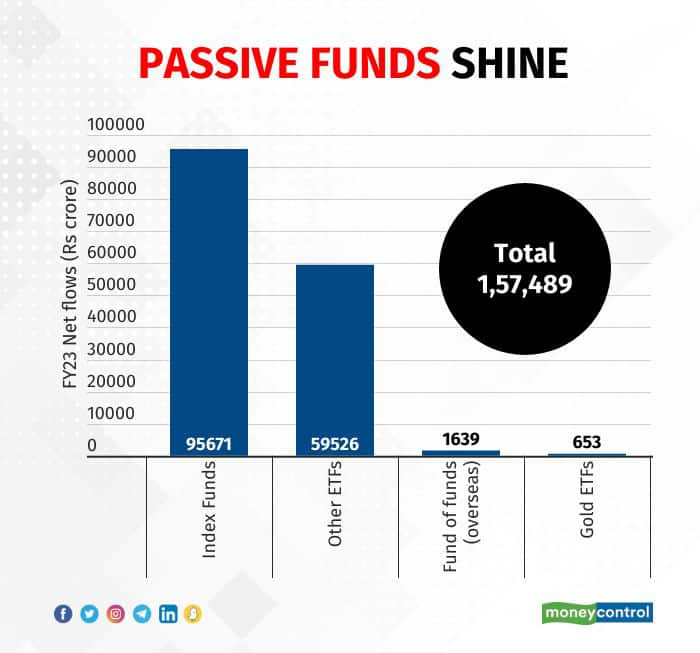

While active mutual fund (MF) schemes have struggled to beat their benchmarks, passive schemes have dominated the MF industry in the financial year 2022-23, garnering net inflows of Rs 1.57 trillion.

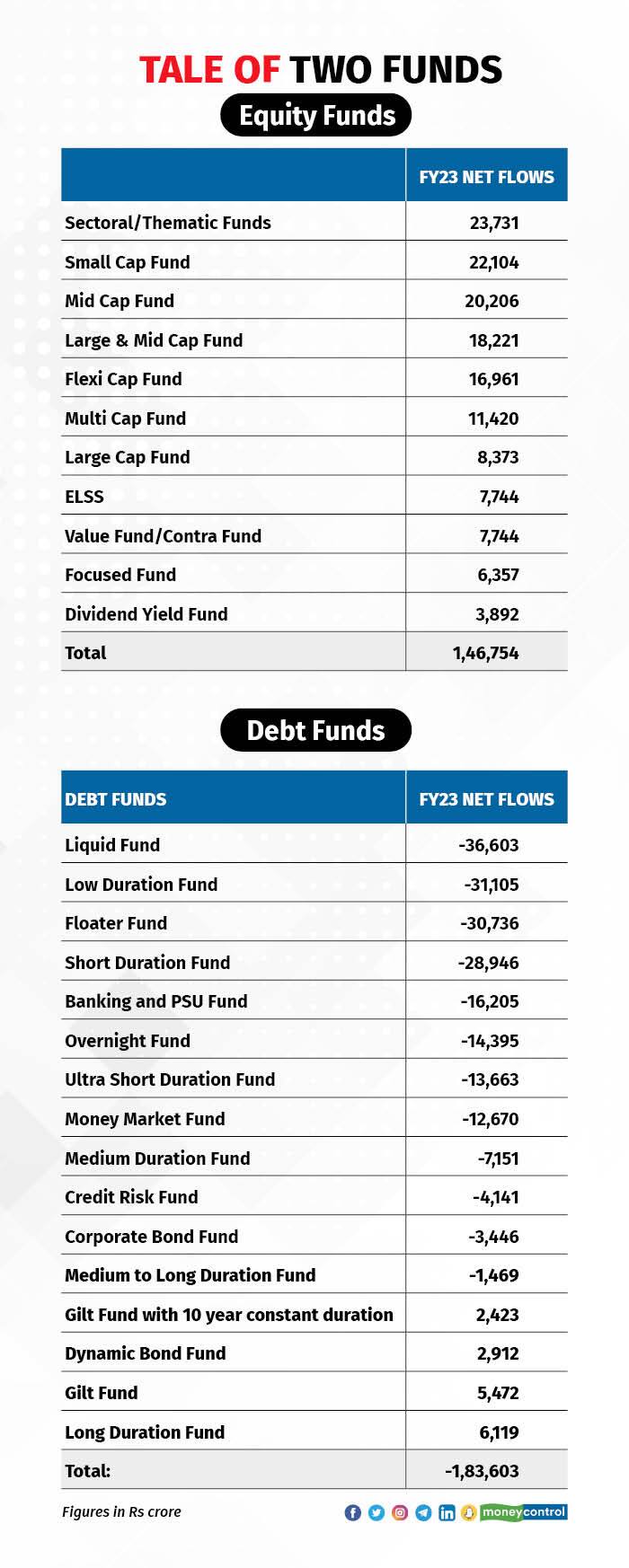

Data shows active funds saw net outflows of Rs 53,826 crore during the fiscal, mainly due to selling in debt funds.

Despite flattish stock markets, equity funds saw net inflows of Rs 1.47 trillion during the financial year. Overall, the Indian mutual fund industry saw a net inflow of Rs 1.04 trillion during the financial year, and a net outflow of Rs 1.84 trillion in debt funds.

Compared to this, in FY21-22, mutual funds overall had seen a net inflow of Rs 3.31 trillion.

Let’s look at the key categories that saw the most activity during the recently-concluded financial year.

