Highlights:- - Margins in the electro-mechanical segment have been improving

- Weakness is likely to persist in unitary cooling products

- The stock can be bought on correction

--------------------------------------------------

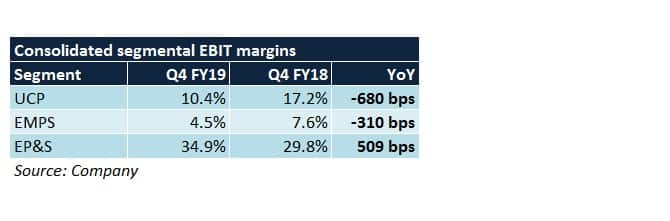

Voltas saw a disappointing Q4, weighed down by a sharp weakness in the unitary cooling products (UCP) segment. While profitable contracts in the electromechanical project space (EMPS) will be prioritised, revival of AC demand and achieving benefits of scale in 'Voltas Beko', its recently-launched home appliances unit, will be crucial for the stock's re-rating.

- Voltas' market share in the AC space increased to 23.9 percent in FY19, from 22.1 percent in FY18

- Uptick in order execution and revenue recognition in connection with projects nearing completion drove turnover in the EMPS segment

- Margins in the EP&S (Engineering products and services) segment improved because of a good product mix

Negatives- Consolidated margins contracted sharply because of significant weakness in the UCP segment. This, in turn, was attributable to high costs on raw materials and employees, weak demand scenario for ACs and air coolers, one-time costs and muted performance in commercial refrigeration

- In the EMPS segment, profitability declined since most of the orders were low-margin in nature

- Losses from subsidiaries, associates and joint ventures rose substantially year-on-year

- Revenue in the EP&S segment declined year-on-year because of sluggish demand for textile machinery

Voltas' carry forward order book stood at Rs 4,976 crore at the end of FY19, as against Rs 5,062 crore as on March 31, 2018. This is estimated to grow on the back of increased emphasis on government-funded urban infrastructure projects pertaining to electrification, roads, metros, airports, water treatment, healthcare and education.

In the Middle East, concerns relating to Qatar-based operations are being resolved and opportunities are being explored in Bahrain. An uptick in oil prices should augur well for economic growth in these countries, which could help Voltas bag more orders. However, there are still some delays in receiving collections from an Oman-based joint venture entity.

In Q1 FY20, the company bagged orders worth Rs 392 crore and Rs 626 crore for domestic and international verticals, respectively. Notwithstanding quarterly volatility, the aim is to keep margins in the range of 7-7.5 percent in the long run.

In a bid to boost profitability, the management will bid for assignments which are commercially viable, cost-efficient and those where risks associated with completion-related delays are minimal.

UCP segmentLiquidation of AC inventory stuck across trade channels (due to extended winters in Q4 FY19) will be prioritised to reduce working capital strain. In Q1 FY20, summer conditions are expected to remain stable, which should facilitate demand revival.

The management guided for margins of 11 percent on a sustainable basis for the upcoming fiscals. Introduction of inverter ACs -- comprising 40 percent of split AC sales in FY19 -- and market share gains (which hint at volume growth) would be the key drivers in this regard.

A new AC manufacturing factory will be set up in Tirupati. The move should help Voltas target the southern and western India markets better, save logistical costs and reduce dependence on imports.

Under the 'Voltas Beko' brand, the company has launched 31/5/12 new SKUs (stock keeping units) in refrigerators/washing machines/microwaves, respectively, so far. In due course, these products would be made available across India in a phased manner.

Moreover, domestic manufacturing of such appliances at Sanand in Gujarat is slated to commence in Q3 FY20. This would save costs substantially from FY21 onwards (currently, all 'Voltas Beko' products are entirely imported).

A total of 39 SKUs of air coolers have been introduced in the market to capitalise on the industry shift from unorganised to organised players.

In commercial refrigeration, new models have been launched in areas such as convertible freezer, freezer on wheels, curved glass freezer, water dispensers and coolers. This domain has been gaining strong traction lately.

EP&S segmentTo reduce exposure to capital-intensive textile machinery sales, the management is shifting its attention to maintenance services instead.

In contrast, Voltas' Mozambique-based mining operations have been going on fairly profitably.

OutlookWhile we remain optimistic about Voltas' improving trajectory in the EMPS segment, the UCP segment may face some margin pressure in the near term because of weak air cooler sales and investments in brand building for Voltas Beko (by way of high dealer margins and spends on advertisements).

Nevertheless, if AC sales pick up pace and contribute to operating leverage, to some extent, the negative impact can be taken care of.

In our view, the stock may continue going through a rough patch in the next few quarters. Prospects of a re-rating anytime soon seem pretty bleak. We advise investors to buy on corrections.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.