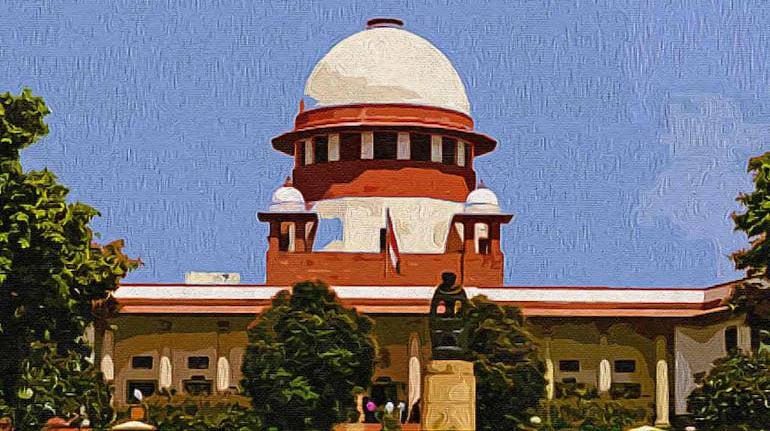

A plea claiming massive daily losses to the state exchequer as well as to the common man caught the Supreme Court's attention. Following this, the apex court has questioned the Ministry of Finance as to why promoter guarantees of defaulting corporates are not invoked by public sector banks, the Business Standard has reported.

The petitioners were asked to make a representation before the finance ministry in this matter, noting that the issue is a significant one and that a response from the ministry is important.

According to the report, the court noted that the ministry had directed via a circular that personal guarantees of promoters or managerial corporates are to be invoked in cases of loan defaults. However, the petitioners have claimed that Public Sector Banks (PSBs) have failed to adhere to the direction despite having incurred losses to the tune of Rs 1.85 trillion in a financial year. Some of the biggest corporate defaulters have gotten away after defaulting on huge loans since banks did not invoke their promoter guarantees.

The apex court observed that since the PSBs have not complied with the finance ministry circular, the petitioners must first move the ministry in this regard. Accordingly, the court directed that representation be made within two weeks from now, following which it has given the finance ministry a period of four weeks from the time it receives the representation, to file its response. The court allowed the petitioners to withdraw their writ petition at this point, allowing them to return after the ministry's decision.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.