Anubhav Sahu Moneycontrol research

We have been recommending Tata Global Beverages (TGB) ever since we sniffed the winds of change at the group level. However, media reports suggest the restructuring is far from over. The management is evaluating proposals for positioning TGB as a fast moving consumer goods (FMCG) major, with a portfolio ranging from beverages (tea, coffee and dairy) to lentils and food ingredients.

Reports suggest that one of the proposals that Tata Group is evaluating involves merging salt and branded lentils business of Tata Chemicals with TGB and full consolidation of Tata Coffee. Such a move can remove business risk on account of limited exposure to beverage but also opens up space for product extension in food and beverages. As a result, we expect valuation discount to the FMCG sector average to narrow.

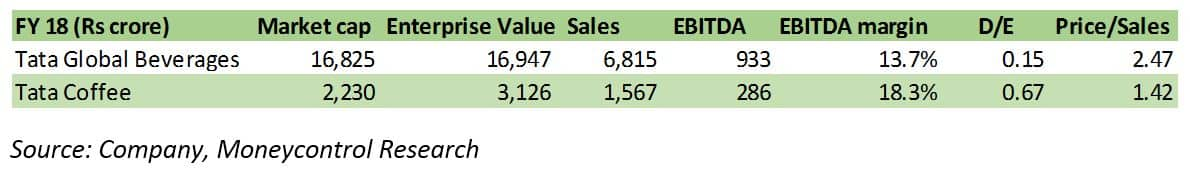

What does the new proposal mean? TGB already has a 57.5 percent share in Tata Coffee and consolidation of both businesses means TGB acquiring another 42.5 percent stake in Tata Coffee. This can lead to full consolidation in tea and coffee businesses under one roof.

Due to its existing stake in Tata Coffee, 12 percent of its consolidated sales are accruing from low margin non-branded business. The latter manly consists of tea and coffee plantations. For TGB, profit before tax from this business was a mere 5 percent in FY18. Consolidation of Tata Coffee with TGB would mean that the share of the non-branded business would increase further to 14 percent of the merged entity’s consolidated sales of Rs 7,481 crore. As return on capital employed (RoCE) on the non-branded business has been low and volatile compared to that for branded business (4 percent versus 17 percent in FY18), we expect non-branded business to be kept out of the equation.

What’s available from Tata Chemicals? Another related proposal been talked about is moving the food/consumption business from Tata Chemicals’ stable to TGB. This includes mainly branded pulses/besan and salt business. Salt constitutes about 36 percent of Tata Chemicals’ turnover (Rs 1,275 crore revenue in FY18). It posted a 4 and 3 percent CAGR (FY16-18) growth in sales and volume terms, respectively. Domestic production of iodised salt is 66 lakh tonne, of which Tata Salt’s market share is about 14 percent.

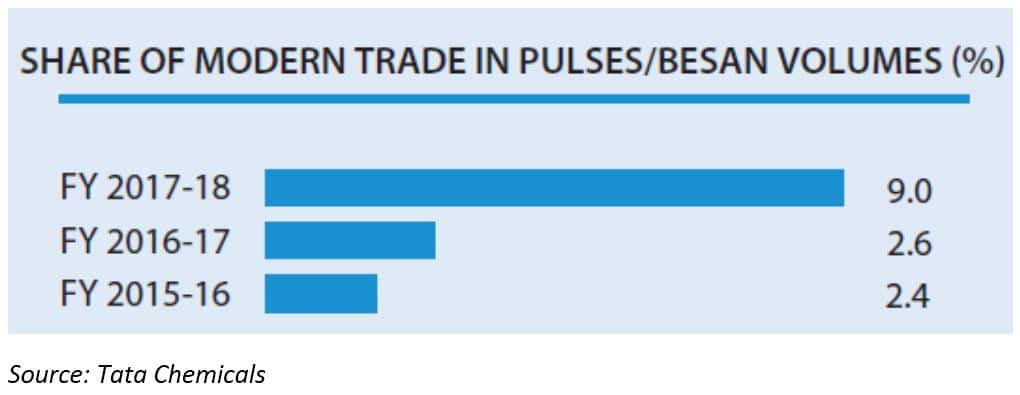

Tata Chemicals has been marketing pulses and besan under brand Tata Sampann. In recent years, there has been a sharp increase in modern trade’s share of pulses and besan volumes from 2.6 percent in FY17 to 9 percent in FY18. Estimate for branded sales is not available but is reported under ‘others’ (Rs 146 crore in FY18). This includes water purifier, spices and nutritional solutions.

As of now, the basket of products expected from Tata Chemicals for TGB is commoditised with salt accounting for about 90 percent of sales.

Having said that, there is a justified case for bringing spices and nutritional solutions into TGB and position it as a food and beverage giant. In the case of nutritional solutions, the management is targeting the food ingredient space (Fructo-oligosaccharide and Galactooligosaccharide), which should fetch a higher valuation multiple (price-to-earnings around 30 times). Sales for this product segment was Rs 34 crore in FY18 (30 percent YoY growth). Here it is looking at major expansion and is constructing a 5,000 tonne capacity in Nellore, which would be nearly three times last year’s production.

The management also seems to be on the prowl for expanding its consumer product portfolio.

Scale up in consumer portfolio on the cards? Consolidation of consumer-oriented businesses under one umbrella can lead to acceleration of product launches and extensions.

Restructuring initiatives for TGB will help reduce business risk from being a beverage company only. At present, TGB’s stock commands a valuation multiple (price-to-sales) in the range of 2.5 times, which is higher than pure volume plays in the dairy sector and similar to that witnessed by the snacks industry (Prataap Snacks and DFM Foods). Looking at the food and beverage segment under Thomson Reuters classification, one finds that TGB’s enterprise value multiple (EV/EBITDA) is currently at a 25 percent discount to the segment.

To unlock value for shareholders and help reach valuation multiples closer to the FMCG sector averages (price-to-sales of around 10 times), the management would focus on a couple of steps. First, it would continue to take out low margin, non-branded businesses. Second, scale up contribution from the consumer food business.

Since last year, the management has taken steps to reorient itself for profitable ventures by exiting operations in China and Sri Lanka and restructured the Russian unit. Some of their joint ventures (Starbucks and Nourishco) have now turned profitable. The next leg of opportunity would stem from strategic decisions. Takeaways from recently concluded annual general meeting suggest that the management’s focus is more on India businesses where there is higher consumption-led growth.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.