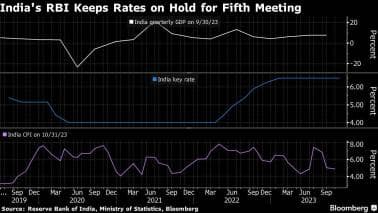

The Reserve Bank of India on December 8 left its key interest rate unchanged for the fifth consecutive meeting, citing a potential resurgence in inflation and signalling that price stability remained its primary objective.

The Reserve Bank of India's monetary policy committee (MPC), as expected, kept the repo rate, at which banks borrow short-term funds from the central bank, at 6.5 percent, as prices remain higher than the central bank’s medium-term target of 4 percent.

Repo Rate on Hold

Repo Rate on Hold

The headline inflation remained within the RBI's tolerance band of 2-6 percent for the second straight month in October at 4.87 percent but has stayed above its medium-term target of 4 percent for 49 consecutive months now.

Core inflation, which excludes food and energy prices, eased to 4.2 percent from 4.5 percent in September.

RBI CPI Forecast FY24

RBI CPI Forecast FY24

The MPC hiked the repo rate by 250 basis points (bps) to 6.5 percent in 2022-23 to rein in inflation. One basis point is one-hundredth of a percentage point.

Earlier, an MC poll of 10 bankers and economists had predicted a status quo in policy rates.

The RBI has been fighting a tough battle against a persistently high inflation. High inflation snatches away the purchasing power of poor households and, thus, impact the overall demand scenario.

Announcing the MPC decision, RBI Governor Shaktikanta Das said the rate-setting panel was closely watching the inflation and was willing to act on rate front in keeping with the data.

Besides domestic factors, the MPC was closely watching global developments for risks, which include commodity prices and evolving geopolitical situation.

The MPC's next meeting is planned for February 6-8.

This is a developing story. Please check back for details.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.