Anubhav Sahu Moneycontrol Research

The way Sunday’s independence referendum vote on Catalonia plays out could bring financial market sentiment back to the edge, similar to the mood experienced when Britain was teetering on the brink of Brexit. Investors are fretting over the vote to secede, political instability and a possible contagion effect.

The saving grace is that the Catalan ructions are happening at a time when the Eurozone has shaken off a disinflation threat, and when political commitment to Europe has strengthened, partly on the back of Emmanuel Macron’s win in France.

Catalonia’s impact on markets has been limited so far, but the political discourse in Spain bears close watching.

Catalonia – The case for referendum

Catalonia, one of the 17 autonomous communities of Spain, constitutes about 6 percent of Spain’s territory and accounts for 20 percent of the GDP and 25 percent of exports. Barcelona, Catalonia’s capital, is a leading tourist hub and beloved of sports enthusiasts because of its football team.

Catalonia, since the 16th century, has been an integral part of Spain and owing to its distinct history and culture, has enjoyed political autonomy. The state has its own police force and legislates over subjects such as education, healthcare and welfare.

Catalonia's clamour for greater autonomy gathered pace after the 2007-08 financial crisis. Linked to it is the growing resentment that Catalonia, one of the wealthiest regions, contributes more to the central Spanish exchequer through taxes than it receives in the form of financial support.

As per the Catalonian government, Catalonia contributes ~18 percent more taxes per capita than the average autonomous community (17 autonomous communities in Spain) contribution and receives less fiscal resources than the state average.

While pro-independence supporters opine that Catalonia as a sovereign state would be viable, its high indebtedness (EUR 72 billion, 33 percent of GDP) is seen as a constraint.

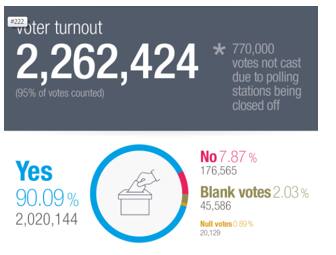

Sunday’s referendum vote

In the referendum vote, which had a turnout of 43 percent, 90 percent voted for independence. Spain’s central government regards this referendum unconstitutional. Due to the government’s stand, a lot of pro-Spain voters didn’t participate as well. However, referendum results are to be considered in the regional parliament next.

Market reaction – largely local

Financial market reaction has been largely local. IBEX 35, Spanish equity benchmark index, was flat on Tuesday after losing 1.3 percent on Monday. Spanish bonds weakened and thereby increased the yield spread with respect to German bonds. EUR/USD also reacted negatively though dollar strength due to surge in US treasury 10-year yield was also the contributing factor.

By and large other European equity indices were positive after Sunday vote, implying that market participants were not discounting any systemic risk.

Next steps

Catalan First Minister Carles Puigdemont has suggested that the regional parliament would consider the referendum vote for the independence. This could prompt Spanish Prime Minister Mariano Rajoy to activate Article 155 of the Constitution to temporarily take control of the Catalan government.

European Commission, meanwhile, has called for a dialogue to resolve the constitutional crises.

Our chat with market experts in this field indicated that markets are optimistic about a more realistic solution to the problem. Giles Keating, Chair of investor advisory firm Werthstein Institute, says that further devolution of power to the regional government could be one practical solution.

Tumultuous days ahead for Spain The scenario of Catalonia going ahead with secession would have severe adverse implications for Spanish economy. It’s noteworthy that DBRS, the Canadian rating agency, is set to review its rating on Spanish government debt this week and developments can have an implication to it.

Regional movements elsewhere in Europe may gain some impetus after this. Belgium’s northern region, Flanders, is the one such region and New Flemish Alliance is one such party to watch out for.

What does it mean for USD/EUR?

EUR/USD vs US treasury and German 10 year yield

Overall, the above events can weigh on euro as the political discourse unwinds in the near-term. Having said that, the USD leg of the currency pair EUR/USD is getting interesting. US treasury's 10-year yield has surged recently with the increasing expectation for a rate hike in the near future. A CNBC Fed survey mentions that 76 percent of respondents believe that Fed would hike interest rates in December.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.