“The work is tough, especially during the day due to the current heatwave. Moreover, customers often call and demand we pick up other things on the way. It takes time to complete a delivery and receive good ratings. It is not a job of 10-15 minutes. The quality of service degrades if one is in a hurry,” said a Mumbai-based delivery executive. He usually delivers 10-20 orders a day.

Another executive, based in Gurgaon, outside Delhi, said, “Delivering was my choice, as I had to run a household also. But a 10-minute delivery adds to my stress. I only rush when I want to pick more orders, otherwise I avoid doing so.” Both executives asked that they not be identified.

Lakhs of such executives are working around the clock to deliver orders in the promised 10-20 minutes. It has been some time coming but over the last month or so, the quick commerce space has seen a swirl of activity. From restaurant aggregator Zomato’s 10-minute delivery and grocery delivery firm Zepto’s 10-minute food delivery service Café, the segment has seen some moves that change its underlying dynamic.

But if the speed of deliveries has picked up, so has the pace when it comes to employee churn. Moneycontrol spoke to several experts including analysts tracking the space, as well as to entrepreneurs and investors to understand how this battle is playing out against the backdrop of all-time-high attrition and poaching, apart from a raft of deals.

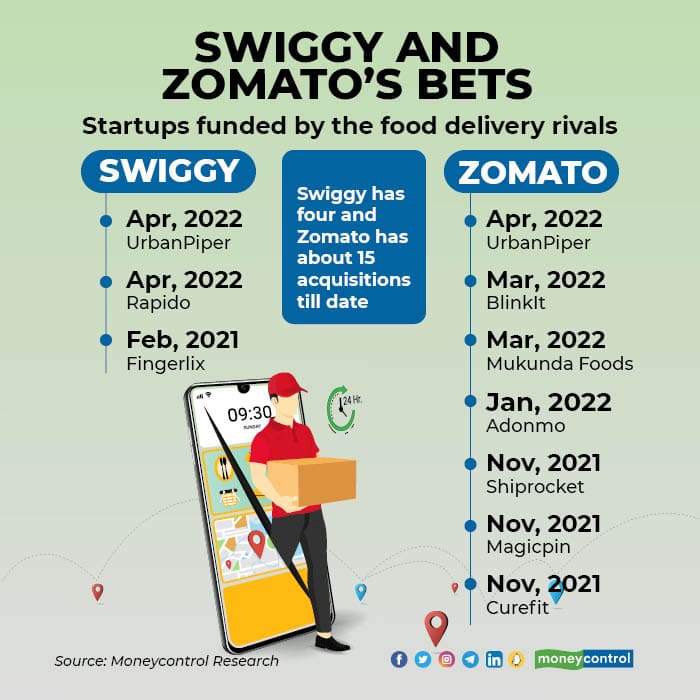

Take on deliveryPerhaps the more interesting development is food ordering and delivery platform Swiggy investing in bike taxi firm Rapido, Given the high churn, experts say that this move will give it an edge over their competitors in terms of delivery executives. The monthly attrition rate in the industry is 18-20 percent, say experts.

In a business where human capital is of critical importance, retention of talent assumes primacy. So among other moves to combat the high turnover, both Swiggy and Zepto now allow delivery executives to transition into full-time, managerial-level jobs, while last week Zomato founder Deepinder Goyal said he will be donating all his employee stock option plan (ESOP) proceeds worth Rs 700 crore towards the education of children of Zomato delivery partners.

But Swiggy’s deal for a 15 percent stake in Rapido has attracted attention. “Rapido has been a leader in the bike taxi space. This move basically means that others cannot invest in them and it's a missed opportunity for the rivals,” says a startup founder who works with many of these players. The thinking is that Rapido delivers Swiggy an in-house pool of delivery executives.

But speed may not always be a good thing. Speaking to Moneycontrol, Rapido co-founder Pavan Guntupalli said, “As these companies look to penetrate deeper inside cities and towns, the demand for delivery executives increases. And these time-bound deliveries then provide incentives to the riders which makes the delivery job stressful.” He added the average time for food delivery for Rapido riders is 26 minutes.

Swiggy in a blogpost said it is not into the 10-minute delivery business. “When we started Swiggy Instamart, we did deliveries in 30-45 minutes; with the growth in the number of dark stores, improved tech, logistics and learnings, we brought it down to 15-30 minutes. Today, in the major cities, we deliver in under 20 minutes.” Dark stores refer to large warehouses where orders placed online can be collected.

This also fits in well with Swiggy’s intracity errand service Genie, which now contributes 5 percent to its overall business.

“With this investment, Swiggy can now penetrate into the Tier 2 market where Rapido has a strong presence,” said Saurav Chachan, director at research and consulting firm RedSeer.

Some see this as the way ahead, “If you see how China’s companies have progressed, many went from food delivery to transportation. So, these partnerships are understandable and it obviously becomes a disadvantage for others,” said Abhishek Bansal, co-founder of logistics firm Shadowfax. He added that a lot of these apps may plan to go horizontal and become a super app, so focusing on a single category will not help achieve it.

But while Swiggy may have found a workaround for the employee churn problem for now, that is not the case with the industry at large. Chachan said, “With the number of offerings these players already have, attrition of delivery executives is definitely a problem.”

This demand is reflected in statistics from staffing companies like Teamlease and Quess Corp that are also seeing high demand for delivery executives in the quick commerce space. For instance, Qjobs, the online platform of Quess Corp, saw a 129 percent growth in the delivery segment in Q4FY22, with Delhi, Mumbai, Hyderabad and Bangalore topping.

Zomato, on its part, last year invested in logistics firm Shiprocket, which is currently not into the quick-delivery space but is likely eyeing it, according to a person aware of the development. “Shiprocket lets its merchants decide the speed of shipping with same day (3-6 hour) delivery being the fastest speed we can offer to merchants today,” said Saahil Goel, co-founder, Shiprocket.

On the other hand, Zomato is also set to acquire online grocer Blinkit, formerly Grofers, which promises quick service, and has made other strategic investments including Delhi-based hyperlocal merchant aggregator Magicpin and Bengaluru-based food tech firm Mukunda Foods.

An executive tracking this market added, “With these investments, they can now better control their operations, can decide over the clientele, which gives them an added benefit.”

Another executive of a rival company had a word of caution, though: “Many conclude that there are a lot of synergies and they will merge, etc, but merging operations is very difficult. And it even slows down the businesses.”

10-minute delivery: how long?

From calling it a gimmick to terming it an unsustainable model, many experts have been leery of the 10-minute delivery model. But not all see it that way.

“Actually, a lot of the delivery executives love it. It involves short travel which means less fuel as there are dark stores set up every 2 km. So you deliver more orders in less time with more incentives,” said Bansal of Shadowfax.

A Zomato spokesperson said, “We are not facing any issues so far. We are achieving this by extensive training and ensuring that there are no use cases (with short and defined routes) where the partner has to exceed normal speed (20-30 kmph in city traffic).

Then there is the huge problem of logistics. An executive of a logistics firm who manages dark stores said, “There are two issues. One is your real estate cost and then the scaling of these dark stores. To do a 10-minute delivery, say you need 100 dark stores in that geography and each dark store should be able to carry out more than 500 orders to be sustainable. If it is one player, the market is obviously big. But if there are 20 players, is the market big enough?”

Quick-commerce penetration within the online consumables market is about 7 percent and is expected to grow to 12-13 percent by 2025, which will be a $5-billion market, according to a report by RedSeer. That still begs the question: Is it big enough?

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.