Rekha Rakesh Jhunjhunwala, wife of ace investor Rakesh Jhunjhunwala, is going to invest Rs 80 crore in VA Tech Wabag, the Indian multinational player in the water treatment industry.

The company has decided to raise Rs 120 crore via preferential issue, and on September 29, finalised the allotment of equity shares on a preferential basis.

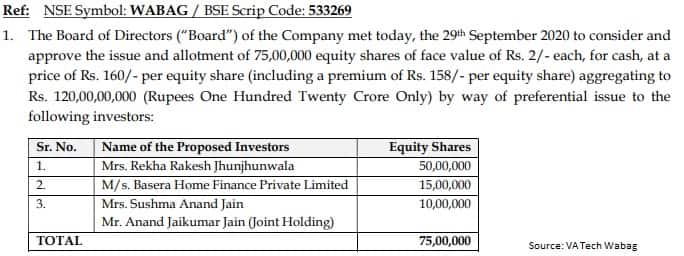

"Board of directors approved the issue and allotment of 75 lakh equity shares of face value of Rs 2 each, for cash, at a price of Rs 160 per equity share aggregating to Rs 120 crore by way of preferential issue to four investors," company said in its BSE filing.

Board approved the allotment of 50 lakh shares to Rekha Rakesh Jhunjhunwala, 15 lakh shares to Basera Home Finance, and 10 lakh shares to Sushma Anand Jain and Anand Jaikumar Jain.

The 75 lakh shares allotment to Rekha Rakesh Jhunjhunwala is valued at Rs 80 crore for 8 percent stake in the Va Tech Wabag.

With this, Jhunjhunwala will become the major individual shareholder in the company.

The Chennai-based water solutions provider said consequently, the issued, subscribed and paid-up equity share capital of the company stands increased to Rs 12,43,80,856 (divided into 6,21,90,428 equity shares of Rs 2 each) from Rs 10,93,80,856 (divided into 5,46,90,428 equity shares of Rs 2 each).

Promoters held 24.68 percent equity stake in the company and the rest is held by public as of June 2020. Mutual funds held 4.84 percent shareholding in the company and foreign portfolio investors 22.29 percent including Government Pension Fund Global, Sumitomo Corporation and KBI Institutional Water Fund.

The share price jumped 152 percent in last six months to trade at Rs 190.5 on the BSE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.