Indian pharmaceutical sector has been in the doldrums recently with Nifty Pharma tumbling about 10.7 percent so far in 2019. The sector has been in the news for regulatory and pricing issues.

However, analysts are hopeful that the domestic market will lead them out of woods. A glimpse of that was seen when Torrent Pharmaceuticals announced its earnings for the quarter ended June 2019.

The company on July 23 reported a 32.51 percent rise in its consolidated net profit to Rs 216 crore for Q1FY20, primarily driven by robust growth and margin performance in the domestic market.

Torrent's Indian business grew 9 percent YoY to Rs 907 crore, while the US revenue stood at Rs 376 crore, up 13 percent from the year-ago period.

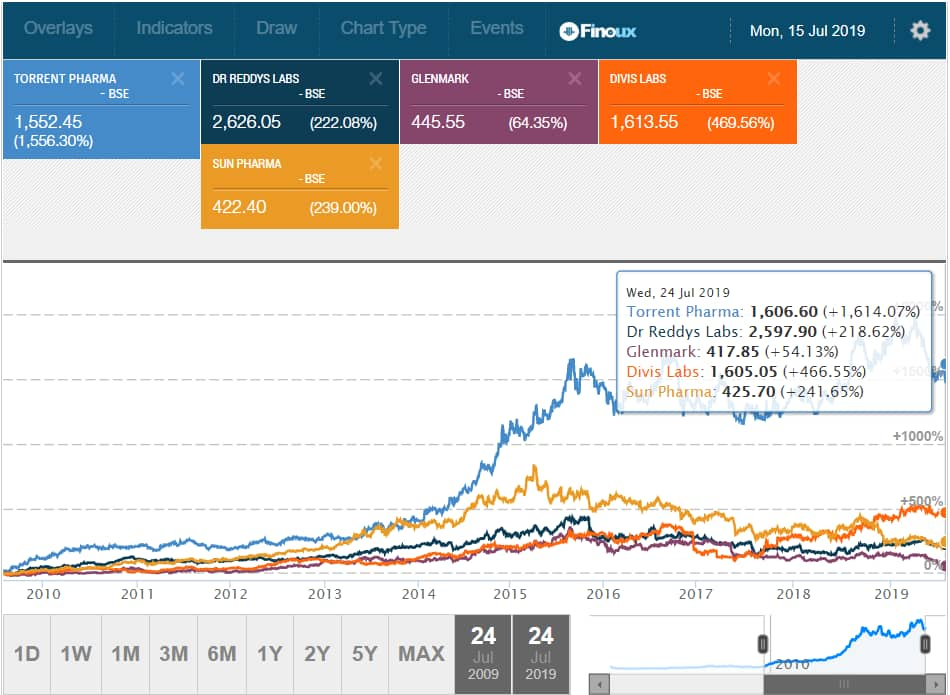

The scrip has returned 1,614 percent in the last 10 years, way ahead of peers like Dr Reddy's Labs (219 percent), Divi's Labs (467 percent), Sun Pharma (241 percent) and Glenmark Pharma (54 percent). In the same period, Nifty Pharma returned 118 percent.

Experts believe that Torrent Pharma's blockbuster run is not over just yet. Analysts at various brokerages firms see up to 16 percent upside on the back of strong Indian presence, synergies from the Unichem integration and continued debt reduction.

"We expect revenue and earnings CAGR of 9.3 percent and 25.7 percent respectively, over FY19-FY22E, with EBITDA margin expansion of 140bps led by higher growth in India business (12 percent CAGR). Return ratios dropped in FY19 with Unichem acquisition, but we expect RoE and RoCE to revert to 22.3 percent and 17.8 percent, respectively, by FY22," said analysts at ICICI Securities.

However, analysts are not so upbeat about its global business. Nomura said the company may face headwinds outside India due to regulatory issues.

US drug regulator has classified Torrent's Dahej plant as Official Action Indicated (OAI). This implies that the regulator will not grant any new approvals from the site until its reservations are addressed.

Adding to the worries, Nomura expects its Indrad facility of the company to also fall under the purview of USFDA. The regulator had already carried out an inspection at the site, earlier this year in April.

"We think the risk of the Indrad site too being classified as OAI remains high. In such a case, even though the existing sales from Indrad are unlikely to be impacted, developments so far present a substantial risk to new product launches," said Nomura.

Fittingly, Kotak Institutional Equities advised Torrent to focus primarily on the domestic market, where it is on track to deliver 11 percent CAGR from FY2019-22E.

Brokerage CallsKotak Institutional Equities: Buy | TP: Rs 1,840 | Upside: 16 percent

ICICI Securities: Buy | TP: Rs 1,800 | Upside: 13 percent

Nomura Holdings: Buy | TP: Rs 1,778 | Upside: 12 percent

Disclaimer: The views and investment tips expressed by brokerages on moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!