India's population might be expanding, but fewer Indians are buying homes. The real estate sector, which is the largest employer after agriculture, has been stagnating over the past couple of years.

Housing projects are overshooting their handover deadlines. Developers are finding it difficult to raise capital for new projects. Banks are becoming increasingly cautious of disbursing loans to both promoters and home-buyers. As prices cool, real estate is losing its sheen as a safe investment that offers significant returns in the medium term.

The slowdown can be viewed as a market correction, with the real estate sector recoiling from the cash crunch engendered by demonetisation and reforms such as the Real Estate Regulation Act (RERA) and the Goods and Services Tax (GST).

However, historical data shows the prevailing negative sentiment is not just a product of recent policy interventions, but part of the large malaise that has plagued the sector in the past decade.

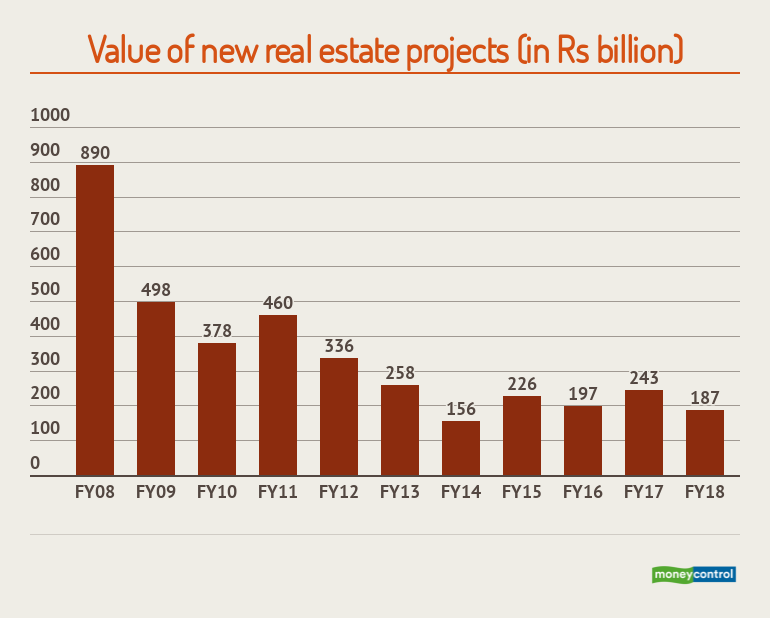

New project launches Source: Centre for Monitoring Indian Economy (CMIE)

Source: Centre for Monitoring Indian Economy (CMIE)Data compiled by the Centre for Monitoring Indian Economy (CMIE) shows the launch of new real estate projects in the June quarter of the current financial year has dropped by 60 percent from the year-ago period. The market for residential complexes has shrunk by 42 percent between 2011 and 2017.

Demand for real estate led to a boom in the construction business in the aftermath of the global financial crisis of 2008. With other financial instruments turning risky, realty was considered a safe haven for investors reluctant to weather the storm unleashed in the equity market. Between 2008 and 2011, the number of new housing projects went up by 66 percent, from 428 to 711.

However, the construction of commercial complexes has not fluctuated significantly from the average. Leasing of space for office and commercial use is largely determined by corporate performance. This can be used as a surrogate metric for gauging the prevailing consumer sentiment. In the first half of 2018, 48 new commercial complexes were announced, a sharp drop from the 193 projects commissioned in 2017.

Source: Centre for Monitoring Indian Economy (CMIE)

Source: Centre for Monitoring Indian Economy (CMIE)The total worth of new projects undertaken has also declined. 2018 presents an anomalous example. The number of new projects commissioned in the first half of 2018 is significantly fewer than those for the previous year. However, data suggests that these are big-ticket projects. The total worth of real estate development undertakings in the first half of 2018 is in the same ballpark as the figure for 2016.

Farrukhnagar Industrial Park Project, whose worth is Rs 600 crore, is the largest deal announced in 2018. Almost Rs 2.5 lakh crore is locked in stalled real estate projects. Stalling rate is defined as the value of stalled projects as a proportion of the projects being implemented. Commercial stalling rates touched a stalling rate of 20 percent in 2018, according to CMIE data.

Hostile banking sectorData from the Reserve Bank of India (RBI) database indicates that many construction and real estate development companies have run afoul of the banking sector. Fewer banks have been willing to risk exposure to housing and commercial projects after 2014. Credit growth to the sector went into the red in 2017 before picking up marginally to the present level.

Activity in the housing space might have taken a hit after demonetization and the implementation of policies to protect the interests of buyers in the event of a default by property developers. However, stagnation in prices is also indicative of sluggish demand.

According to data compiled by National Housing Bank-Residex, the value of real estate has tapered, especially in tier-I and tier-II cities. Prices have remained flat in the suburbs of cities such as Mumbai and New Delhi. With the RBI’s monetary policy committee (MPC) favouring inflation control over low-interest rates, demand might remain muted as housing loans will remain expensive.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.