An April 18, 2019 CARE Ratings report on the status of central government infrastructure projects makes for interesting reading. It shows that the next government will start with unpaid infrastructure development bills of Rs 12.4 lakh crore.

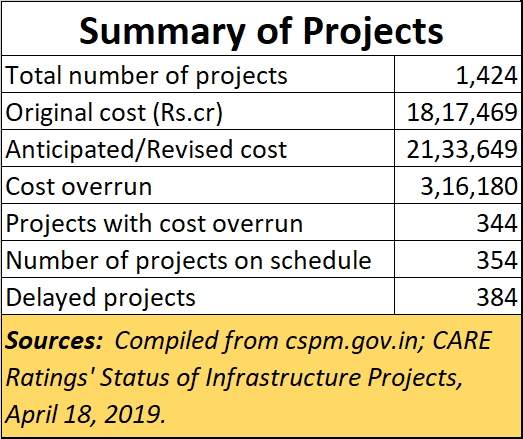

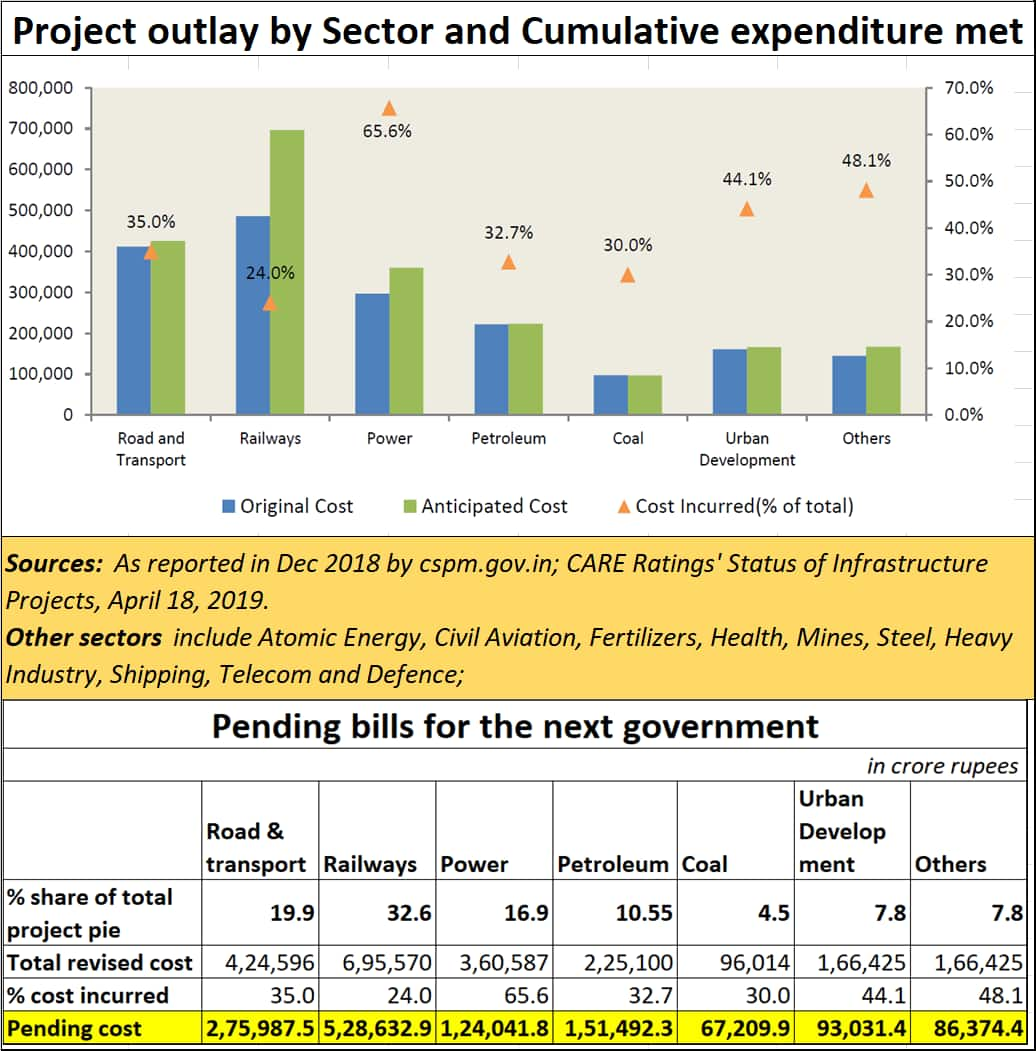

The report has compiled infrastructure spends over the past five years and pointed out the time and cost overruns for various projects during the period. The bare facts are thus:

