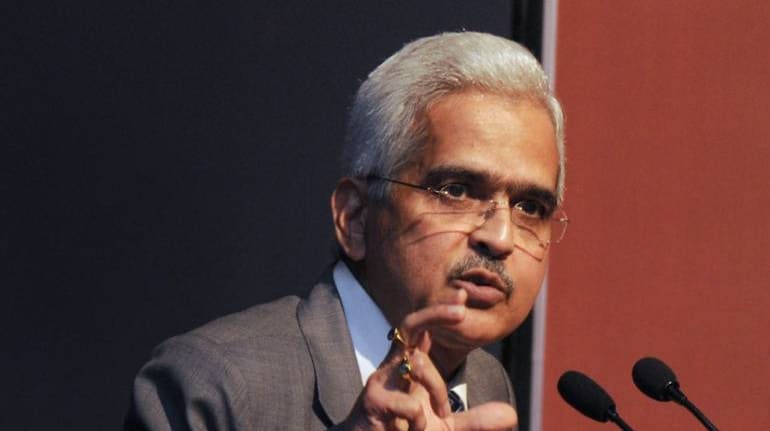

The Reserve Bank of India (RBI) has done its part to support the country’s dwindling economic growth but there is room left for structural reforms by the government, said Governor Shaktikanta Das on Wednesday after delivering the fourth consecutive rate cut.

The Monetary Policy Committee (MPC) that met from August 5-7, voted in favour of reducing the repo rate by 35 basis points to 5.4 percent, its lowest in nine years. Since February, the RBI has cut its key policy rates by 110 basis points.

“At this point, perhaps, it is a cyclical slowdown, not really a deep structural slowdown but nonetheless we have to recognise that there is a room for certain structural reforms which need to be undertaken,” Das said, adding that adequate measures need to be taken by all stakeholders.

The RBI expects growth to pick up in the fourth quarter of the current financial year, on the back of monetary policy easing and government reforms. The central bank has cut its overall growth projection for 2019-20 by 10 basis points to 6.9 percent.

Das also said this was not the time to look at real interest rates and closing the output gap was the determining factor of the MPC’s decision.

In terms of monetary policy transmission, Das said that banks are expected to lower their lending rates soon and credit growth is likely to pick up going ahead. “Banks have just come out of the overhang of non-performing assets and other problems. They were experiencing continuous quarters of loss, some of them are turning around. Credit flow will improve in the coming months,” he said.

Also, this is the first time that the central bank has used an unconventional measure to deliver policy action. Das said that the size of the rate cut was calibrated to the dynamics of the situation and a 35 basis points cut was a balanced measure.

“MPC was of the view that the standard 25 basis points would be inadequate in view of global and domestic macroeconomic developments. On the other hand, reducing policy repo rate by 50 basis points might be excessive, especially after taking into account the actions already undertaken by the RBI,” he added.

Also Read: RBI Policy: MPC cuts repo rate by 35 bps to support growth

Also Read: RBI cuts repo rate by 35 bps: Here are 10 takeaways from MPC meet

Also Read: Boost to NBFCs: RBI to set up payment registry, raises limits for bank lending

Also Read: Rate cut in consonance with medium-term CPI inflation objective, says RBI

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!