Anubhav Sahu Moneycontrol research

Astral Poly Technik’s Q1 2018 results were impacted by the channel destocking and lack of clarity amongst the distribution channel participants regarding the GST transition. The company is, however, upbeat about the progress on restocking in Q2 of FY18 and confident of posting double digit volume growth in this fiscal year. We, therefore, remain positive on the stock.

Read more: This midcap's focus on volume push & new products could make it a piping hot stock

India business impacted by sharp destocking

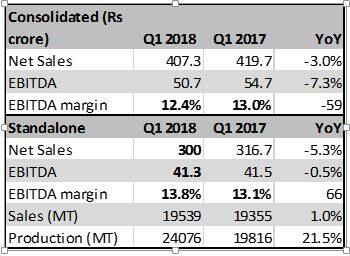

Astral’s consolidated sales in Q1 FY18 declined by 3 percent mainly on the back of destocking in the India business. Sales volume in the piping business grew by just 1 percent and net realization per ton declined by 6 percent. EBITDA margin improved to 13.8 percent (+66 bps) benefitting from better product mix. The company highlighted lower bottomline number, partially, on account of higher promotional activity (IPL related etc.) done in the last quarter which led to the rise in other expenses (+39 percent YoY).

International business (28 percent of Q1 FY18 sales), which is mainly into adhesives had also suffered due to business transition. Resinova business had a shorter number of days for operations in Q1 FY18 on account of SAP implementation, though it still managed 9 percent YoY growth in sales.

SEAL IT business (UK) had 11 percent sales growth on a constant currency basis. However, sharp GBP depreciation on a YoY basis led to sales de-growth in rupees terms.

Volume guidance for FY18 maintained

Management cited that month of July witnessed 19 percent volume growth in the pipes business on the back of sharp restocking. For FY18, company guided to 16 percent plus volume growth which, if achieved, would be commendable after a lackluster sales in the first quarter. Nevertheless, historically, first quarter has been the weakest quarter in terms of sales, contributing about 18 percent of annual sales.

Margin guidance reiterated

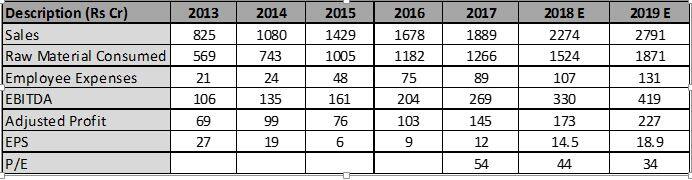

On the margin front, the company is confident of maintaining 14-15 percent EBITDA margin for the current year. Astral’s margins are expected to find support from the continued backward integration of PVC/CPVC compounding in every plant. In the Hosur plant, full benefit of CPVC compounding would be visible in Q3 FY18.

Capacity expansion plan on track

On the status of capacity expansion plans, management mentioned that the new plant in Rajasthan would be complete by December 17 and capacity expansion in Hosur plant would be over by end of March 2018. Thus, aggregate capacity for the piping business would be about 175,000 MT by the end of the current fiscal year.

Positive on company’s execution capability

While Q1 results were expected to be weighed down by GST related channel destocking, early indications on restocking are assuring. The company’s capacity expansion plans for the domestic business seems to be on track and we expect Astral to post volume-driven growth in the medium term in the pipes business.

On the adhesives business, Indian business is in a nascent stage and company can benefit from the discounted pricing strategy compared to market leader (Pidilite). We haven’t yet factored the upside from selling high margin adhesive products from the international subsidiary in the domestic market.

Our financial projections remain largely unchanged. Currently, the stock trades at a multiple of 34x 2019e earnings, which in the context of near-term volume growth and foray into high margin adhesive products, looks reasonable and worth a candidate for accumulation, in our view.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.