Of the total 1,424 projects under implementation, 444 are mega projects with an outlay of over Rs 1,000 crore; the combined cost of these projects constitute 80 percent of the total project spend. The anticipated cost of implementation for these Rs 1,424 projects is currently pegged at Rs 21.34 lakh crore. These projects were originally expected to be completed at a cost of Rs 18.17 lakh crore. In the past five years, Rs. 8.07 lakh crore or 37.8 percent of anticipated cost has been already incurred.

What this means is that the cost overrun amounted to Rs.3.16 lakh crore. Yet, significantly, sectors relating to power, roads, railways and petroleum accounted for most project completions (85 out of 101) by December 2018. This is a considerable improvement over the previous years and the number of projects completed by year-end would be at least 50 percent improvement over the previous years, underscores CARE Ratings. The present government needs to be complimented on this performance.

However, in spite of this improved project management, the fact remains that the present government has left behind 384 projects which collectively account for pending bills worth Rs.12.4 lakh crore.

This figure may not have mattered much in the normal course of things. Projects do get carried over from the term of one government to another. But this time, the country’s banking sector faces the problem of burgeoning non-performing assets which had surged beyond Rs.10 lakh crore by the end of 2018. The non-banking financial company sector is facing its own problems including that of liquidity. The total power sector is reeling under losses which are estimated to have crossed Rs 3 lakh crore. High frequency indicators suggest an economic slowdown and that does not bode well for tax collection with targets already missed.

Essentially, the big question is where will the government find money to pay the bills for these infrastructure projects? Note that these are unpaid infrastructure bills left over from the last five years. When you add new projects and welfare schemes, which political parties have promised in their respective manifestoes, the total bill will only go up. And given the way politics works, it is probable that the focus will be on freebies and doles. his has two advantages. First, it can be politically populist. Second, it allows for a lot of skimming of funds. This huge imbalance of central government spending and income is notwithstanding the huge deficits of the state government as well.

We know that government spending is always higher in the two years prior to elections. There is little money left after elections are over. Therefore, expect government spending to be tighter come June 2019. With falling FDI (foreign direct investment) – down 7 percent in April – December 2018 compared to a year ago -- there are urgent calls for reworking the clauses relating to investment protection. It is three years now, and not a single government has signed the present government’s new version of the Bilateral Investment Treaty (BIT). One of the vexatious clauses there is the right to arbitration from a seat outside India.

It is clear, therefore, that someone has to blink. If the new government has to create jobs, it has to promote investment. Unlike the past few years, the new government may not have the funds for fresh investments. It has already used up money from PSUs as part of its off-budget-financing strategies; it has arm-twisted the RBI into giving it interim dividends, and it has burdened LIC with IDBI shares and the losses of many companies (disclosures have not yet been made about the amounts involved).

The only silver linings are the rising stock market indices, the surge in foreign portfolio investments (FPI) and higher foreign exchange reserves. But as economists point out, it would be too early to celebrate this news, because it is not unusual for funds to flow into the country during election season.

In any case, emphasizing too much on populist spending will result in a crisis, which may push the government into finally reconsidering its stand on investment protection. And if the recent surge in FPI proves to be ephemeral, and if funds disappear from the stock markets, expect a full-blown financial crisis to confront the new government.

In other words, the new government will have to manoeuvre through some very dangerous rocks in the coming months. But the flip side is that India ends up doing the right thing only when there is a crisis. Remember 1991 and the financial crisis confronting India then? Recall how India had no option left but to break down some of its licence raj barriers?

And the past pattern suggests that India does well when the government at the centre is weak. So, could it be the heralding of spring when winter sets in?

Very interesting times ahead.

The author is Consulting Editor with moneycontrol.comDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.