Madhuchanda Dey

Moneycontrol Research

VIP Industries reported one of its best quarterly results ever as strong macro-economic advantages and a concerted effort by the company helped it report robust topline growth, aided by all four key brands and all its distribution channels.

Despite the depreciation in the rupee impacting its gross margin, operating profit margin rose sharply and the company expects it to be stable because growth outlook remains strong.

While the stock has been a big outperformer in the past, the opportunity in it remains significant as growth in travel and tourism is gaining momentum and organised players like VIP are gaining market share in a predominantly unorganised market after the implementation of GST.

We expect earnings to grow at a CAGR of 44 percent over the next couple of years and the stock’s performance should mimic the same even in the absence of multiple re-ratings.

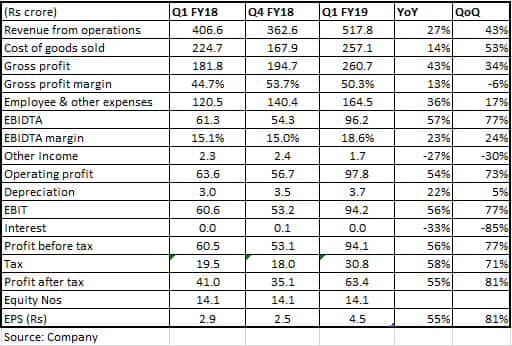

Quarter at a glance

For the June quarter, VIP reported a 27 percent year-on-year rise in revenue. When adjusted for the impact of GST, the rise in revenue was over 31 percent.

The management ascribed this rise to buoyant market conditions supported by robust growth in air travel and the introduction of GST leading to a shift from unbranded to branded luggage, especially in the value segment where Aristocrat appears to be a beneficiary.

Other factors mentioned by the company were the new refurbished range of products of the VIP brand that have been accepted well by the market, and the unlimited warranty offered on its brand Carlton Edge, which was also received well by consumers.

In terms of distribution channels, modern and general trade, as well as e-commerce, did well. But the performance boost came from the CSD (canteen store department of the army) channel, which had an exceptionally weak quarter in Q1 FY18, but has grown strongly and come back to pre-GST levels.

Despite the depreciation in the rupee eating into the company’s gross margin, which declined on a sequential (quarter on quarter) basis, the company saw a sharp surge in operating margin to 18.6 percent, thanks to the momentum in sales and control over fixed overheads.

Outlook – as good as it gets

The strong outlook for the domestic market, moderate competitive intensity, and GST-related advantages have given the company’s management the confidence to guide to margin stability, going forward.

Incidentally, the international business has de-grown and the company intends to focus on the more profitable domestic market, where its brands are resonating well with consumers.

The company is expanding capacity in Bangladesh, which will principally cater to the growing Indian market. In the Bangladesh operations, while sales grew handsomely by 83 percent to Rs 25 crore, profit growth was muted due to up-fronting of costs for the new facility.

The company has stepped up its advertisement spend and saw a good response for all its four brands -- Skybag, VIP, Aristocrat and Carlton -- as well as for ladies handbag brand Caprese.

While all categories are firing, the company is especially optimistic about backpacks (Skybag), where despite unorganised competition and lower ticket size, the market potential is huge and the replacement cycle is shorter.

The tailwinds

VIP is the market leader in a market where unorganised players still dominate with an 80 percent share in volume terms and over 66 percent in value terms. Competitive intensity remains rational as foreign players like Samsonite and American Tourister do not have the aggression of domestic branded players.

The growth of travel infrastructure such as roads, airports and railway stations have contributed significantly to the development of the travel industry in India. Over the years, both domestic and international air travel have witnessed consistent double-digit growth and it is likely to accelerate.

Aided by macro drivers like GDP growth, rising personal income levels, changing lifestyles, huge middle class, and the availability of cheaper flight tickets and diverse travel packages, India is rapidly becoming one of the fastest growing outbound travel markets in the world.

These trends have a significant positive impact on the long-term fortunes of the domestic luggage industry.

Also, luggage has become an important part of the wedding trousseau, with even people in tier-II and tier-III cities buying branded suitcases and strollers during the wedding season. The penetration of luggage as a category is much lower than other consumer products.

The management’s commentary is full of optimism. Buy the stock for consistent earnings, and a multiple re-rating to FMCG counterparts will be a bonus.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.