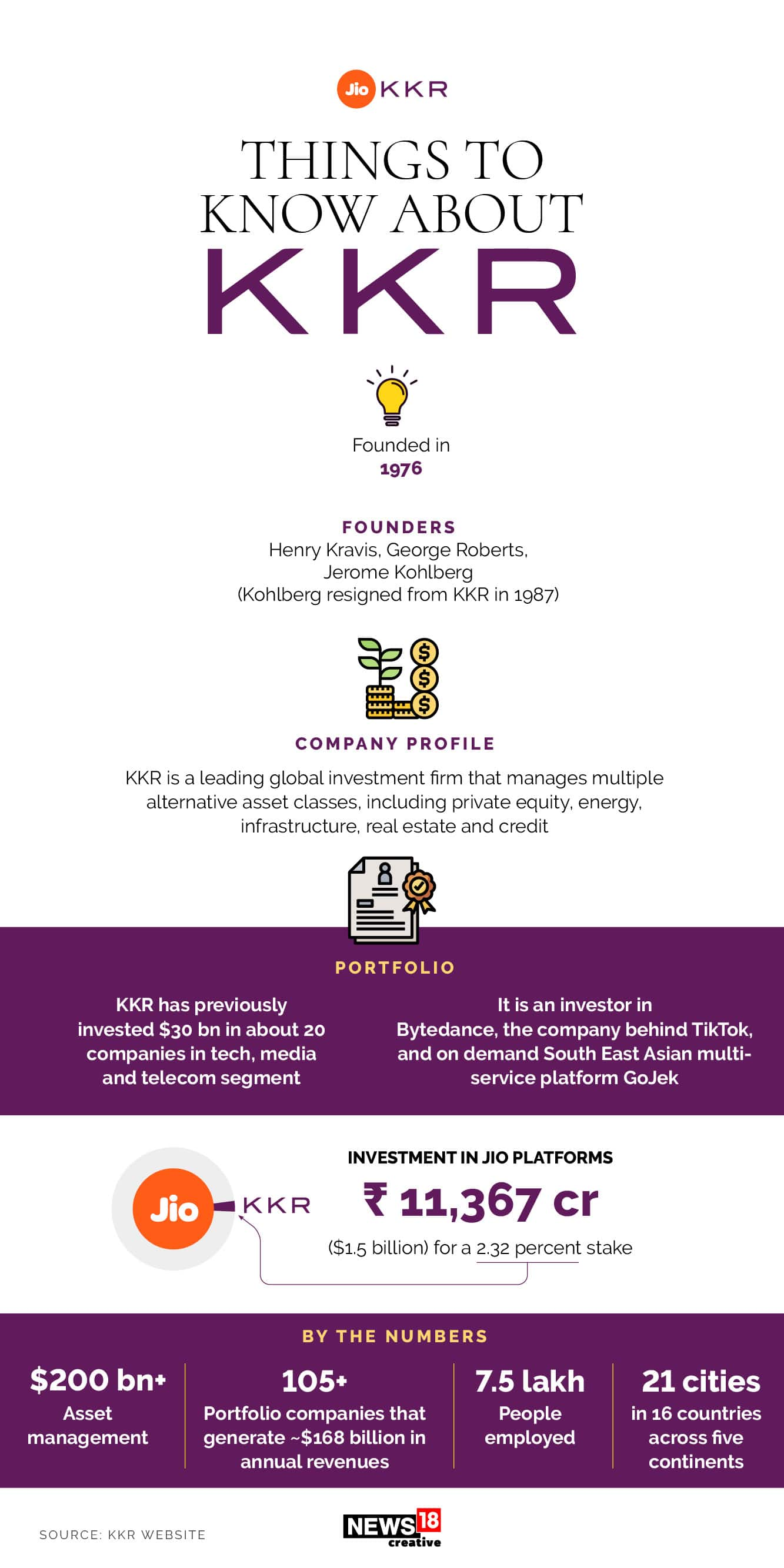

US-based private equity (PE) firm KKR has invested Rs 11,367 crore ($1.5 billion) into Jio Platforms for a 2.32 percent stake in the company.

Jio Platforms is the telecom unit of billionaire Mukesh Ambani's Reliance Industries. This is Jio Platforms' fifth major deal in the past month, after receiving investments from Facebook, Silver Lake,Vista, and General Atlantic.

The transaction is not KKR's first investment in India as it has gradually added Indian companies to its portfolio over the years.

The PE firm has invested in Indian companies such as Max Financial Services, Bharti Infratel, Ramky Enviro Engineers and Coffee Day Resorts.

In 2019, it bought a majority stake in education franchise EuroKids Group from Gaja Capital.

KKR, headquartered in New York, was founded in 1976 by Jerome Kohlberg Jr,Henry Kravis and George Roberts. Kravis and Roberts are cousins who worked at Bear Stearns before starting KKR.

KKR raised its first $1 billion institutional fund in 1984, and eventually went on to expand its presence across Europe, the Middle East and the Asia Pacific region.

The investment firm's portfolio includes various asset classes, such as private equity, energy, infrastructure, real estate and credit, with strategic partners that manage hedge funds.

KKR acquired KKR Private Equity Investors in 2009. The company listed on the New York Stock Exchange (NYSE) in 2010.

Mumbai-based KKR India Financial Services ("KIFS") is KKR’s alternative credit business in the country.

Read all KKR Jio deal stories hereDisclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!