For the first time, India’s venture ecosystem has a critical pool of listed ‘startups'. Increasingly, the mid-late-stage private markets are being driven by valuations of and sentiment around these listed startups.

We strongly felt that our ecosystem needed an objective and comprehensive barometer to measure this sentiment. We introduce to you the TRMG RainGauge Index - a market cap-weighted index of the listed venture-backed companies that really matter. We'd be publishing this index every quarter along with the key sectoral trends that we are witnessing.

While compiling the inaugural edition, we came across some interesting learnings:

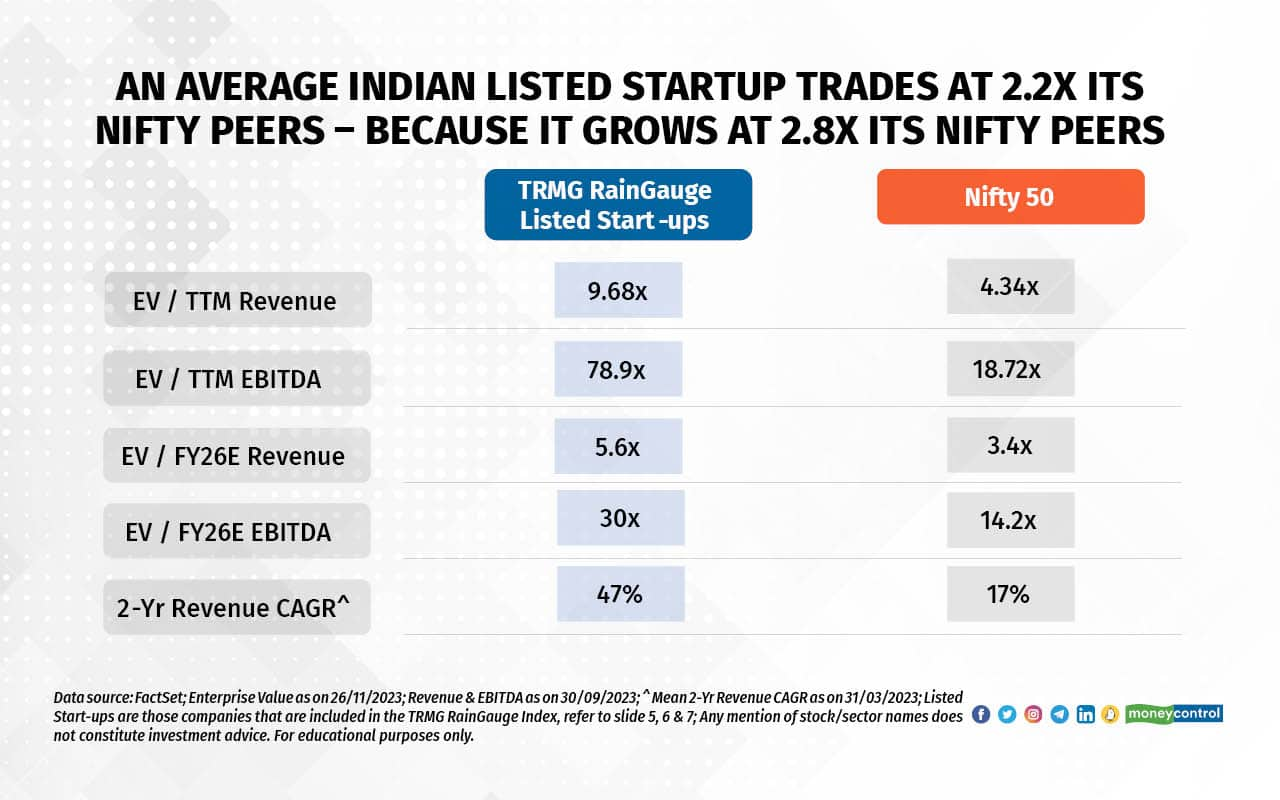

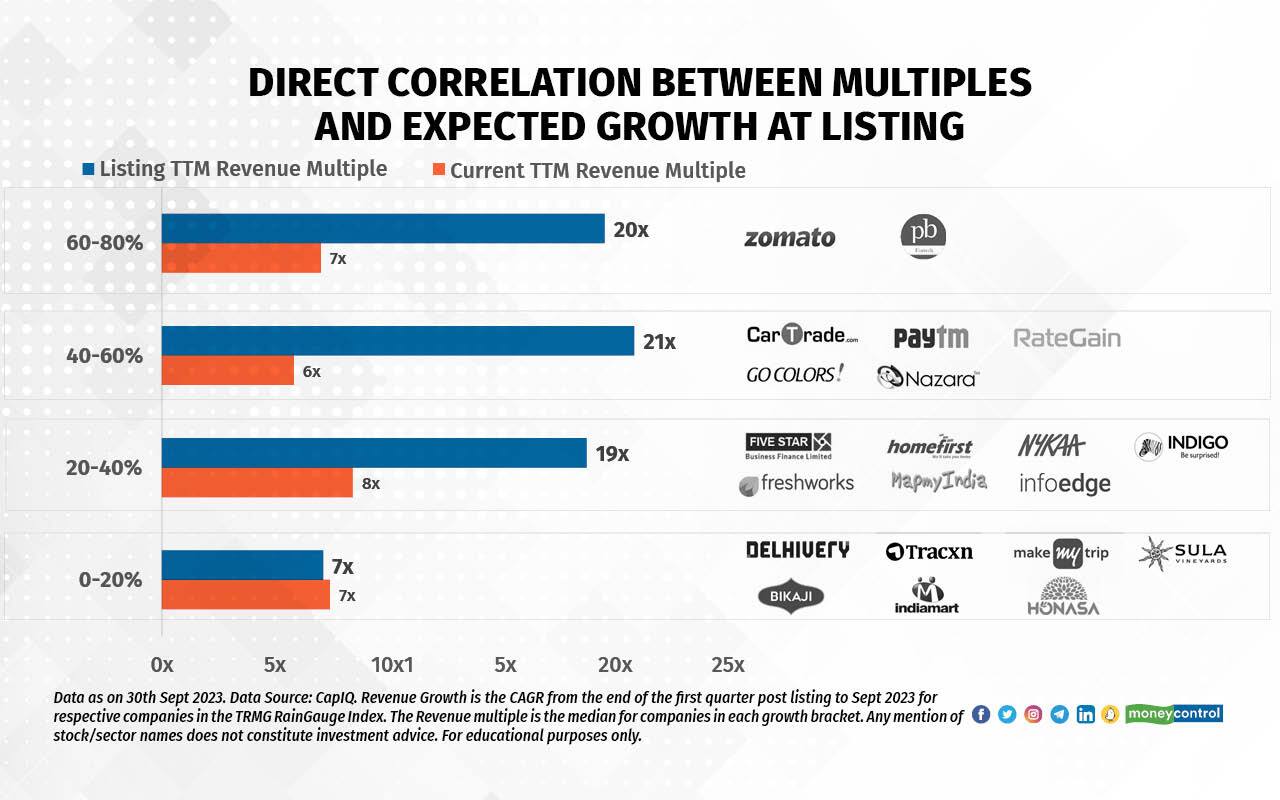

We learnt that all startups showing ‘premium growth’ -growing over 20 percent year-on-year (y-o-y) are being valued not on their TTM (trailing twelve months) earnings - but rather on their ‘earning power’ and most of them are trading at 30-40X their FY26 operating margins or a similar multiple when applied to steady state Ebitda (earnings before interest, taxes, depreciation and amortization) margins on their FY25 revenues.

One of the critical drivers of returns for startups has been the credible visibility of their end-state profitability. Fintech companies in the index showed a whopping 18 percent improvement in operating margins, while consumer internet companies showed a credible improvement of 7 percent.

We believe that in 2024 the growth equity market in Indian privates would be driven by businesses that show very similar characteristics as the listed cohort - all fundable companies would need similar financial hygiene and PEs, sovereigns would be driving the valuations and most funding situations would be secondary in nature.

Download the complete report from here.

Kashyap Chanchani is the Managing Partner, while Dhwani Mehta is the Head of Corporate Development at The Rainmaker Group. The firm advises mid-late stage private, venture-backed companies on fundraising.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.