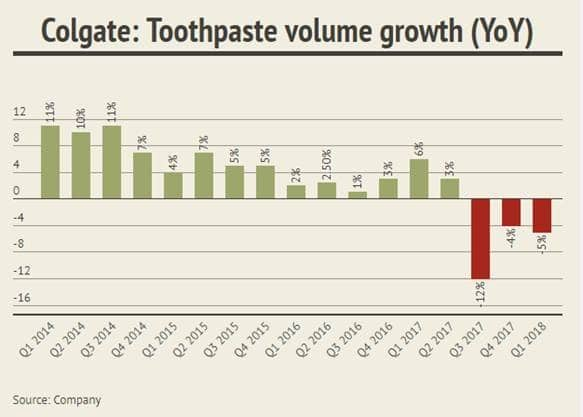

Like with the other FMCG companies, the destocking theme reverberated through the quarterly results at Colgate. The company posted sales shrinkage and a volume dip but nevertheless outperformed the muted expectations of the market.

While this should lift the immediate uncertainty shrouding Colgate, we nevertheless remain concerned about the declining market share of the company in the toothpaste category. Growing competition from Patanjali and Dabur and the commentary from the other FMCG players keep us cautious on the stock.

Quarterly result: Margin expansion on lower input cost and ad spend

Q1 2018 net sales (Rs 978 crore) shrank by 3.5% on account of a destocking-led decline in volume (-5%). EBITDA margins improved by 182 bps YoY benefiting from lower raw material prices and advertising spend. Other income was up 24% which aided in the 8.5% jump in profit after tax.

No respite from market share contraction

The company’s market share has shrunk further in the toothpaste category to 54.3% (vs 55.1% in FY17). Going by some other market research sources, slippage in market share is much higher.

In H1 CY2017, market share for Colgate stood at 52.4%. Dabur has gained from 10.8% (CY2014) to 12.2%. Nevertheless, the big disruptor has been Patanjali. It has gained market share from 0.6% (CY2014) to about 6% now. Patanjali, in fact, has gained market share by 300 basis points in last one year. This figure doesn’t factor in sales from Patanjali’s own stores.

So, certainly, Dabur and Patanjali (Dant Kanti) have wrested market share from the likes of Colgate and HUL. While Colgate is attempting to recoup market share by focusing on herbal category (Cibaca Vedshakti, Activ salt), the market share drop is yet to get arrested. In the tooth paste category also, the company lost its market share from 47.4% in FY17 to 45% now.

Colgate Palmolive’s global CEO, Ian Cook, in a recent global investor call, has acknowledged the competition and changing consumer preferences in India.

Colgate has been a beneficiary of GST rates (18% vs 25% earlier), on account of which the company has reduced prices, both in toothpaste as well as in toothbrush categories. However, valuation remains expensive at 49 times 12-month trailing earnings. The falling market share for this single product category company keeps us concerned and we prefer to wait on the sidelines, looking for any definitive signs of improvement.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.