Valuations of most of India's edtech soonicorns appear to be going askew as they brace for slower growth after having raised funds at sky-high revenue multiples until the first half of 2022.

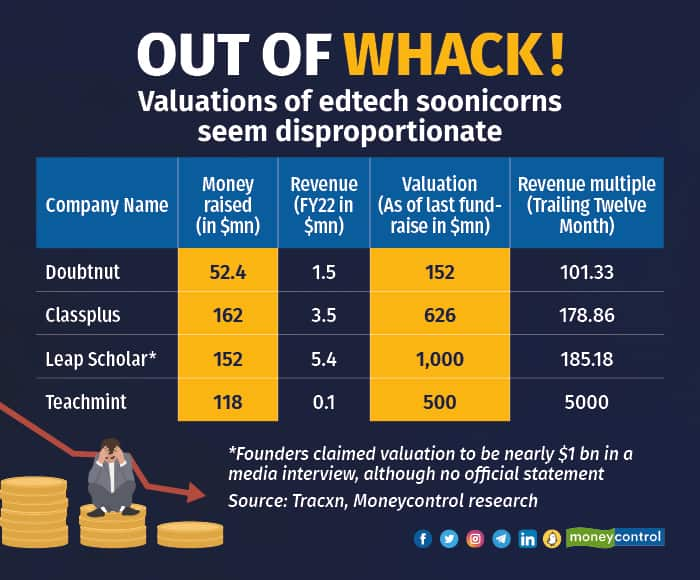

Edtech soonicorns – or soon-to-be-unicorns (a moniker used to define startups having a valuation between $150 million and less than a billion, according to Tracxn) – such as Doubtnut, Leap Scholar, Classplus, and Teachmint raised funds at unprecedented revenue multiples ranging from 100 to almost 5,000 as of FY22, according to data compiled by Moneycontrol through Tracxn Technologies.

Teachmint had the highest revenue multiple of almost 5,000. The company, valued at $500 million in March 2022, had revenue of $96,595, the data showed. Doubtnut, which last raised funds in a $2.5 million round through convertible notes, had revenue of $1.5 million (Rs 10.8 crore) for FY22. Before this, Doubtnut raised $32 million in January 2021 at a revenue multiple of 382, Tracxn data showed.

Investors use revenue multiples to assess the value of a company's equity relative to its revenue. Startups are typically valued using forward revenue multiples rather than trailing 12-month multiples. However, the projections are typically based on the last 12-month data.

Online learning declines

The data attains significance as funding for the edtech sector has dried up significantly over the past two years, mainly due to challenging macroeconomic conditions and a notable decrease in demand for technology-driven educational solutions. Funding for Indian edtech companies plummeted 46 percent to $2.86 billion in 2022 from $5.32 billion in the previous year. In 2023, it dropped to $889 million.

During the two pandemic years – 2020 and 2021 – the edtech sector got a tremendous boost with a surge in demand for online learning. These companies raised billions of dollars at high valuations, projecting substantial revenue growth. Consequently, four new edtech unicorns – companies valued at $1 billion or more – emerged in India.

Many younger edtech companies also joined the frenzy, raising funds at inflated valuations on expectations the growth momentum would persist post-Covid.

However, as physical tuition centres reopened and students gravitated towards them, demand for online learning declined, forcing edtech companies to reassess their growth projections and business models as the sector was transitioning to become more hybrid (online and offline)-oriented.

“If you have raised a lot of money, but your business model doesn’t make unit economic sense, then it is not sustainable and scalable,” said Anirudh Malpani, founder of Malpani Ventures and a critic of Indian edtech companies. “At some point, all these chickens are going to come home to roost.”

Malpani said trying to create a centralised model to earn money at the expense of others is not a great way to run a business in a country like India, especially for education, where a more decentralised model works.

“My sense is a lot of (edtech) companies might continue to be zombie companies going forward because these valuations make no sense,” he added.

