Private equity and venture capital funding to Indian artificial intelligence (AI) startups has slowed down as funding winter worsens and ChatGPT takes centre stage in the generative AI space.

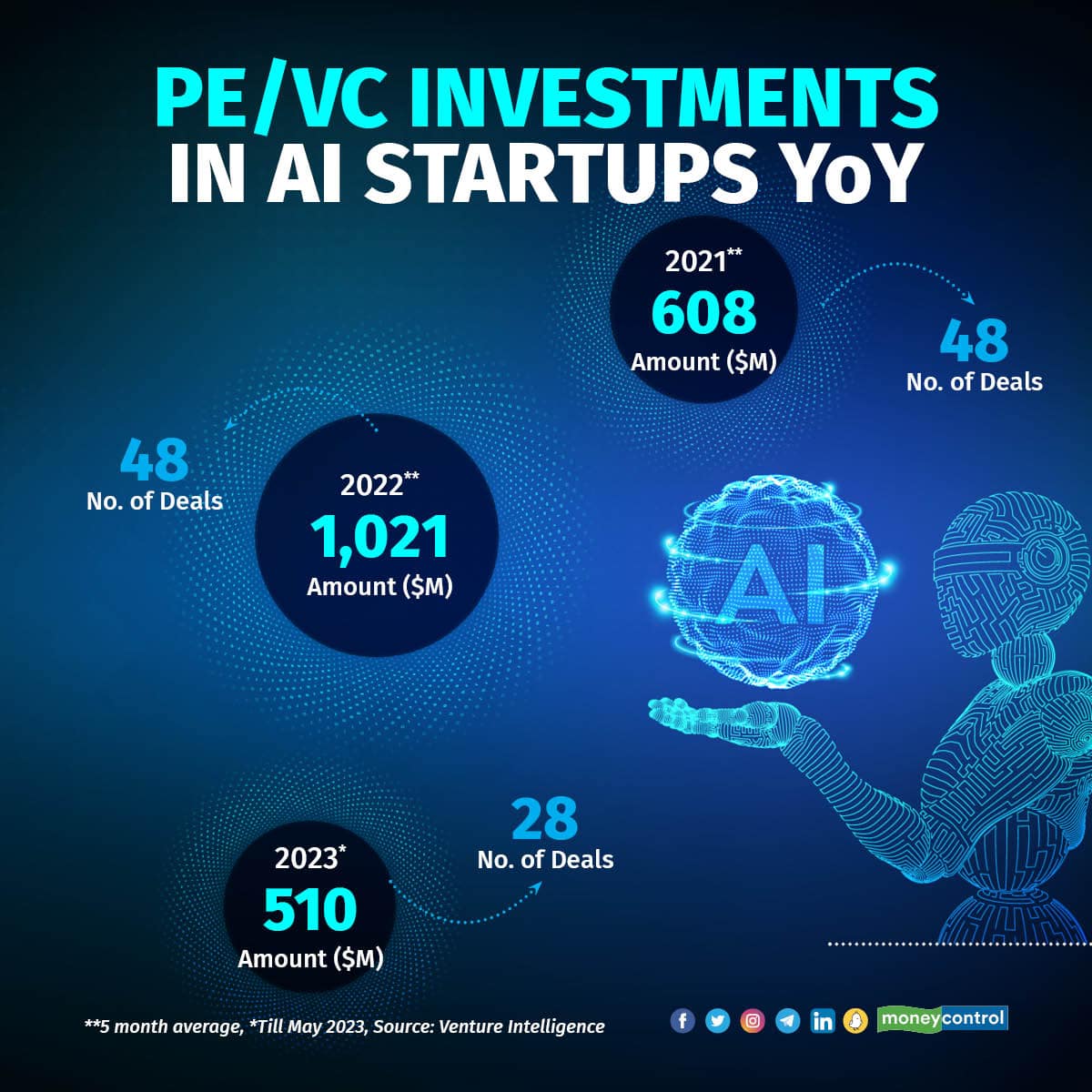

Investors have channelled in about $510 million in only 28 deals from January to May in 2023, half of the five-month average of $1.02 billion last year indicating a slow rate of investments this year, according to data shared by Venture Intelligence.

AI Investments in AI startups YoY

AI Investments in AI startups YoY

This comes at a time when funding to Indian startups has plunged to about a fifth in the first five months of 2023 compared to the same period last year, with no end in sight to the funding crunch.

More importantly, the slow pace of AI investments defies the bullish trend of 2022, a year when investments in AI startups braved through the winter clocking $2.45 billion, up almost 68 percent from $1.46 billion in 2021 – when investments were pouring in.

AI Investments in AI startups 2022 V/S 2021

AI Investments in AI startups 2022 V/S 2021

The increase in investments in 2022 over 2021 was despite the number of deals remaining the same at 114, signalling an increase in deal sizes. AI investments this year, however, have fallen even lower than the five-month average of 2021.