Also see | The complete MC30 basket of mutual fund schemes

Passives making inroads

Per the recent SPIVA India report released by S&P Dow Jones Indices, 88 percent of actively managed equity funds underperformed the S&P BSE 100 in the year ended December 2022. This was at a time when Indian markets were largely flat during the year.

In the one-year period ending December 2021, 50 percent of large-cap equity schemes had outperformed their benchmark. The year 2021 was a bumper period for Indian equities.

Given this, the passive fund category saw a net inflow of Rs 1.39 trillion in FY21-22 and Rs 1.57 trillion in FY22-23.

In FY22-23, Index funds saw inflows at Rs 95,671 crore, while Rs 59,526 crore flowed into Other Exchange-Traded Funds (ETF). Funds-of-funds (overseas) saw inflows of Rs 1,639 crore, and Gold ETFs saw inflows of Rs 653 crore.

Also read | Endowment plans looking attractive post-debt funds tax mess? Think again

Other ETFs include non-gold ETFs such as funds based on silver, Nifty and overseas indices.

“Index funds are good investment options for investors looking to take exposure to an asset class and don’t have the wherewithal to identify an actively managed fund,” said Kaustubh Belapurkar, Director – Manager Research, Morningstar Investment Adviser, India.

Target mutual funds

At Rs 95,671 crore, index funds may have received the highest inflows among all the MF categories in FY23, but a breakup of the data shows that target maturity funds (TMF) were the biggest gainer in this category.

TMFs hold the investments in their portfolio until maturity. Debt securities in these funds either mature together or close to each other. This strategy gives investors certain predictability in returns as the investments are all locked in at a certain yield-to-maturity.

For the whole of FY22-23, the net inflow into TMFs stood at Rs 79,442 crore, including while in March 2023 alone, these funds received Rs 18,849 crore.

The big jump in flows into these funds in March may be due to people looking to lock their investments under the favourable debt taxation regime.

Also read | When should you increase your VPF contributions?

As per new taxation rules applicable from April 1, capital gains from investments in mutual funds where not more than 35 percent is invested in domestic equities will now be deemed short-term capital gains and taxed at a higher rate.

Currently, investors in debt funds pay short-term capital gains tax (STCG) on capital gains according to their income tax slab for a holding period of three years. After three years, the gains are treated as long-term capital gains and taxed either at 20 percent with indexation benefits, or 10 percent without indexation.

“Majority of the flows into index funds have been into TMFs, with clients investing in these funds before the new debt fund taxation set in,” said Belapurkar.

Some experts fear that with the debt taxation change, TMFs may lose some of their appeal.

Radhika Gupta, Managing Director and Chief Executive Officer, Edelweiss Mutual Fund, said, “With the change in taxation, debt funds, in general, may see some moderation in flows, but for many investors funds like TMF shall remain a go-to choice given benefits like diversification, tax efficient reinvestment of coupons, visibility of returns, and most importantly, quick liquidity.”

Target maturity funds had a total AUM of Rs 1.74 trillion as of March 2023.

Equity stays strong

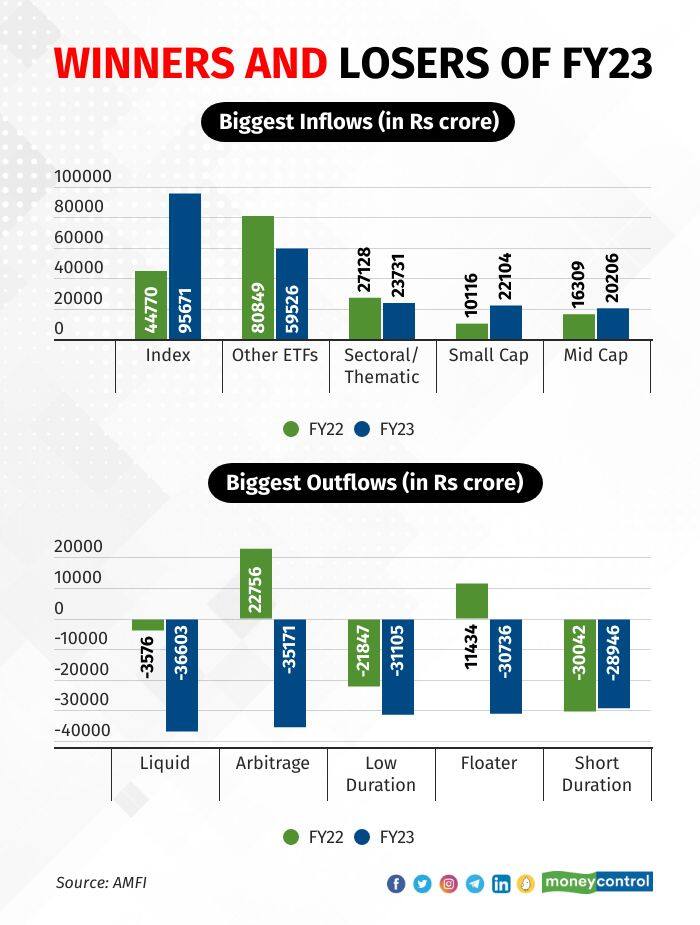

During FY22-23, the BSE Sensex gained 0.72 percent. Despite this, equity funds saw decent inflows during the year at Rs 1.47 trillion.

Risky funds were the top gainers as sectoral/thematic funds saw inflows of Rs 23,731 crore during the year, followed by small-cap funds, with inflows of Rs 22,104 crore.

Focused funds and dividend yield funds got the least inflows of Rs 6,357 crore and Rs 3,892 crore, respectively.

In FY21-22, when the Sensex had gained nearly 20 percent, equity funds had garnered a net of Rs 1.64 trillion.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.