Valuations in the global edtech landscape have declined significantly, with companies such as Coursera, Udemy, and Chegg Inc experiencing drops ranging from 20 to 50 percent over the past year. This downward trend has impacted the valuations of edtech companies in India.

Remarkably, no Indian edtech unicorn has undergone a downround so far – where fundraising is at a lower valuation than in the previous round.

Bigger is better

Byju's, the world's most-valued edtech company, faced scrutiny due to a surprising decline in revenue during FY21, the initial year of the pandemic. However, it maintained its $22 billion valuation when it raised funds in October 2022.

Currently, Byju's is in discussions to secure $700 million in equity funding at a flat valuation. But survival and valuations aren’t a problem for the larger edtech companies, observers reckoned.

“Companies that raised huge sums during Covid won’t have too many problems. You saw Unacademy raising half a billion during Covid and all they had to do is reduce overheads by layoffs and other things,” said a banker who has advised edtech companies on valuations, requesting anonymity.

According to the banker, companies that raised smaller amounts than the larger players will have a problem. These companies raised $45-50 million, which will soon be drying up. They won’t be able to raise money again at peak 2021 valuations.

“So my sense is there will be either down rounds or a lot of consolidation,” the banker said.

Mujtaba Wani, principal at GSV Ventures, a venture capital firm, suggested that edtech companies with limited cash reserves should consider raising funds at reduced valuations or exploring a potential sale. He said these companies might struggle to secure funding even at lower valuations. In such circumstances, the best course may be to cease operations.

“For companies, where fundamental performance is not strong and the valuations set are very, very high, that is where the real problem is,” said Wani. “We don’t like to see companies fail… such companies would either fail or look for consolidation and acquisitions.”

Wani's observation is valid, especially for second-order edtech companies that secured funding during the peak of the pandemic, as many of them grapple with high burn rates.

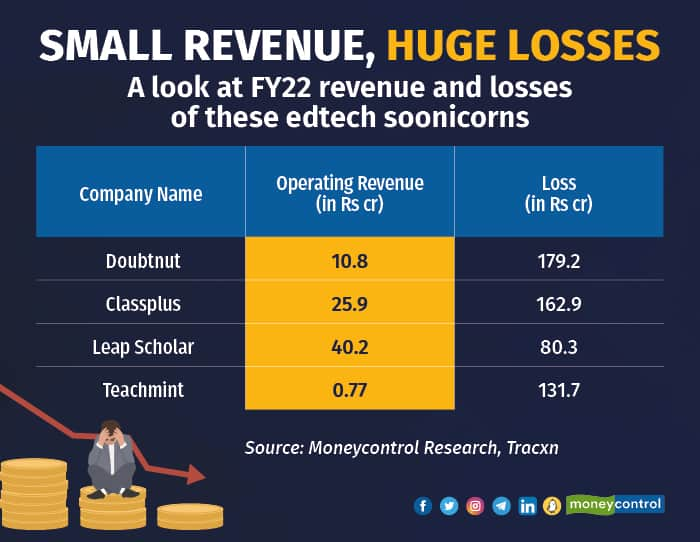

In FY22, Doubtnut recorded a net loss of Rs 179 crore on operating revenue of Rs 10.8 crore. Classplus reported a net loss of Rs 169.2 crore on operating revenue of Rs 25.9 crore. Leap Scholar incurred a loss of Rs 80 crore on operating revenue of Rs 40 crore, and Teachmint, which completed its first full year of operations in FY22, registered a loss of Rs 131.7 crore with only Rs 80 lakh of revenue.

“If you see, the companies that raised huge sums during Covid were talking a lot about TAM (total addressable market). Now, we don’t even talk about TAM internally or we don’t even look at that as a metric,” said the founder of an edtech company.

According to the founder, what matters is unit economics for most companies now.

“That is a reset and I think that will stick, going forward. You will have a lot of companies that justify their burn and valuations,” the founder added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.