Going by the numbers, Indian banks are lending to students seeking education loans at an aggressive pace post the lull during the pandemic phase. The big contributors to education loans are state-run banks, often nudged by the government and enthused by fresh demand from students who are now going back to colleges.

Some numbers first.

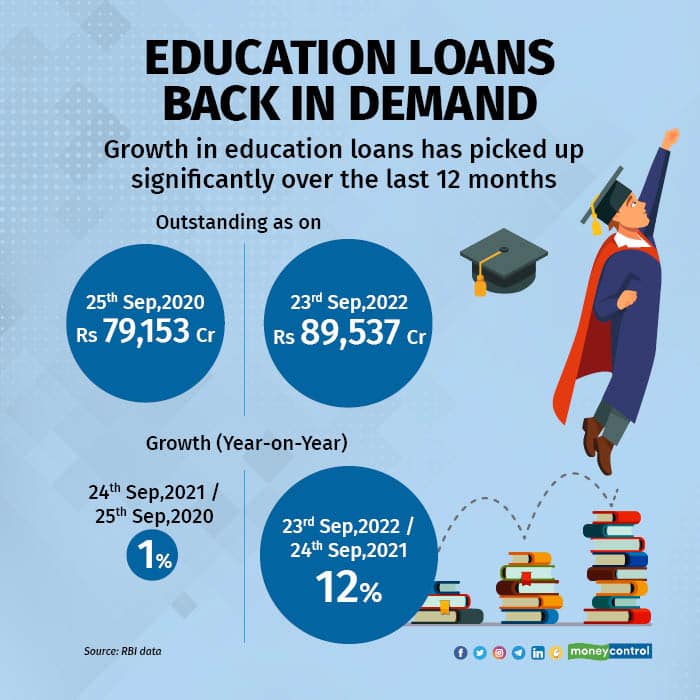

According to Reserve Bank of India (RBI) data, banks’ education loans grew at 12 percent in the 12 months ended September 30, 2022. This is compared with just 1 percent growth in the previous 12 months. If one looks at the variation in the financial year, so far, growth in education loans stood at 8.2 percent compared with 2.3 percent in the previous comparable period.

In absolute terms, outstanding education loans of Indian banks stood at Rs 89,537 crore as on September 23, 2022, compared with Rs 79,917 crore a year ago.

First of all, how do banks lend to students?

Typically, most banks offer a scheme for loans for higher studies as per the Indian Banks' Association (IBA) model education loan scheme to students pursuing higher studies in India and abroad.

Under this model loan scheme, education loans of up to Rs 4 lakh do not require any collateral, loans up to Rs 7.5 lakh can be obtained with collateral in the form of suitable third-party guarantee, while loans above Rs 7.5 lakh require tangible collateral. In all the above cases, co-obligation of parents is necessary.

Why the sudden surge now?

Experts point to several factors that possibly explain the surge in education loans in the last 12 months.

First, students are getting back to universities and other educational institutions after the two-year gap caused by COVID. Particularly, more students are opting for overseas education.

“At a macro level, there is a resurgence in demand for education loans as people have moved from online to offline yet again,” said Sanjay Agarwal, head of the BFSI vertical at CARE Ratings. “Overseas education opportunities, too, have picked up pace,” Agarwal said.

Suresh Khatanhar, deputy managing director, IDBI Bank, too, said there has been a resurgence in education loans post-COVID.

“During COVID times the pursuit of higher education was suppressed for many. Now after a fair recovery of parents’ income as well as students earning themselves, admissions for studies abroad are witnessing an upward trend,” Khatanhar said.

“The foreign universities are also opening up for physical, online and hybrid courses,” Khatanhar added.

Second, learning from past mistakes, banks have improved their processes in the education loans business, aiming to curb future bad loans, said Naresh Malhotra, a former senior official at State Bank of India.

Such a change in processes—mainly credit assessment, collateral and recovery—has given lenders confidence to lend afresh, Malhotra said. Banks seek the help of collection agencies as well to follow up on repayments, said Malhotra.

Third, the base effect, too, is playing a role in high growth numbers, said Agarwal of CARE. There was virtually no lending during the pandemic due to lockdowns and health hazards. On a lower base, the growth figures will look higher, said Agarwal.

Fourth, about 90 percent of education loans are given by state-run banks. These banks face pressure from the government to step up lending to students.

According to a PTI report in November, the finance ministry had called a meeting of public sector banks (PSBs) to take stock of the education loan portfolio and cut down on delay.

The ministry exhorted banks to spread awareness about the Central Sector Interest Subsidy Scheme among field formations, the report said.

How about stress from such loans?

Typically, bad loans in the education loan segment are relatively high and are estimated to be around 8 percent at this point for the whole industry. Non-performing assets (NPAs) in the education loan category including PSBs were 7.82 percent at the end of the June quarter of the current financial year.

But things may improve going ahead, said Malhotra.

“The current high NPA levels you see in the education loan segment is the hangover from the past,” said Malhotra. “That won’t be the case in the future as banks focus more on high-value loans backed by guarantees or collateral,” said Malhotra, who spent more than three decades in the State Bank group across various verticals.

According to Khatanhar of IDBI Bank, for loans below Rs 7.5 lakh, there's now a government guarantee scheme available, which helps banks cover the risk.

“Education loans in the segment of Rs 7.5 lakh and above are generally collateral-based and help credit enhancement,” Khatanhar said.

Another senior banker, who spoke on condition of anonymity, too, said banks are now more cautious while lending to avoid future shocks. However, there is a risk involved in such loans due to local political intervention on small-ticket loans, the banker said.

“Banks face pressure at the branch level during recovery of these loans. Such efforts are opposed by local politicians which make our job tough,” said the banker.

Finally, the unemployment link

Madan Sabnavis, chief economist at Bank of Baroda, said the reason for high NPAs in the education loan segment can be attributed to a high unemployment rate in the country as well.

“Students paying high fees using education loans, except the ones from top institutes, often do not get job opportunities. This results in delayed payment or default,” said Sabnavis.

The unemployment rate in India rose to 7.77 percent in October compared to a four-year low of 6.43 percent in September, data from Centre for Monitoring Indian Economy (CMIE) showed.

What is the takeaway here? The health of banks’ education loan books will depend on a revival in the global economy and job availability. If things don’t go as expected, banks may have to take a hard look at the quality of their education loan books.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.