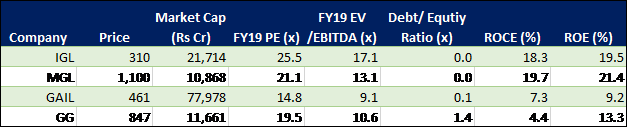

With gas sector companies correcting 2 to 14 percent post the Q2 results and increased focus of the government to move to cleaner fuels and promote CNG, we believe downstream gas sector should be on the radar of investors. While we remain buyers for GAIL, we recommend adding IGL and MGL on corrections, and we stay underweight on Gujarat Gas till we see some traction in volume.

Key sector trendsVolume growth driven by demand from power sectorThe domestic coal availability during the monsoon season was weak and non-availability of domestic coal provided a push to demand from the power plant segment for gas companies. As most of these plants are located in the eastern part of the country, the transmission tariffs for these plants are also higher which led to higher overall blended tariffs and expansion of EBITDA. Owing to normalization of the coal availability, these surge in volumes might not be sustainable in Q3.

GST impactThe quarter witnessed an impact on profitability due to negative impact of GST. Pre-GST destocking and subdued industrial environment post-GST negatively impacting demand. Non-inclusion of gas under GST created additional headwinds and impacted revenues and volumes for the gas companies on the whole. On one hand, the operating expenditure has gone up due to the non-availability of the input tax credit (ITC); on the other hand, absence of ITC has negatively impacted sales volumes. Moreover, it has led to dual compliance pressures. We believe the impact to further normalize in coming quarters and any policy change for inclusion of the gas sector under GST will bring additional benefits for the companies.

Q2FY18 performanceGas Authority of India (GAIL)GAIL surprised the Street positively with 35 percent YoY EBITDA growth owing mainly to higher volumes coupled with higher tariffs and margins for gas transmission and trading. While the gas transmission volumes grew 5 percent YoY and 6 percent QoQ, gas trading volumes increased by 5 percent YoY and 8 percent, sequentially.

Petchem sales were up 29 percent YoY, mainly driven by ramping up of utilization at both PATA plants. However, the realizations declined 18 percent due to increased domestic competition, increased supply from OPAL and RIL and increase in imports.

LPG and hydrocarbon segment EBIT remained strong owing to an increase in volumes attributed to increase in rich gas availability.

Indraprastha Gas (IGL)

Indraprastha Gas (IGL)IGL reported a healthy set of Q2 numbers with mid-teens YoY EBITDA growth. Although EBITDA margins grew YoY, there was a decline QoQ. The volume traction remained steady with an overall volume growth of 14 percent. All segments including CNG, PNG and commercial saw healthy YoY volume growth of 9, 18 and 19 percent, respectively.

Mahanagar Gas Ltd (MGL)

Mahanagar Gas Ltd (MGL)With a 4 percent YoY growth in volumes, MGL saw an EBITDA growth of 24 percent. The quarter saw a QoQ hit on margins, which have earlier been a comforting factor for the the company despite some pressure on volumes. On a YoY basis the margins grew 19 percent owing majorly to better prices for the industrial sector. The company reported a healthy 22 percent YoY rise in EPS and Profit after tax.

Gujarat Gas (GG)

Gujarat Gas (GG)GG’s second quarter earnings performance was subdued, with volumes contracting and margins under pressure. The subdued warmish performance can be attributed to a sequential decline in margins led by 1) industrial disruptions with around 10 days strikes on account of GST implementation 2) non-inclusion of gas in GST 3) lower off-take by industries due to heavy floods in Gujarat. Contraction in sales negatively impacted the overall cost of raw material during Q2 due to lower pass-over of the expensive LNG costs.

Future tailwindsRising pollution and crude prices to benefit the sector

Future tailwindsRising pollution and crude prices to benefit the sectorThe rise in the pollution and attempts to curb the use of polluting fuels has made natural gas an attractive fuel option which stands to benefit the companies from both domestic, industrial and vehicle volumes. Moreover, the increasing price of fuels, especially crude oil makes natural gas a relatively economical option and an attractive alternative. We believe this to increase the penetration of natural gas for both domestic as well as industrial use and boost volumes.

CGD expansion to provide volumesThe government’s policy initiative to switch to cleaner fuels has enabled the sector to grow exponentially and the demand-side boost provides significant tailwinds for gas retailing companies.

With NITI Aayog’s recommendation of expanding city gas distribution to 326 cities by 2022 and the recently awarded utility status for pipes gas, CGD (city gas distribution) will see a massive surge that should boost volumes in the medium to long term.

The downstream gas sector seems attractive and definitely worth keeping an eye on. FY18Q2 was a mixed bag and we see further support for volumes in the coming quarters. Although EVs (electric vehicles) are being seen as a threat for the sector, we believe it will be long before it starts impacting the ground reality.

The stocks have run up significantly since the start of the year and valuations look heady in pockets. While we are comfortable with the business model and valuation of GAIL at the current level, we would prefer a better entry price point for IGL and MGL. For Gujarat Gas we would like to see some uptick in volume before turning bullish. Overall, gas companies remain a play on rising pollution concerns and expected ban on industrial fuels and should definitely be on the radar of investors.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!