Anubhav Sahu

Moneycontrol Research

Vikas Ecotech’s Q4 FY18 result was nothing short of a disaster, with sales declining 70 percent year-on-year. More than the numbers, what makes us cautious is the Directorate of Revenue Intelligence’s (DRI) survey. Adding to its woes, high receivables and payables have knocked down its balance sheet. While the company’s recent investor update point towards restoration of normalcy in operations and capacity expansion plans, the event risk is far from over.

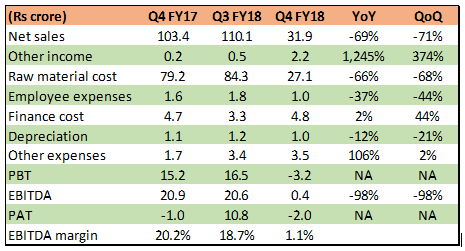

Q4 FY18 result: A rude shock The management explained that last quarter’s operations were disrupted by DRI’s survey of company’s international trade operations, including import and export consignments. As a result, it experienced a significant disruption in its day-to-day operations. Since almost 70 percent of the company’s raw materials are imported and exports constitute more than half of its total revenue, a disruption in operations has hugely impacted revenue.

This is also evident in the segmental performance, where domestic revenue has been broadly stable, and export revenue has contracted 85 percent sequentially.

Result snapshot

Robust mid-quarter performance

After the Q4 FY18 result, the management issued a mid-quarter performance update, highlighting that it has resumed normal levels of production and clocked Rs 55 crore revenue in the first two months of the Q1 FY19 quarter. The company expects a turnover of Rs 180-190 crore in the first half of FY19.

Organotin sales to the US market

During the quarter gone by, the company commenced its sales of organotin stabilisers to the US market. As per a company release, the US had banned use of toxic stabilisers back in 1986 and now is the world’s biggest market for organotin stabilisers, amounting to over 80,000 tonne of annual consumption.

Backward integration in organotin value chain

The company announced it is setting up a 2-ethylhexyl thioglycolate (2-EHTG) manufacturing plant at Dahej, Gujarat. The compound is used as a raw material for manufacturing of organotins. With a capex of Rs 35 crore, the project is expected to be completed in 1 year. At peak utilisation, the company is expected to manufacture 3,600 tonne of 2-EHTG.

Vikas Ecotech’s current requirement is about 2,400 tonne and hence any surplus production would be sold in the open market. At present, its entire 2-EHTG requirement is met through imports, primarily from China. Due to closure of a few manufacturing units in China and non-compliance with environmental norms, supply of this raw material was constrained. This backward integration initiative is expected to cut down the company’s import bill by 20-30 percent.

Capacity expansion plan for organotin stabilisers resume

The management said hindrances with respect to implementing the capacity expansion plan at Dahej have been sorted and now expects new capacity of 6,000 tonne (existing 3000 tonne) of organotin stabilisers to be available in six months. After this, the company could start production from the new facility.

Balance sheet repair reverses

Long term borrowings for the company reduced 33 percent in the last one year. However, the company’s short term borrowings have surged significantly. As a result, its debt-to-equity ratio surged to 0.87 from 0.77 since September last year.

Both trade payables and receivables have surged. Trade receivables as of March 31 amounted to 57 percent of annual sales. Additionally, trade payables have almost doubled in the last six months. Incremental trade payables constitute about 35 percent of cumulative raw material purchased in the last six months.

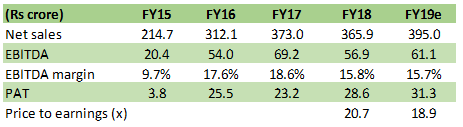

Financial projections

Events to watch out for

After the quarterly result and company updates, we have revised down our projections. While the company’s operations are apparently on a recovery track, growth momentum seen in earlier years has paused.

There are two significant events which investors need to keep an eye on. On the opportunity side, National Green Tribunal (NGT) order deadline for mandatory usage of lead free stabilisers (organotin stabilisers) is expected by July-end. While there is a possibility of extending the timeline, if the enforcement of lead free stabilisers is done within the stipulated time, then a huge opportunity may emerge for the company.

On the flip side is expected follow up on the DRI survey. Any adverse findings or penalties from the Revenue Intelligence Department would further erode investor confidence. We would err on the side of caution and advice investor’s to stay cautious given its balance sheet woes and corporate governance issues.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.