Avinash Tripathi

It’s widely recognised that Finance Minister Nirmala Sitharaman presented her Budget against the backdrop of a challenging economic environment.

Every Budget has two basic functions. According to Article 112 of the Constitution, it presents an ‘Annual Financial Statement’ to Parliament. This statement should depict a ‘true and fair’ picture of the government’s finances. Further, the FM introduces the Finance Bill to take permission of Parliament to levy taxes. Along these two axes, the Budget can be examined.

The main figures in the Budget, the Budget Estimates (BE), pertain to the next year and hence, are prospective in nature. If these projections go wrong, the Budget arithmetic gets problematic.

Unfortunately, the Union Budget, from last year onwards, is suffering from such poor fiscal marksmanship. The documents reveal that tax collection BE for 2019-20 had to be substantially revised downwards, implying that the original tax projection was unrealistically optimistic.

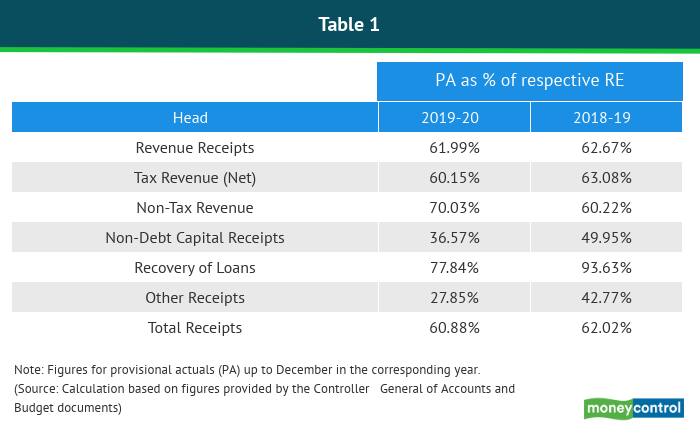

Despite the downward revision, the gap between the Revised Estimates (RE) and Provisional Actuals (PA) of the Controller General of Accounts has only worsened (Table 1).

"Except non-tax revenue -- which includes dividends recieved from the Reserve Bank of India -- provisional actuals (PA) as a proportion of revenue estimates (RE) is consistently lower for this year's budget for every receipt head compared to the last year's budget."

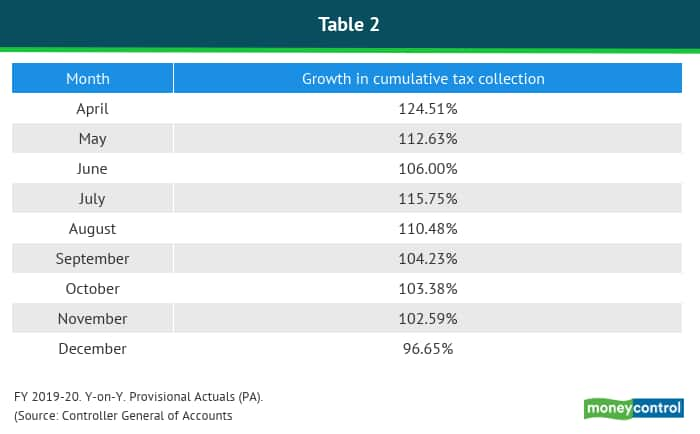

What is also likely to be a problem for the finance minister is that the tax collection growth is decelerating. Notice that the actual tax collection up to December is lower than what it was last year, implying that the tax collection growth rate is negative, at least in the first three quarters (Table 2).

Given the reality of the tax collection, the focus of the government was on revenue mobilisation, not on providing stimulus as was widely expected. The Budget sought to accomplish it by eliminating various deductions and exemptions from the personal income tax.

The key sentence in the Budget speech is as follows: “I have removed around 70 of them [deductions and exemptions] in the new simplified regime. We will review and rationalise the remaining exemptions and deductions in the coming years with a view to further simplifying the tax system and lowering the tax rate.”

To make this elimination politically palatable, tax rates were reduced and an option to stay in the old regime was provided. However, there is a catch. First, as the finance minister noted, this option will become meaningless in future as more exemptions are removed.

Second, deductions and exemptions actually reduce the taxable income from the highest tax rate applicable to an individual. As such, the actual impact of their elimination, even with reduced tax rates, will be to increase the tax burden for a majority of taxpayers.

Further, this ‘overhaul’ is likely to beget more confusion and uncertainty. This is so because of the legal framework within which direct taxes operate. Indian income tax is governed by two different sets of laws.

The Income Tax Act, 1961, determines the procedure for computation of the taxable income. Then, we have the annual Finance Bill that lays down applicable tax rates for every year. Nearly every word of the I-T Act has been litigated and the interpretation has stabilised after the development of the decades of case laws.

What the current proposal does is to introduce a separate provision in the I-T Act (Section 115BAC) that effectively creates a parallel taxation system for those who opt out of exemptions and deductions. This is likely to result in potential complexity, as these two sets of rules are likely to conflict under different scenarios. If that happens, there is a risk that direct taxes may go the way of the goods and services tax (GST).

In a challenging economic environment, the government policy in general and the Budget in particular should provide an anchor of stability, which is not the case with this Budget. The most charitable interpretation is that the Budget has lost an opportunity to invigorate the economy.

Avinash Tripathi is with Azim Premji University, Bengaluru. Views are personal.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.