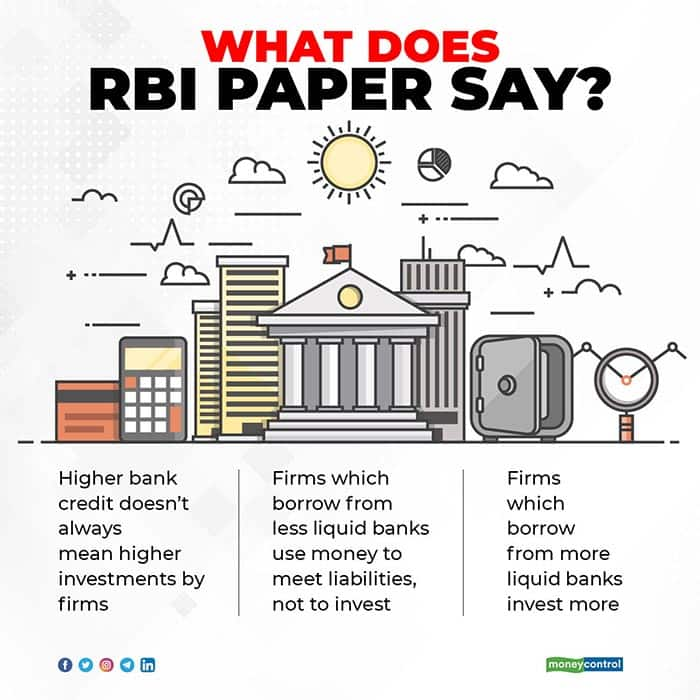

Bank credit offers an important source of funds to support the economic growth. Majority of small and medium firms rely on banks for money unlike big companies which can tap bond markets for cheaper funds. But, even if banks lend to companies, this money doesn’t always translate to higher investments by companies.

According to a Reserve Bank of India (RBI) working paper, companies which borrow from less liquid banks do not increase their capital expenditure, while current liabilities increase for these firms. “This tells us that firms channel their credit lines towards meeting current liabilities while investments take a back seat,” the paper titled, Monetary Policy Transmission in India: New Evidence from Firm-Bank Matched Data, said.

Capital expenditure refers to investments in asset creation, while liabilities mean current liabilities - immediate expenses of firms such as running the daily operations and meeting near-term expenses.

“On the other hand, we find that firms who borrow from relatively more liquid banks are more responsive to increasing their capital spending when the lenders increase their supply of credit,” the paper said.

Why does this happen?

According to Madan Sabnavis, Chief Economist of CARE Rating, only bigger banks with more deep pockets can lend for long gestation projects, while smaller banks stick to working capital loans.

“But, long-term loans also have a higher risk of NPAs, while in the case of shorter loans, banks know there is less risk involved. The bottomline is we need more well-capitalized banks,” Sabnavis said.

This RBI paper finding is important as it clearly tells us that it is wrong to assume higher bank credit doesn’t always mean higher investments in the economy.

“In addition to slow or lagged monetary policy transmission, an increase in credit may not always find its way towards increasing investments. Firms may use their credit lines to finance their current liabilities rather than undertaking capital formation,” the RBI paper said.

Typically, the lack of monetary policy transmission - banks not passing on the benefit of lower policy rates to end borrowers - has been cited as a problem by the RBI. But, as this latest paper suggests, the lack of monetary transmission isn’t the only problem.

The RBI study is important in the context of sharp economic contraction in the economy and the low credit flow to productive sectors due to lackluster demand situation. The RBI paper has found that demand conditions are key and a big decisive factor for loan growth translating to capital spending.

“Only long-term loans can lead to investments. This is an obvious aspect. But, for that to happen, we need well-capitalised banks,” said a banking analyst who didn’t want to be named.

Capital infusion in banks key

In the presence of a weak balance sheet channel of policy transmission, an expansionary monetary policy could help firms in meeting their current liabilities rather than raising their fixed capital expenditure, the RBI paper said. “Thus, capital infusion in banks can make critical difference in improving credit supply and capital formation,” it said.

The government didn't announce any capital infusion in state-run banks in the last budget. This time, liquidity is plenty in the banking system. But, smaller banks may require capital support to meet the mandatory reserve norms, provide for fresh bad loans and find money to kick-start fresh lending when demand picks up in the economy.

Bank credit flow has reduced significantly in the recent past. Bank credit grew by six percent on a year-on-year basis in November, as compared to 7.2 percent in the corresponding period in the previous year.

More worrying part is that the credit to industry contracted marginally by 0.7 percent in November 2020, as compared to 2.4 percent growth in November 2019, mainly due to contraction in credit to large industries by 1.8 percent in November, according to the RBI data.

However, credit to medium industries registered a robust growth of 20.9 percent in November vis-a-vis contraction of 2.4 percent a year ago, likely because of government’s guaranteed loan schemes for mid-sized companies.

Credit growth to the services sector accelerated to 8.8 percent in November from 4.8 percent in November 2019 mainly on the back of acceleration in credit growth to "transport operators" and "trade" within the services sector, the RBI said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.