India’s recovery from the Covid-19 pandemic has boosted equity markets, with the Sensex scaling a fresh record high on November 24, but there are signs that the economic recovery is entering the slow lane, according to analysts at Societe Generale.

“Two and a half years into the pandemic, India’s report card reads thus – total employment contracted, negative real rural wage growth, persistently declining unit labour costs and sharply higher Sensex EPS,” India Economist Kunal Kumar Kundu and EM Strategist Vijay Vikram Kannan said in an investor note.

“As a consequence of the exaggerated K-shaped recovery – aided by rapid economic formalisation – the informal sector, India’s largest job generator, and MSMEs are losing out to big businesses,” they added.

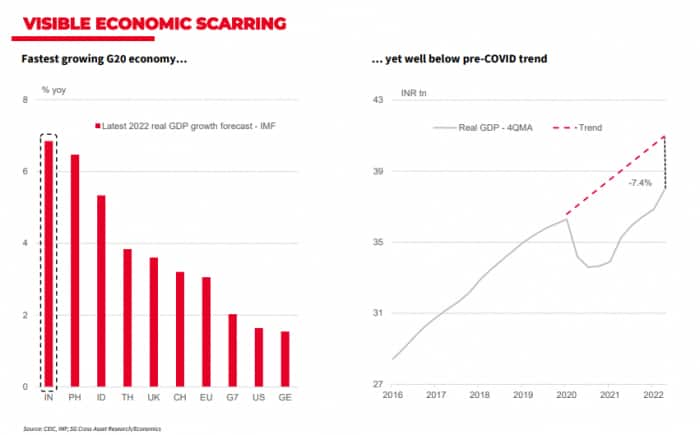

To be sure, India will be among the fastest-growing economies this year despite global headwinds, including financial market volatility and sharp monetary tightening across the world.

The county’s private sector capital expenditure is improving after several years as, according to the finance ministry’s chief economic adviser. Continued economic reforms over the medium term will help boost the potential growth beyond the currently estimated 6 percent, Goldman Sachs has said.

The central government is expected to present its budget for the next financial year on February 1 amid expectations that it would continue with reforms and infrastructure spending.

Outlook

The divergence between the strong equity market and weak economy will likely continue because of sharply lower unit labour costs and as most bigger corporates have adequately deleveraged, cushioning them from impact of rising cost of capital, according to the Societe Generale analysts.

Still, there are signs that all is not well.

About 20 percent of the economy accounts for nearly 80 percent of growth in India, while the remaining 80 percent contributes barely 20 percent, the analysts said.

Also read | India’s employment challenge explained

While India will be the fastest-growing G20 economy this year, according to forecasts by the International Monetary Fund, the growth is still well below pre-pandemic trend.

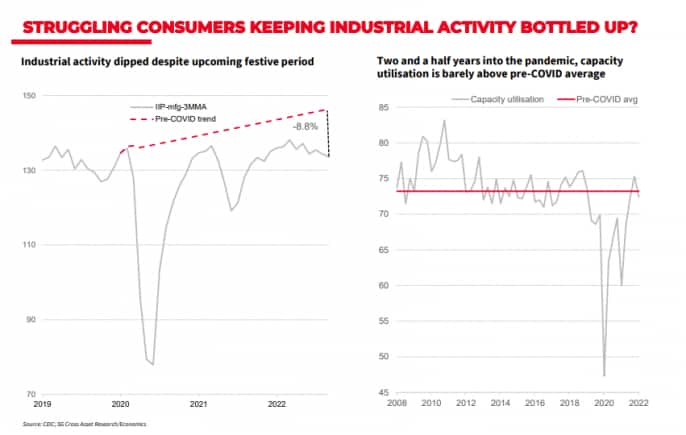

And while capacity utilization has surged in recent months, bolstering hopes of a revival of private investments, this key metric has yet to exceed pre-Covid average, they added.

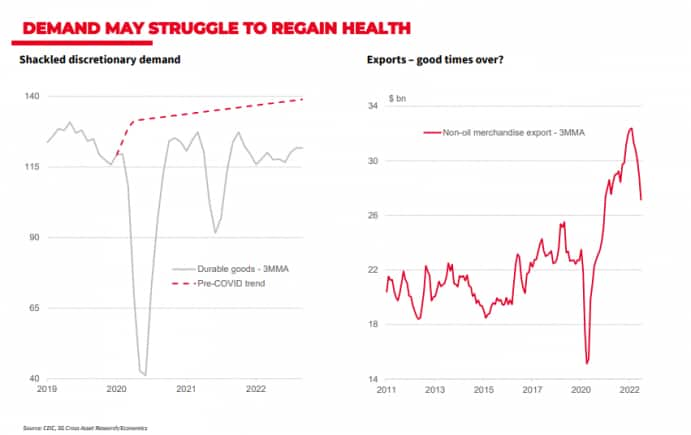

Slowing exports -- outbound shipments shrank on year in October for the first time in nearly two years -- also continue to be a cause for concern while discretionary demand, though rebounding, continues to be below trend.

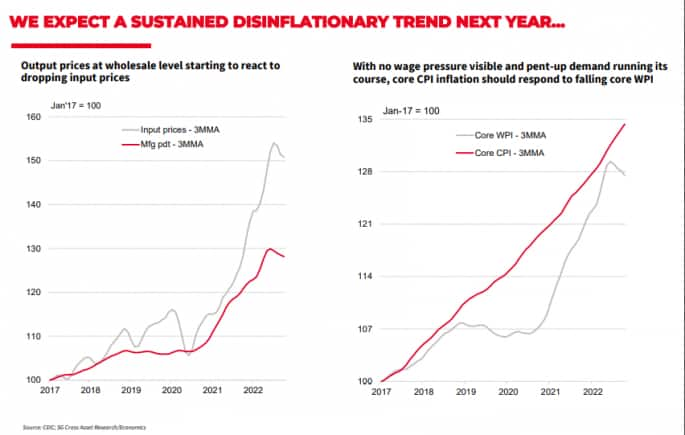

On the bright side, inflation is expected to ease into next year, giving the central bank to address the economic stress and to soon end its rate-hike cycle, the analysts said.

The house pencils in two additional rate hikes, of a cumulative 60 basis points, taking the terminal policy rate to 6.5 percent, before the central bank refocuses on growth.

(Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.