Real Estate Investment Trusts, or REITs, were billed as the ideal fixed income alternatives when these securities appeared in the Indian capital markets over three years ago. But the recent under-performance of listed REITs has cast a shadow of doubt on the viability of this investments for individual investors.

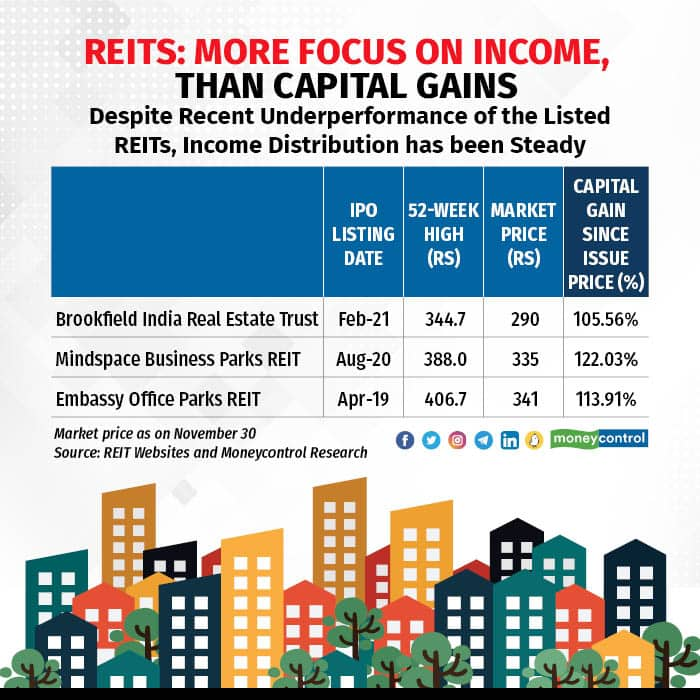

All the three listed REITs in the Indian equity markets are down 14-16 percent from their 52-week highs.

REITs are structured as trusts that own and operate property with the objective of generating a rental income or yield. The REIT entity is listed on stock exchanges, similar to any company’s shares and the income (rentals, at least 90 percent) made from properties held by the REIT is distributed to investors who hold these REIT units as interest and dividends.

Given that rentals are a visible, steady income and ideally REIT properties have long-term leases with their vendors, this type of income is considered stable and semi-fixed.

Also read | Do you need REITs in your portfolio?Capital gain or lossFor investors, the yield from income distributed is the primary reason to buy REITs, even though as listed entities there is an element of capital gain or loss on the unit market price, which one has to contend with as well.

Since, 90% of the income generated is distributed, the market price of the REIT is not expected to fluctuate too wildly in the long term

Since, 90% of the income generated is distributed, the market price of the REIT is not expected to fluctuate too wildly in the long termSince, 90 percent of the income generated is distributed, the market price of the REIT is not expected to fluctuate too wildly in the long term.

COVID-19 led to empty spacesEmbassy REIT was the first to list in Indian stock exchanges in March 2019. Exactly a year later, in 2020, COVID-19 struck. Offices shut down, people shifted to working from their homes and home towns. Offices emptied and co-working spaces were deserted.

Companies with large office spaces began to feel the pinch of rentals paid for empty spaces and began to renegotiate their terms. Clearly, the property owners would have to defer the receipt of rentals or in some cases, where the initial commitment period was yet to to run out, even let go of expected revenue from rentals.

More than two years since the start of the coronavirus pandemic, now, prospects appear to be improving.

According to Vivek Rathi, Director of Research, Knight Frank India: “Given the strong premise of office space as an enabler of enhanced work experience, corporate brand identity and productivity, return to office began post the pandemic experience. We expect that recession fears in the US and some European countries next year will lead to some delay in occupier decision making. However, the strength of the Indian office market, driven by availability of technology talent, improving space cost arbitrage and quality supply eco-system will ensure a strong occupier interest.”

What is the likelihood that this situation will gradually go back to pre-pandemic norm of only working from office?

Nishant Agarwal, Senior Managing Partner and Head of Investment Advisory and Family Office, ASK Wealth Advisors, believes that things are looking up. “We are seeing escalations, renewals and new leases all trending upwards. Plus, there are more large-sized, global tenants taking up space, which allows us to remain positive on the Indian commercial real estate market,” he said.

Despite the uncertain timing of the listing of three REITs in the Indian markets, fact is that it is still very early days for the investment avenue and a lot more growth may be expected post the brief pause thanks to the pandemic.

