Thanks to the Reserve Bank of India’s liquidity inducing steps and measures to kick-start the economy by reducing interest rates, bank deposit rates have also fallen to multi-decade lows. Liquid, ultra short-term and money market funds too have delivered pre-tax returns of 4.5-6 per cent over the past year. So, if you want to invest in debt instruments, what are the attractive options you have?

Investors in the higher tax brackets have a way out. If they wish to invest for short-term goals, tax-free bonds are available in the secondary market. A few series of tax-free bonds issued by state-run infrastructure finance companies are available with residual maturity of 1.3-3 years in the secondary markets. They are liquid and offer better post-tax returns.

Tax-free bonds offer safetyThere were 14 state-run infrastructure finance companies including National Highways Authority of India (NHAI), Indian Railway Finance Corporation (IRFC), REC (formerly Rural Electrification Corporation Limited), Power Finance Corporation (PFC) and Housing and Urban Development Corporation (HUDCO) that had been allowed to issue the secured tax-free bonds in the period between financial year (FY) 12 and FY16. These bonds were issued with the tenure of 10, 15 and 20 years, paying interest annually.

Interest earned from these bonds is tax-free. And since these bonds were issued by public sector undertakings and financial institutions that are backed by the government of India, they are largely safe.

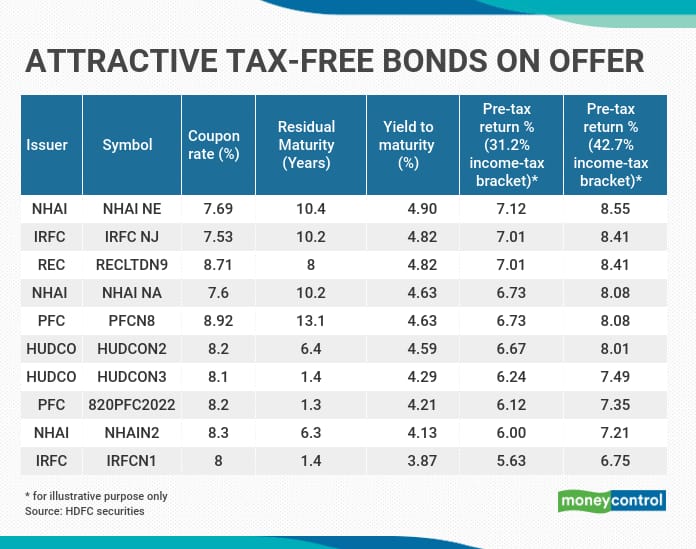

A total of 193 series of tax-free bonds are listed on the bourses. They are now traded in the cash segment of the BSE and NSE. Data compiled by HDFC Securities shows that while most of the series have low volumes, around 18-20 series of tax-free bonds are traded with relatively higher YTM (yield to maturity) and reasonable liquidity in the exchanges.

Stick to high-quality and liquid bondsThough many of these bonds are issued by government companies – fully or partly owned – you must stick to highly rated ones. The tax-free bonds issued by NHAI, PFC, IRFC, HUDCO, REC and IIFCL India Infrastructure Finance Company Limited) have the highest ratings. Jawaharlal Nehru Port Trust (JNPT), NHPC, NTPC (formerly National Thermal Power Corporation), National Housing Bank (NHB) and NABARD, too, are rated at the highest ‘AAA’ grade by credit rating agencies.

Liquidity or the trading volume plays an important part while buying and selling bonds in the secondary markets. When executing buy orders, you may not get the desired price in the bonds that are thinly traded.

HDFC Securities’ data shows that out of the 193 series of listed tax-free bonds, only nine bond series are traded with daily average volume of at least 1,000 units in the last one-month, either on the BSE or the NSE (as on October 19, 2020).

Higher yielding bonds work out betterWhile buying bonds, keep an eye on the yield to maturity (YTM). The higher the YTM, the better it is because it indicates that your bond prices, and hence the capital gains, are likely to go up. A bond’s YTM can be calculated in a Microsoft Excel spreadsheet, or your broker can easily calculate that for you. But go for higher rated bonds at higher YTMs as far as possible.

As per HDFC Securities data, around 18-20 series of tax-free bonds are traded with relatively higher YTM. The highest YTM currently available is 4.4-4.9 per cent. In comparison, State Bank of India (SBI) fixed deposit now offers just 4.9 per cent for one year to less than two years’ tenure. But as interest is taxable, post-tax returns in bank FDs go down to around 3.4 per cent, for investors in the 30 per cent bracket. Hence, tax-free bonds are attractive avenues for investors in the higher tax bracket.

Is this the right time to invest at low yields?Low yields on tax-free bonds can backfire if interest rates start to move up and you remain invested in longer tenured bonds. You suffer a capital loss, as yields and bond prices move in opposite direction. Deepak Jasani, Head of Retail Research, HDFC securities says, “Yields of these tax-free bonds are likely to remain sticky at these lower levels at least for the next few quarters, given the commitment of the RBI to prioritise revival of growth and maintain the “accommodative” stance at least in the current and next financial years. Locking-in your investments at current low yields in the longer residual maturity bonds is not advisable now as the possibility of MTM (marked-to-market) gains due to further fall in interest rate from here on is limited. However, investors can consider investing with a short-term horizon.”

But you should look at bonds that are due for maturity soon. Consider tax-free bonds available with residual maturity (the remaining time until maturity date) of between 1.3 years and 15 years. Of the actively traded bonds list, around seven series are available with residual maturity of 1.3-3.3 years. Invest in these bonds and hold them till maturity.

Ashish Shah, founder of Wealth First says, “With the 4.4-4.6 per cent YTM, tax-free bonds are still an attractive buy for investors in the 43 percent tax slab, as it is equivalent to 7.8-8 percent yields that the AAA rated corporate bonds offer (on a pre-tax basis). Currently, the AAA rated bonds are available with YTM of 7 per cent or lower.”

You need demat accounts to buy these tax-free bonds in the stock exchanges. Both the BSE and the NSE facilitate the purchase and sale of tax-free bonds.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.