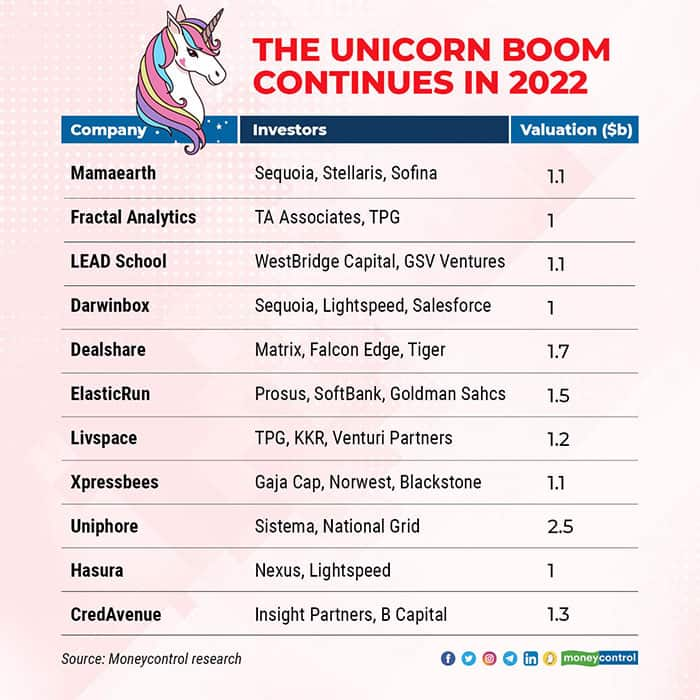

CredAvenue has raised $137 million in a Series B round that values the online debt marketplace at $1.3 billion within 18 months of inception, the fastest a fintech startup has turned a unicorn in the country, the company said on March 6.

In a debt-starved market like India, investors have been bullish on CredAvenue which makes it easier for firms to access the debt market to raise funds, secure loans and also helps banks and non-banking finance companies (NBFCs) to lend as well as track the loans.

The round was led by Insight Partners, B Capital Group, and Dragoneer, with participation from existing investors, the Chennai-based startup said. A unicorn is a privately funded company valued at $1 billion or more.

Moneycontrol reported on February 16 that CredAvenue was in talks with Insight Partners for its unicorn round, with further investments by existing investors Sequoia and Lightspeed India.

The company is the 11th startup in 2022 to join the unicorn club after the likes of Mamaearth, Dealshare and Xpressbees.

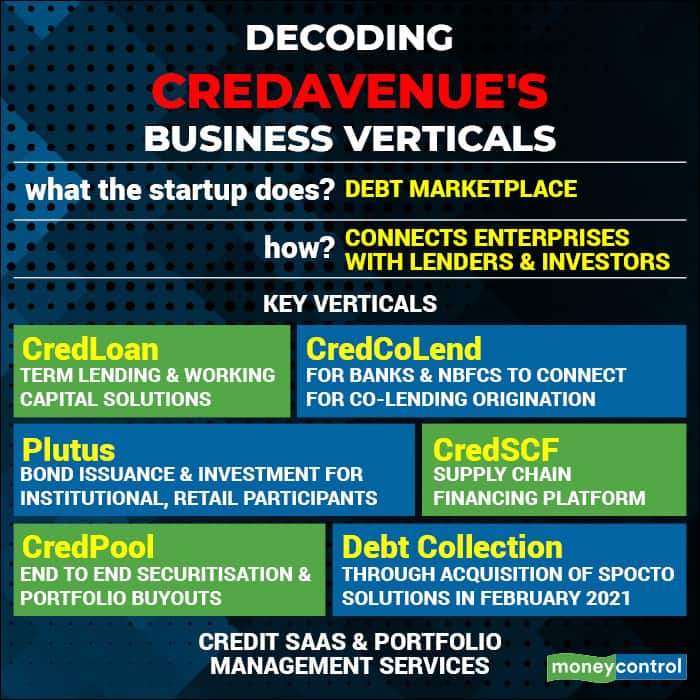

Founded in 2020, CredAvenue acts as a marketplace to connect enterprises to lenders and investors. It also helps businesses and lenders to access primary as well as secondary bonds.

It intends to use the funds to expand its business in India along with key global markets and will also deepen its technological capabilities.

Expanding services

The company recently acquired Mumbai-based artificial intelligence and machine learning-powered debt recovery platform Spocto Solutions for around $46-56 million.

With the acquisition, lenders on CredAvenue’s platform will be able to access underwriting and collection services as well on the same platform.

In an interview to Moneycontrol post the announcement, CredAvenue founder and CEO Gaurav Kumar had said, “We are looking at building the Spocto franchise globally, the company is already present in the Middle East and we plan to take them to other markets.”

While the startup will expand acquired Spocto Solutions internationally, it will put on hold the global expansion plans for CredAvenue itself, Kumar added. CredAvenue will continue to focus on growth in the Indian market.

The startup will be looking at adding capabilities in the credit SaaS (software as a service) space on both the retail and the enterprise side. It also sees an opportunity in growing the supply chain financing vertical, Kumar said.

Nikhil Sachdev, Managing Director at Insight Partners said, "By leveraging a next-gen business intelligence and data-collection platform, CredAvenue enables efficient match-making and minimises manual and recurring efforts in underwriting, executing and monitoring debt.” The company said that Sachdev would be joining its board.

The startup closed FY21 with revenues of Rs 47 crore and saw its revenue grow to Rs 450 crore within the first six months of FY22.

On the growth plans Kumar said, “We plan to grow the number of enterprises on our platform from 3,000 currently to close to 30,000. Also, today our platform processes close to 72,000 transactions daily. In the next year, we plan to grow that to a million transactions a day.”

The platform has over 2,300 corporates and 750 lenders as clients and has facilitated debt volumes of over Rs 90,000 crore.

Plugging the gap

CredAvenue’s offering is seen as one of a kind by investors and the right fit for a country like India.

In 2020, India’s credit-to-gross domestic product (GDP) ratio stood at around 56 percent, which is half of the G20 average, according to data from the Bank of International Settlements (BIS).

With the ratio much lower than its peers, India has a long way to go in increasing access to credit.

"At $1.9 trillion, the Indian debt market is still underserved. CredAvenue helps automate and increase efficiency across the value chain. This is reflected in the strong retention amongst borrowers. We like their tech-first approach to solve this problem," said Kabir Narang, Founding General Partner at B Capital Group.

Its previous round of $90 million in September 2021, led by Sequoia Capital, Lightspeed Ventures, TVS Capital, and Lightrock, was the largest Series A equity fundraise by a startup in India.

The company raised around $8 to $10 million in its seed-funding round led by Lightrock India.

Avendus Capital served as the financial advisor to CredAvenue on the Series B round.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.