A record 40.32 lakh people registered for systematic investment plans (SIPs) in December riding on the back of a sustained bull run in markets. This was a 31 percent spike over November and a 73.5 percent surge over the last year.

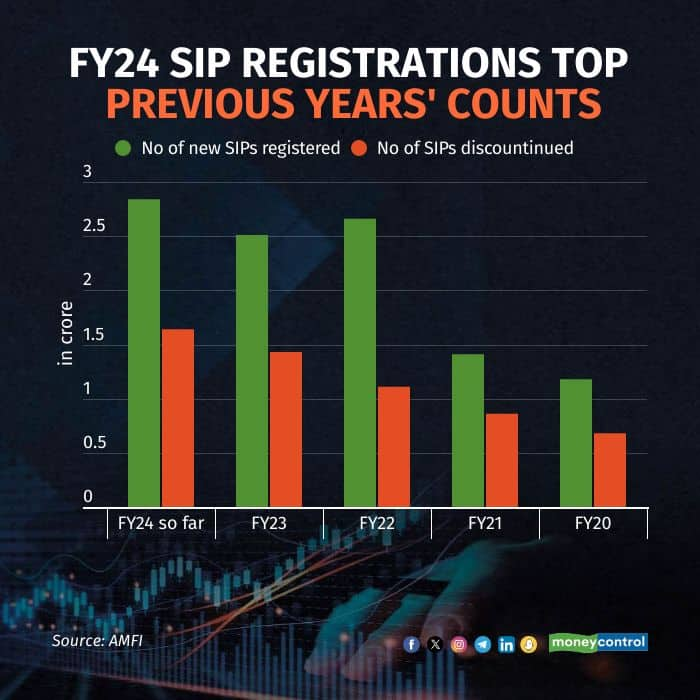

A consistent 30 lakh fresh additions every month since July has driven the SIP registrations for FY24 above the the combined figure for FY23 and FY22, according to the Association of Mutual Funds in India (AMFI). Between April and December 2023, there were 2.85 crore new registrations, surpassing the totals of 2.51 crore and 2.66 crore for the entire FY23 and FY22 respectively.

Analysts said the surge in SIP registrations reflect a reinforced confidence among investors in India's macroeconomic fundamentals and hopes of potential interest rate cuts by the central banks this year. The BJP-led NDA sweep in the recent state elections in Hindi heartland also boosted faith in continuation of policies of the Narendra Modi-led government at the Centre after the general elections around May this year.

If the Modi-led NDA regime returns to power for a third straight time, analysts feel, the conducive government policies will help the Indian economy stay the course to reach its $5-trillion goal. Several brokerages recently raised the Nifty targets for 2024. Nomura sees the benchmark index at 24,260 by the end of 2024, while ICICI Direct forecasts Sensex at 83,000 and the Nifty at 25,000.

On the flip side, discontinued SIP accounts or completed tenures increased in December 2023, with 20.8 lakh investors withdrawing funds. In FY24 so far, some 1.64 crore investors terminated their SIPs, compared to 1.43 crore in FY23 and 1.11 crore in FY22.

According to Jean Christophe Gougeon, director and chief marketing officer, Sharekhan by BNP Paribas, the growth of SIPs vis-à-vis the discontinuation can be attributed to new offerings in mutual funds due to the entry of new players with fresh ideas and features. Additionally, there are many young entrants in the market who look to make quick returns and hence move out if they don’t get the desired performance. "However, it is encouraging to see the investors who understand and appreciate the importance of adopting a disciplined approach towards investing via SIP," he said.

In December, open-ended scheme assets hit Rs 50.80 trillion from Rs 48.78 trillion a month back and analysts expect it is well on track to achieve the targeted aim of Rs 100 lakh crore in the next few years. SIP inflows rose to Rs 17,610 crore in December from Rs 17,073 crore, showing the confidence in retail investors. Small Cap funds gained Rs 3,858 crore, while midcap fund inflows dropped 48 percent. Large Cap funds faced Rs 281 crore net outflows.

Read: After JPMorgan, Indian govt bonds could become part of Bloomberg indices in 2024

Analysts said most investors don't choose perpetual SIPs, contributing to the increasing trend in SIP discontinuations. However, the rising number of new SIP registrations signifies a growing preference for disciplined investment. Increased inflows through SIPs demonstrate investors' trust in this approach. With markets at all-time highs, sticking to SIPs rather than lump-sum investments indicates a prudent approach and highlights the growing awareness among investors.

"Addition of SIPs reflects new investors joining the equity bandwagon and betting first on the proven way to create wealth i.e. SIP. Also, some older investors may be adding SIPs in the midcap and smallcap category going by the way the NAVs of such schemes have risen lately," said Deepak Jasani, analysts with HDFC Securities.

Jasani cited various reasons behind discontinuance of SIPs. These include end of tenure, lack of funds, underperformance of schemes, lack of funds on payment dates, SIPs closed a few months after they were opened to oblige some RM or friend, booking profit in fear of correction in the markets, NAVs of invested schemes above the average cost of entry and providing a small return etc.

Read: Leadership churn at Swiggy continues, Instamart VP Sidharth Satpathy quits

Recently, data from the Central Depository Service and National Securities Depository showed a surge in new investors opening demat accounts, with December posting the highest ever monthly additions. The number of demat accounts opened in December totalled over 41.78 lakh, compared to 27.81 lakh a month ago and 21 lakh a year ago. The total demat tally crossed 13.93 crore, up 3.1 percent from a month ago and 28.66 percent from a year ago.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.