The Indian rupee is likely to witness heightened volatility in the first six months of the next calendar year on account of global headwinds, experts said. The risks to the rupee include a potential recession and resurgence of COVID, they added.

However, the second half of 2023 may see appreciation of the rupee as interest rates may peak and inflation ease, treasury dealers said.

"Over the first half, economic woes around the globe will impact the global economy, especially China. European economic growth may improve as the worst-case scenario in energy prices did not materialise,” said Anindya Banerjee, VP - Currency Derivatives & Interest Rate Derivatives at Kotak Securities Ltd.

Banerjee added that global economic woes could impact volatility in the local currency.

The US Federal Reserve slowed the pace of rate hikes in December, but the commentary remained hawkish, an IDFC First Bank report said on December 20. The Fed is not just fighting inflation, but also market expectations which remain dovish due to worries on growth, the report said.

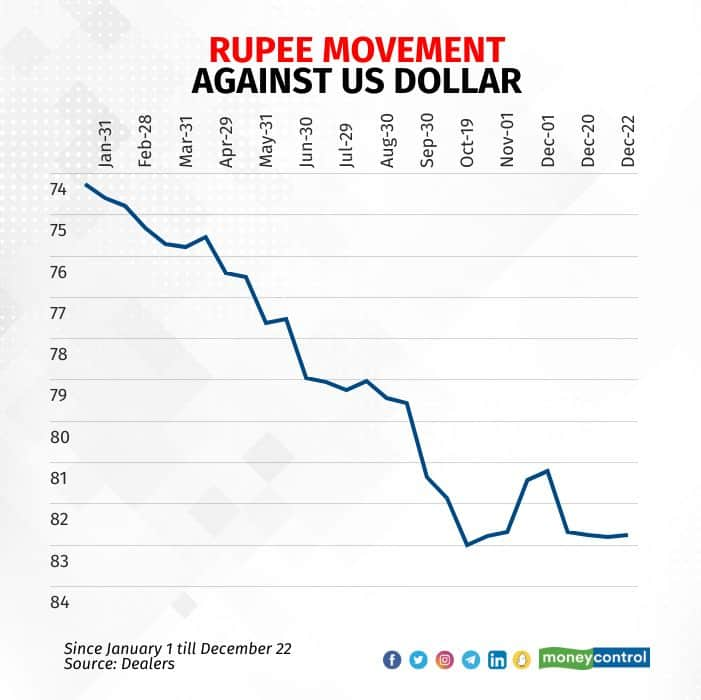

Rupee rangeExperts have given a broad range of 79-85 for the rupee against the US dollar in 2023, with a first half range of 80-82, and slightly below this level in the second half.

“We believe the rupee will trade in the range of 79 to 84, and the first half of next year could be weak for the rupee," said Dilip Parmar, Research Analyst, HDFC Securities.

Banerjee of Kotak Securities also said that during the second half, central banks are likely to shift focus towards a cut in rates as inflation may fall sharply. A rate-cut by the US Fed may pave the way for a weaker dollar during the second half.

Also, less aggressive policy from global central banks, India’s expected bond inclusion in the Global Bond Index, and foreign fund inflows may play a major role in aiding the rupee, Parmar said.

Also read: India's forex reserves rise for 5th straight week

Forex reservesForex dealers said rupee appreciation may give headroom to the central bank to build forex reserves to the level witnessed during the COVID-19 pandemic.

"RBI is likely to use periods of dollar weakness to build FX reserves which will limit USD-INR from falling below 81 levels,” said Gaura Sen Gupta, Economist at IDFC FIRST Bank Economics Research, in a report.

“Seasonal factors and market expectation of a dovish Fed will limit the upper end of the range till 83.50," Gupta said.

The RBI has been intervening in the forex market in the last few months to defend the rupee from depreciating sharply. During this course, the central bank has spent heavily from its forex kitty.

But in the last five weeks, India's forex reserves have risen due to stability in the rupee. Since November 18, forex reserves have risen more than $30 billion, according to RBI data.

According to Swati Arora, Senior Economist, HDFC Bank, RBI is likely to continue to intervene to keep the rupee stable. “The central bank is not defending any level per se but would intervene to prevent sharp volatility or a free-fall in the rupee," said Arora.

So far in 2022, the rupee depreciated around 10 percent and breached the 82 per dollar mark. Sharp depreciation in the rupee was witnessed due to persistent outflows via foreign institutional investors (FIIs) and aggressive rate hikes by the US Fed.

Despite this, the dealers said, the rupee has remained more stable compared to the Pound Sterling, Euro, and Japanese Yen, among others.

RBI Governor Shaktikanta Das, at the monetary policy statement, said that the movement of the rupee has been less disruptive compared to peers.

"In fact, the rupee has appreciated against all other major currencies except a few," Das added.

On a financial year basis, between April 2022 and October 2022, the rupee has appreciated by 3.2 percent in real terms, even as several major currencies have depreciated.

Cross-country comparisons of exchange rate movements are typically made on an inflation-adjusted basis or what is known as real effective terms.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.