October 13, 2022 / 16:12 IST

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities

The Bank Nifty index witnessed some selling pressure on the higher end and faces stiff resistance around the 39,500-40,000 level where aggressive call writing has been seen. The index remains in a downtrend with lower high and lower low formations intact.

The index if breaches below 38,400 on a closing basis will lead to further sell-off towards 38,000-37,500 levels. The immediate upside resistance is placed at 39,000 and if breached will see some short covering moves.

October 13, 2022 / 16:03 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities Ltd

Markets continued to witness a tumultuous ride as weak Asian cues came as a dampener although positive European markets helped temper the fall. The gloomy mood due to global economic uncertainty has precipitated the fall in recent sessions.

Banking stocks bore the brunt of the overall pessimism on concerns rising interest rate regime could hit demand for loans.

The Nifty is consistently taking support near the 200-day SMA (Simple Moving Average) or 16950 while facing strong resistance at 17150. A sharp correction wave is possible if the index trades below 16950 and on further decline, it could slip till 16800-16700.

October 13, 2022 / 15:44 IST

Vinod Nair, Head of Research at Geojit Financial Services

Retail inflation persisting above the desired levels has been a major cause of concern for the Indian economy. This, coupled with declining industrial production in August may not be taken well by the market because Indian economy is anticipated to sustain its resilience.

In this backdrop, the impending US inflation figures, which are forecasted to remain high, may cause volatility in the global market.

October 13, 2022 / 15:35 IST

Market Close:

Indian benchmark indices ended on negative note on October 13 amid volatility.

At Close, the Sensex was down 390.58 points or 0.68% at 57,235.33, and the Nifty was down 109.30 points or 0.64% at 17,014.30. About 1283 shares have advanced, 2054 shares declined, and 130 shares are unchanged.

Wipro, Adani Ports, SBI, SBI Life Insurance and L&T were among the top Nifty losers. HCL Tech, Sun Pharma, Coal India, Britannia and Tata Motors were the top gainers.

Barring metal and healthcare, all other sectoral indices ended in the red.

BSE Midcap index and Smallcap indices fell 0.5 percent each.

October 13, 2022 / 15:34 IST

Rupee Close:

Indian rupee closed marginally lower at 82.35 per dollar against previous close of 82.31.

October 13, 2022 / 15:24 IST

NS Ramaswamy, Head of Commodities, Ventura Securities

The Indian rupee traded an extremely narrow range for the second day ahead of US consumer inflation data to gauge the next leg of direction.

The pair dropped to a record low of 82.68 on Monday but recovered slightly after RBI intervention. The focus now shifts to the US inflation data due later in the day. The pair could trigger major gap-up or gap-down if there is a major change in US data.

October 13, 2022 / 15:19 IST

Nomura View on Wipro

Broking firm Nomura has a ‘neutral’ call on Wipro with a target price of Rs 380.

Investors need to brace for near-term weakness as margin recovery is likely to be gradual.

Guidance for Q3 is disappointing and alludes to slowdown. We cut FY23-24 EPS (earnings per share) estimates by 3-5 percent.

Wipro touched a 52-week low of Rs 378.10 and was quoting at Rs 379.25, down Rs 28.50, or 6.99 percent.

October 13, 2022 / 15:16 IST

Apollo Micro System to issue 1.01 crore warrants

The board of directors of the company, considered and approved, to issue upto 1,01,00,070 warrants each convertible into, or exchangeable for, one equity share at a price of Rs 183.30 each (including the warrant subscription price and the warrant exercise price) aggregating upto Rs 185,13,42,831 to Mr. Karunakar Reddy Baddam, Promoter and Managing Director of the Company and to certain

other non-promoter group persons.

Apollo Micro Systems touched a 52-week high of Rs 223.45 and was quoting at Rs 217.50, up Rs 18.65, or 9.38 percent on the BSE.

October 13, 2022 / 15:13 IST

JPMorgan View on Wipro

JPMorgan keptunderweight call on the stock with a target price of Rs 360.

Weak momentum for Q3 with margin pressures persisting as environment worsens. We remain Underweight as we continue to expect margin and revenue headwinds.

October 13, 2022 / 15:04 IST

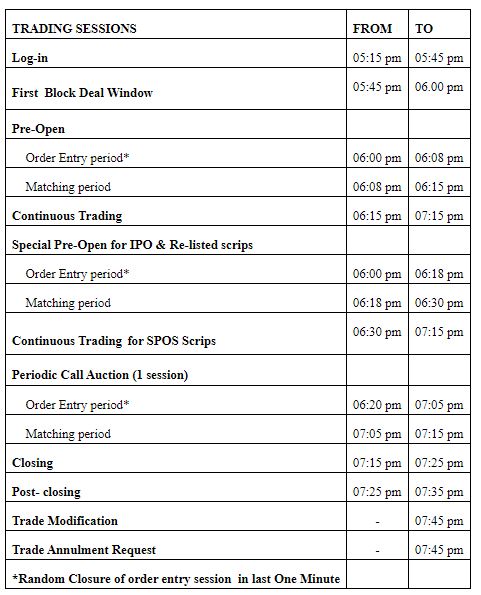

Muhurat Trading Session on account of Diwali Laxmi Pujan for Equity Segment to be held on October 24, 2022

October 13, 2022 / 15:01 IST

Market at 3 PM

Indian benchmark indices were trading lower with Nifty hovering around 17000.

The Sensex was down 328.12 points or 0.57% at 57297.79, and the Nifty was down 91 points or 0.53% at 17032.60. About 1194 shares have advanced, 2007 shares declined, and 92 shares are unchanged.

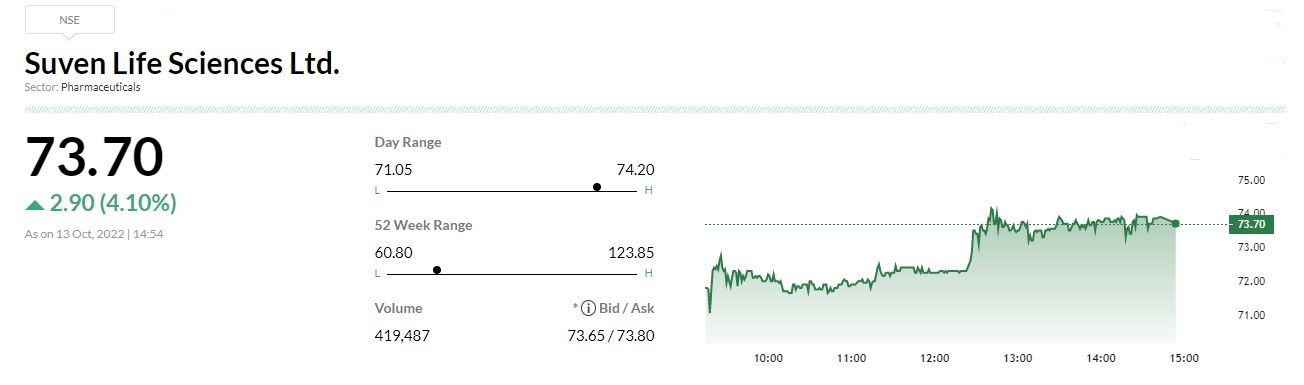

October 13, 2022 / 14:55 IST

Suven Life Sciences to raise Rs 400 crore

Suven Life Sciences said the board of directors has approved rights issue size of 7,26,91,239 shares for Rs 399.80 crore. The issue price is Rs 55 per equity share.

The rights entitlement ratio is (1:2) one rights equity share for every two shares held by the eligible equity shareholders of the company.