Surajit Majhi, founder and CEO of Graphixstory, narrates an anecdote about a startup client who held back his company’s campaign after entering a 0ne-year deal with the tech- and animation-driven ad agency in March.

“This is just an example of what is happening with agencies and creative studios like us... the start-up party is now over," Majhi told Moneycontrol.

Majhi is matter-of-fact about it, saying: “Whenever there is a funding freeze, a startup’s marketing budget is the first to get affected. This time is no exception.”

This is one instance of the knock-on effects the troubled startup sector is having on its ecosystem as it battles a painful funding freeze that has forced it to rationalise marketing and advertising spending, shut down non-core units, lay off thousands of people and go slow on hiring.

Amid rising interest rates, which have choked liquidity that flowed freely over the past two years, and the Russia-Ukraine war, venture-capital and private equity firms have cut back investments in both public and private markets.

According to data shared by market intelligence firm CB Insights, venture funding to India-based startups dropped to $3.6 billion in the second quarter of 2022 so far from $8 billion in the January-March quarter and over $10 billion a year back. The data also showed that venture funding slowed for the first time sequentially in the January-March quarter of this year since the October-December quarter of 2020.

Startups last year contributed Rs. 8,500 crore for a 11 percent share of advertising expenditure in India, according to the Pitch Madison Advertising Report 2022. This year, ad expenditure by the startup category is expected to reach Rs 10,000 crore, according to the report released on February 15, before all the bad news started getting worse.

Hitting the pause button

To be sure, it is difficult to quantify the impact the startup funding slowdown will have on advertising spending, but anecdotal evidence shows it won’t be negligible.

According to Majhi, his agency’s start-up clients are slashing budgets on ad campaigns to almost half of what they spent last year.

Shrenik Gandhi, co-founder and CEO of digital ad agency White Rivers Media, said startup clients had pressed the pause button on campaigns that are high in cost and low in terms of the immediate, measurable impact they have.

One example of what is ironically called “high-impact advertising” is hiring platform Hirect’s outdoor campaign with the message Hire Directly Without Consultants screaming from bus shelters, skywalks, cabs and cafes. The month-long campaign, which wasn’t affected, focused started in May and focused on markets like Mumbai, Delhi and Bengaluru.

"Only the advertising campaigns that add value to the business are being executed...We will not experience any out-of-the-box marketing activities for the next two quarters. In this period, the brands will continue to run campaigns which are adding value and contributing to their revenue," said Akshae Golekar, founder and CEO of Mumbai-based digital advertising agency Optiminastic Media.

One such campaign was aired on TV during the Indian Premier League cricket tournament. The 20-second ad by delivery platform Dunzo showed a QR code against a black backdrop with the message “Inconvenience is regretted. Scan for convenience.” Those who scanned the QR code were directed to the Dunzo app.

The startup saw a 10 X increase in traffic on its platform during the week it ran the campaign and recorded its highest order volume ever.

To be sure, advertising on TV during IPL is costly. Rates for a 10-second slot were in the range of Rs 15-18 lakh during IPL 2022.

Digital to dial down

Digital media is expected to feel the brunt of the expected slowdown in startup spending on advertising, some marketers said.

"Startups’ digital marketing spends contribute 20 to 35 percent of total digital spends. So, if there is a slowdown or a pullback on spends it will affect the overall digital ADEX," said Prashant Puri, co-founder and CEO of AdLift, a digital marketing agency.

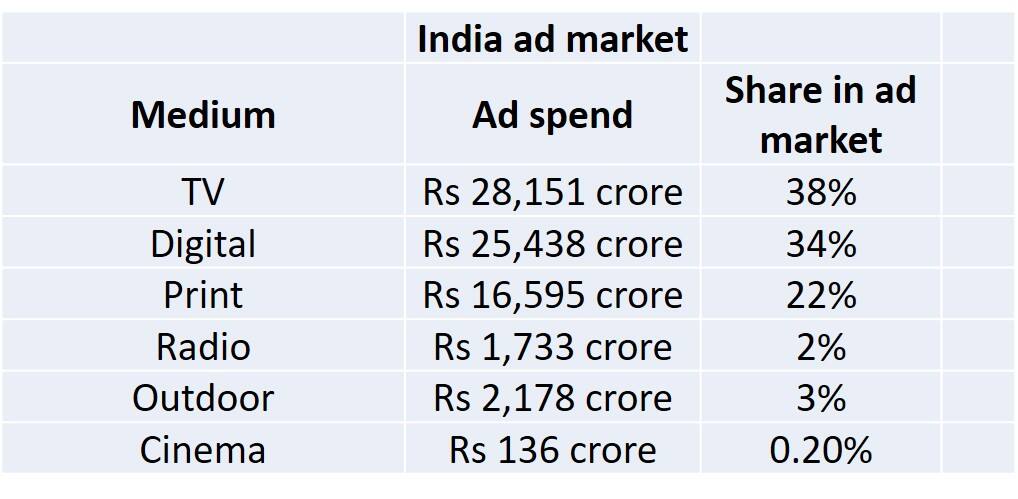

In 2021, ADEX, or digital advertising expenditure, was Rs 25,438 crore and had been expected to reach Rs 33,070 crore this year, according to the Pitch Madison report.

Zeus Dhanbhoora, co-founder and CEO of fintech company BridgeUp, said that on an average, startups spend between 30% and 40 percent of every venture capitalist dollar on Meta, Google and Amazon.

He expects the contribution of startups to overall AdEx to decline this year.

Gandhi of White Rivers Media said digital marketing expenditure by startups may range from $100,000 a month to even a few million dollars a month.

"Top spenders in this category include the BFSI startups, which include Web 3.0. Buy Now, Pay Later as a category is doing well, along with fantasy gaming due to IPL and D2C start-ups," he said.

BFSI is short for banking, financial services and insurance. D2C stands for direct-to-consumer.

Pressure on performance

To be sure, the advertising is facing a challenge because of the woes confronting startups, but marketers don’t expect their promotional spending to dry up entirely.

"There’s been a huge push in growing organic channels such as SEO and we’ve seen spends grow 6-8X from pre-COVID days," said AdLift's Puri.

SEO is short for search engine optimisation.

"Startups are figuring out ways to reduce their customer acquisition cost (CAC) and one of the ways to do that is to increase SEO traffic, revenue, transactions. AdLift’s research data shows that if a brand drives equal amount of SEO traffic as compared to paid search traffic, their overall search CAC reduces by 55% to 65%," Puri added.

Neha Puri, CEO and founder of Vavo Digital, an influencer marketing agency, said her discussions with startup clients made her realize that of most of them preferred to take the middle path.

"While the investment in marketing may have gone down it hasn’t stopped altogether. They are cautious as the upcoming few months look unpredictable, but at the same time, the established startups are looking towards expanding their verticals to gain investor attention." Puri said.

White Rivers Media's Gandhi said startups have for long been a sunrise category.

"Over the last few years, they have been among the fastest growing categories. With immediate brakes pulled, there may be some changes, but the category in itself will go on strongly..,” he added.

Startups are expected to be back with a bang during the festive period later this year.

"Our expectation is that when the high-spend season will come, which is around Diwali, Christmas and other festivals, there will definitely be a splurge of money,” said Himanshu Arora, co-founder of Social Panga, a digital marketing agency.

Dhanbhoora thinks that startups will prioritise performance marketing over brand building, and Puri agrees.

"Companies will optimize their ad expenditure by prioritizing performance marketing, affiliate marketing and sponsored ads via influencers pages, above brand creation," said Puri.

Source: Pitch Madison 2022 advertising report

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.