India’s top EV players, Ather Energy and Ola Electric, posted contrasting performances in Q2 FY26, reflecting different strategies toward growth and profitability. While both companies narrowed their losses and improved operational efficiency, their revenue trajectories and cost structures varied.

Here’s a snapshot of how the two electric scooter makers stacked up this quarter across key financial and business metrics.

Ather vs Ola Electric: Q2 FY26 at a Glance

Ather Energy continued to outpace Ola Electric in topline performance during Q2 FY26, clocking Rs 898 crore in revenue, a 54% jump year-on-year, while Ola’s sales fell 43% to Rs 690 crore amid weaker deliveries. Both players narrowed their losses, but Ather’s sharper focus on cost control and rising volumes helped it close the quarter with a smaller net loss of Rs 154 crore versus Ola’s Rs 418 crore.

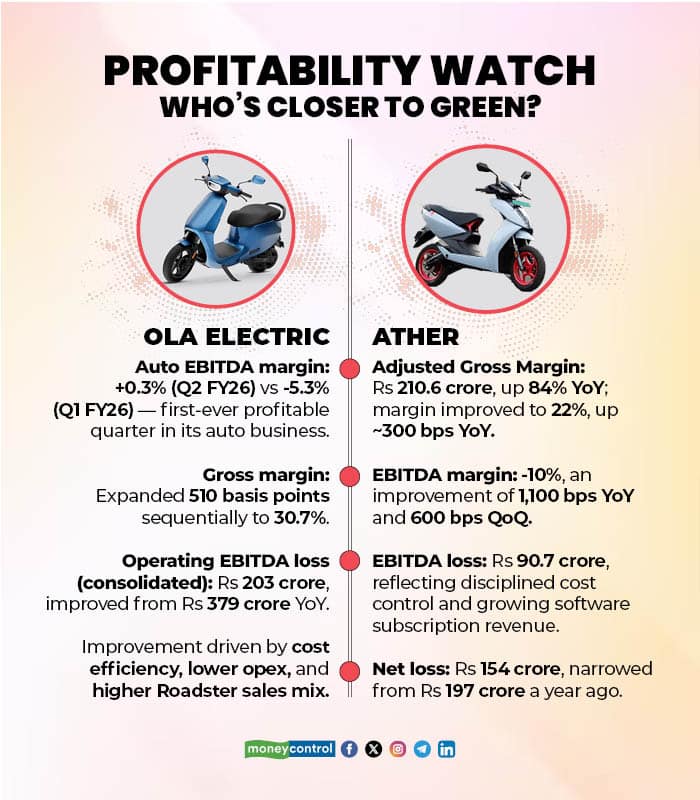

Profitability Watch: Who’s Closer to Green?

Ola Electric posted its first-ever profitable quarter at the auto business level, with a positive EBITDA margin of 0.3%, driven by reduced costs and a higher mix of premium Roadster sales. Ather, meanwhile, showed strong progress with a 22% gross margin and a steep 1,100 bps YoY improvement in EBITDA margin to -10%. Both firms are inching toward breakeven, signalling improved operating efficiency as the EV market matures.

The Cost Story: Trimming the Fat

Ola Electric tightened its belt this quarter, cutting operating expenses to Rs 416 crore and improving gross margins to 30.7%, even as revenue dipped. The company’s sharper cost discipline and supply-chain optimisation drove a 46% YoY improvement in operating EBITDA loss. In contrast, Ather’s total expenses rose 37% YoY on higher raw material costs from scaling production, but stronger sales helped it narrow losses, underscoring better leverage from growth.

Future Outlook & Expansion

Both EV makers are doubling down on capacity and new products to fuel their next growth phase. Ola Electric is ramping up its Gigafactory capacity and betting on its in-house cell technology with the new Ola Shakti line, expected to meaningfully add revenue from FY27. Ather, on the other hand, is expanding its manufacturing footprint with a new plant in Maharashtra, positioning itself to boost production volumes once operations begin by March 2026.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.