Digital payments firm One 97 Communications, which operates under the Paytm brand, has reported robust growth in its credit business for the month of February, prompting many analysts to revise their price targets for the stock.

According to its monthly performance update, the company clocked disbursements of Rs 4,158 crore ($503 million) in February 2023, a robust year-on-year (YoY) growth of 254 percent, with the number of loan disbursals soaring 86 percent to 40 lakh.

The company’s consumer base continued to expand, with average monthly transacting users (MTU) of 8.9 crore for the quarter-to-date, increasing 28 percent over February 2022.

Paytm’s Merchant Payment Volumes (GMV) for the quarter-to-date (January and February 2023) stood at Rs 2.34 lakh crore ($28.3 billion), up 41 percent YoY.

The number of merchants paying subscriptions for payment devices like Soundbox has reached 64 lakh as on February 2023.

In a report, Citi Research said there has been a continued shift in the disbursals mix towards personal/merchant loans (vs post-paid ‘buy now pay later’ or BNPL loans).

“We think Paytm has several existing and emerging levers to drive long-term platform stickiness (BNPL, devices, etc) and improve overall profitability (Financial Services) in the business. Paytm's key edge is its first-mover advantage on both sides of the payments ecosystem (71 mn MTUs and 25 mn merchants) which gives it a solid customer acquisition engine for new services – commerce, financial or payments,” its analysts said.

It has given a target price of Rs 1,061, implying a potential upside of over 80 percent based on the current share price of Rs 573.

However, Citi acknowledged that the stock has declined materially from its IPO price of Rs 2,150, in line with the fintech sector de-rating YTD, compounded by concerns on profitability in the core payments business (overstated in its view) and regulatory headwinds in India, which it termed a “moderate risk”.

“At CMP, we think valuations are attractive and are pricing in most of the downside risks,” it added.

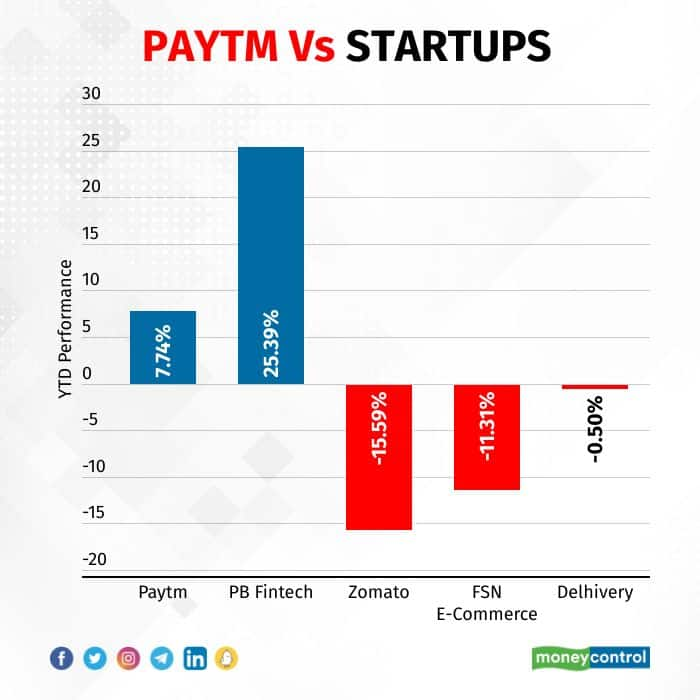

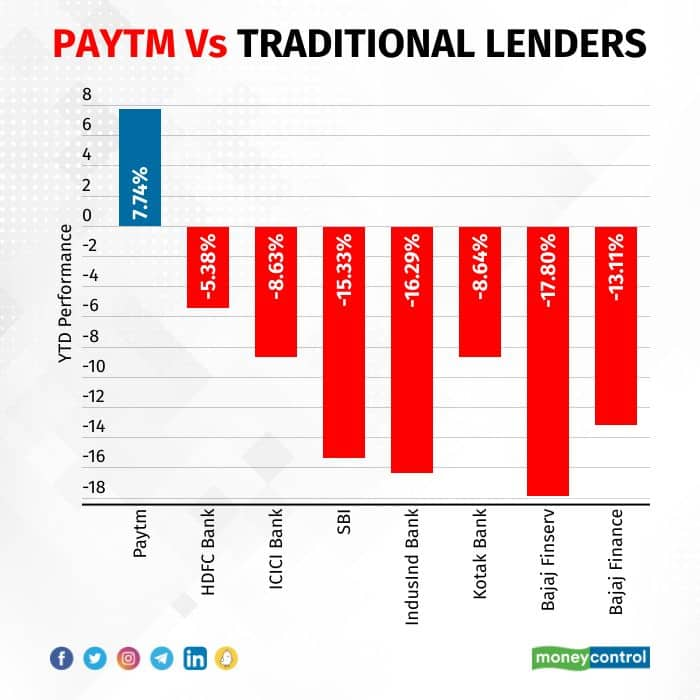

The current spell of improving performance metrics is clearly reflected in Paytm’s share price movement as well.

However, the issue of profitability has been a major overhang on the stock.

In Q3 FY23, Paytm’s revenue rose 41 percent to Rs 2,062 crore compared to the year-ago period, while net loss narrowed to Rs 392 crore from Rs 778 crore.

In a letter to shareholders, Paytm Founder and CEO Vijay Shekhar Sharma said that the company had achieved operating profitability in Q3, which is three quarters ahead of the guidance which was for the September quarter.

Domestic brokerage Geojit, in a recent note, said the company reported “exceptional” revenue growth and improved margins in Q3.

“Cost optimisation and strategic partnerships improved its bottom line. A robust product portfolio and a growing customer base bode well for the company’s growth potential and will continue to improve its long-term financial performance,” it said, reiterating its ‘buy’ rating.

Macquarie had recently double-upgraded Paytm’s stock to 'outperform' from 'underperform' on the back of strong showing by Paytm’s lending products, including Paytm Postpaid, personal loans and merchant Loans, which are underwritten by the fintech giant’s lending partners.

“The company has now seen several repeat purchases/transactions over the past 12 months, which assures us of the quality of these loans,” it had said in a note.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions. Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.