According to Anand Lunia, founding partner at India Quotient, apart from a stunted deal flow and overall activity in venture capital, the introduction of OpenAI’s ChatGPT has also put the Indian AI ecosystem in flux.

“With something as overarching as ChatGPT, some of the players who were working for a domain or a product-specific AI innovation funded two-three years ago, have become less relevant. Founders and investors are figuring out what to do next,” Lunia told Moneycontrol.

Anurag Ramdasan, partner at 3one4 Capital said tech giants like Notion, Google, and Microsoft, which have a distribution advantage, have already embedded generative AI in their documenting software. “Such incumbents are disrupting the early wave of AI-powered solutions,” he added.

Data by Tracxn Technologies showed that venture capital firms like Tiger Global Management, Alpha Wave Global, Blume Ventures, and Info Edge, among others, have not made any investments in Indian AI startups this year so far, after leading such investments in 2022.

Investors continue to be bullish

Ganapathy Venugopal, co-founder and CEO of Kris Gopalakrishnan-backed Axilor Ventures, however, believes investments in the sector will gradually grow as unlike the US market, where funding tends to flow in pools of capital towards new technologies, the Indian market is broader and generalist.

Lunia also said that the investments will pick up after a brief pause as a few prominent entrepreneurs will rise to challenge OpenAI while others will start building solutions leveraging its capabilities to create new businesses.

Indian software-as-a-service (SaaS) major Zoho has already taken up the challenge and announced it is building its own LLM (large language model), similar to OpenAI's GPT and Google's PaLM 2 models, overseen by founder and chief executive officer (CEO) Sridhar Vembu.

Also read: What powers ChatGPT and Bard? A look at LLMs or large language models

Indian investors, especially in the seed and early stages, are also evaluating AI startups, and expecting funding for the field to grow, they told Moneycontrol.

Data by Tracxn shows that 100X.VC, along with the US-based tech startup accelerator Y Combinator, has been leading the way with about four seed and early-stage investments each in the first five months of 2023. While the former made no investment in AI in this period last year, the latter had five.