A PWC report from April 2022, India’s Real Estate and Infrastructure Trusts: The Way Forward, has published data comparing the market capitalisation of REITs across different countries. At Euro 9,267 million, India’s REIT market capitalisation is 10 percent of the Singapore REIT market and 0.5 percent of the US REIT market.

Currently, the three listed REITs in India operate in the commercial real estate and office park space. Recent reports suggest that a REIT operating retail assets may also soon be on offer for investors.

The way aheadThere are 198 REITs listed in the US and 33 in Singapore, India so far has three and all in commercial real estate. This suggests scope for expansion in the long run. As the market evolves, more areas of real estate like retail, residential, hospitals and so on will be included in the structure of investing.

REITs offer small investors a way to earn from large real estate with the advantage of small ticket-size investments and stability of rental income. While a REIT is technically an equity asset, valuing REITs like other equity stocks may make for confusion. Their real value lies in the certainty and visibility of future cash flows through contracted leases.

As REITs evolve and options emerge in other types of real estate, investors too can get more discerning about where they invest.

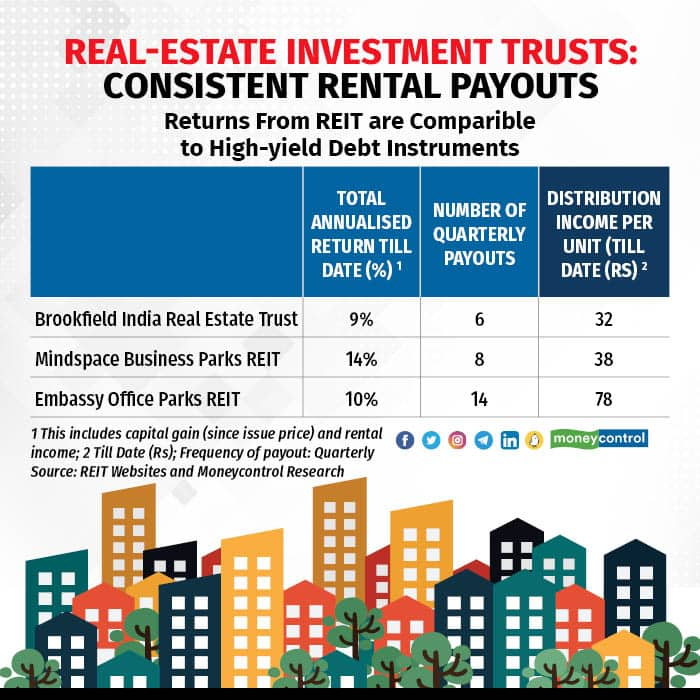

Agarwal says: “Within the debt allocation of investor portfolios, REITs have a place in the high yield/hybrid allocation. This could be around 8-10 percent of the debt portfolio at its most optimistic level.”

Investors in IPOs of these REITs have gained anywhere between 9 percent and 14 percent in total returns in which period, capital plus income, but for those who buy REITs in the secondary market, the purchase price is an important consideration.

Investors in IPOs of these REITs have gained anywhere between 9% and 14% in total returns

Investors in IPOs of these REITs have gained anywhere between 9% and 14% in total returnsExperts suggest that investors look at the consistency of distributable income over the last few quarters and then compare it to the overall post-tax yield against the next best debt investment alternative. In the current trend, one may see a heightened risk of short-term capital loss given that the nominal interest rates in the economy have moved higher quite quickly and rental yields are yet to catch up, affecting the valuation of REITs.

According to Nitin Bavisi, Chief Financial Officer of Ajmera Realty Infra India, “The recent corrections in the price points of the three listed REITs has made it further lucrative for investors. Considering other merits of the assets diversification, tax efficiency, regular returns, etc., REIT works for investors looking for diversification and a product between pure equity and debt entry.”

He added: “REITs, apart from the returns, also offer an advantageous aspect of participating in real estate play with limited capital, ease of entry and exit modes and professional management under a strong regulatory framework.”

What should you do?REITs are not without their own risks. For commercial property REITs, maintaining high long-term lease occupation is important and should be tracked closely. The ability to negotiate timely escalation and keep renewing such leases is also of primary importance. Cash flow from such long-term leases is what will add to stability of distributable income.

If you are looking to add REITs to your high yield debt portfolio, experts suggest that your expectation at a 2-3 percent premium over conservative debt returns.

Look at the historical trend of income distribution along with the potential yield at the current market price. Whether you buy in the secondary market or wait for a new REIT public issue, be sure to have a long-term, 7-8 year-plus investment horizon with the focus on maximising gains from income distribution rather than capital gains.

As the REIT market evolves, more investors will understand its place in their long-term portfolios and price discovery of listed entities will also benefit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.