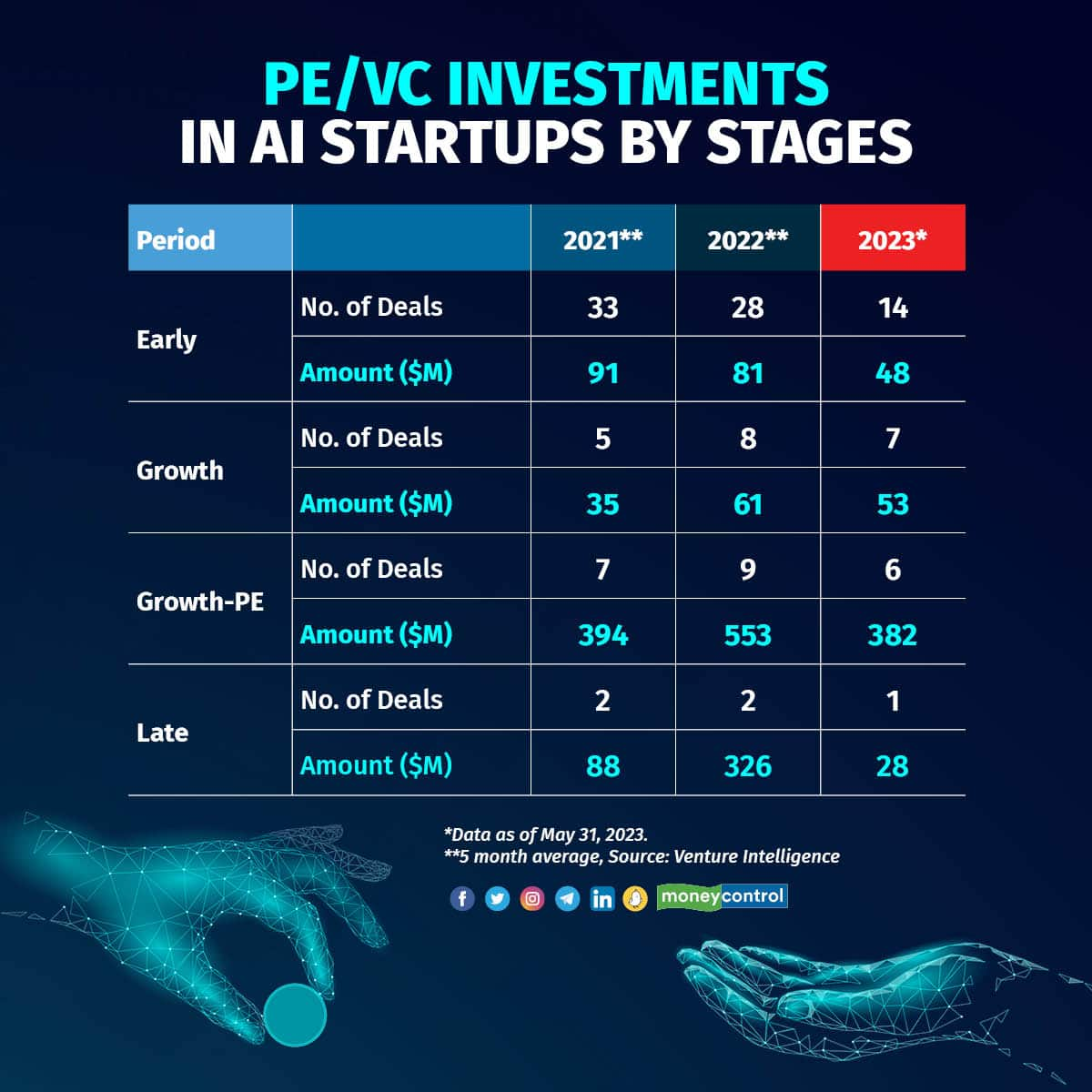

Notably, investments in AI startups have plunged across stages this year, according to Venture Intelligence data.

AI Investments by stages

AI Investments by stages

Shashank Randev, co-founder of 100X.VC, believes the investments in AI startups will continue to grow here as India sits on abundant, cheap data and the ability to generate data after the wave of generative AI.

“AI has become more or less horizontal. Previously, investors would say ‘I invest in healthcare, I don't invest in fintech’ or vice versa. Both of these now have AI incorporated. So by default, everybody's an AI investor,” Randev told Moneycontrol.

Lightspeed Venture Partners, Kalaari Capital, BlackSoil and Prime Venture Partners, among others, began funding AI startups in 2023 after making zero such investments last year, according to data curated by Tracxn.

Generative AI

A major chunk of AI investments this year are going into generative AI startups, investors said, following the release of OpenAI's ChatGPT and the availability of APIs (application programming interfaces).

“We have observed a notable increase in generative AI deals. Currently, approximately 7-8 percent of all deals we come across fall into the generative AI category, and we are actively exploring more opportunities in this field,” said Anurag Ramdasan, partner at 3one4 Capital.

While Accel’s investments in AI-related deals fell from five to two in the January to May period this year compared to last, Prayank Swaroop, a partner at Accel, said the firm is keen to invest in Indian startups building AI businesses revolutionising key industries.

Also read: Salaries, skill sets, open roles: All you need to know to build a career in Generative AI

"In education, it has the potential to personalise learning experiences, adapt curricula, and enhance educational content creation. In healthcare, generative AI can accelerate drug discovery, improve diagnostics, and enable precision medicine. In manufacturing, it can optimise production processes, automate quality control, and drive innovation. In agriculture, it can aid in crop monitoring, optimise resource allocation, and improve yield predictions,” said Accel’s Swaroop.

Axilor Ventures' Venugopal added that the general tendency for investors to start taking smaller bets in upcoming areas has gone up. “Nobody is considering large cheques in areas where there are late-stage companies which are themselves struggling for their next rounds and optimising the business model,” he said.

Generative AI startups stand to benefit from the trend as a new sector.

AI washing or real solutions?

Vikram Chachra, founding partner of 8i Ventures and an early-stage investor, cautioned that the space also seems to be overhyped currently with companies also attempting AI washing to attract investors. AI washing refers to when companies embellish their products’ AI capabilities to enhance sales or attract funds.

“If you are perceived as an AI company, the valuations are rock solid. So many founders are looking to take that route as well. There will be a number of people who will try to represent themselves as if they have got to do something in AI. There is a need for more nuanced applications of AI,” Chachra told Moneycontrol.

Lunia agrees. “Every company is trying to attach the label of AI because that makes them look enticing. AI for gaming, AI for education, the same guys were going crazy over NFTs (non-fungible tokens) about a year or two ago,” he said.

Standing out

Any new technology stack comes with three layers - foundational, infrastructural and consumer or business-facing layers, said Chachra. “When we look at AI, right now, what is really scary is that the foundational layer, which is the LLM, seems to look more like end-user applications. The real question is, how will a startup compete with these?”

The opportunity, Chachra believes, is in entrepreneurs building solutions with India as a motivator to not get disrupted easily.

“You don't want to be in another situation where you're building something where you get out-competed easily by anybody building the same thing and doing a tad better job,” he said.

3one4’s Ramdasan highlighted that the firm is particularly interested in how AI can revolutionise infrastructure and foundational layers. “This focus has led us to dedicate an increasing amount of our time to exploring these areas,” he added.

The VC firm has already made two investments in AI-related startups in the first five months of 2023 as compared to zero in the same period last year, as per data by Tracxn.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!