Slowly but surely, index funds are gaining popularity in India. At least for large-cap investing, taking the index fund route seems to be gaining traction.

Passive funds replicate their chosen equity benchmark by investing in the same stocks which constitute the underlying index. Also, the proportion of each stock in the portfolio will be exactly the same as the weight of the stock in the index. So the index fund will match the performance of the markets and not try to outperform it.

So why invest in index funds at all?

The idea behind index investingApart from giving a low expense and maintenance investment option for investors, another factor to be considered is that over the last few years, the number of active large-cap funds that have beaten the index has reduced. Even for those active funds that are still beating the index, the margin of outperformance has been reducing. This is a far cry from the earlier years when active fund managers could easily beat their benchmark indices.

Now comes the next question of which index funds to choose? Or more specifically, which index to choose. There are many in India, but the major ones when it comes to index fund investing are Sensex and Nifty 50. These are the most popularly tracked Indian stock market indices.

The major difference between the Sensex and the Nifty is that the former is a measure of the performance of the top-30 Indian companies, while the latter tracks the top-50.

One obvious factor used to choose between Sensex and Nifty is the return delivered by either.

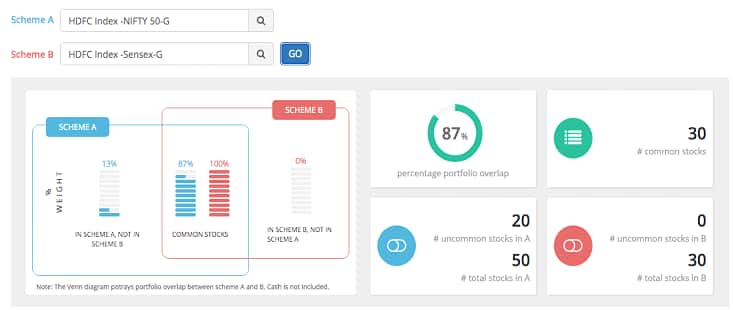

From the historical data, it is clearly evident that even though there might be slight differences in the daily movement of both the indices, the long-term path followed by both are more or less in sync. There is a large overlap in the portfolio of the indices, as highlighted (87 percent currently). The following image is on two index funds tracking the Sensex and Nifty 50 (source: thfundoo.com).

Comparatively, the Sensex is more concentrated given the lesser number of stocks it is made up of. So it’s possible that if there is a narrow rally in markets, then Sensex may give slightly better returns than the Nifty due to its higher concentration. On the other hand, if it’s a more broad-based rally that encompasses stocks that are part of Nifty but not Sensex, then Nifty might hold the advantage.

Historically, the moves have been more or less similar. So it would mostly be the case of intermittent phases of one index doing better followed by the other one taking charge. So, if you are an index follower and plan to invest in index funds for the long term, seemingly, there won’t be much of a difference between the returns of either Sensex or Nifty.

Concentration riskOne problem that all index funds replicating the Sensex or Nifty 50 suffer from is concentration risk. That is, the index ends up having a more-than-comfortable concentration in just a few stocks or sectors. But that’s not too big of an issue for now and hopefully will be addressed by the index management committees in due course of time.

But that apart, there is nothing substantially different to choose between the two benchmarks while picking your index funds. So, if you were to ask me as to which amongst the two indices is better, then I would say that both are reasonably good choices. You can go with either.

Many people invest in both. That is not required. Don’t pick both Sensex and Nifty index funds as they won’t help you with any additional diversification, given the inherent overlap in portfolios. Instead, you can pick just one amongst Sensex or Nifty for large-cap index level exposure. And for more, you can look at other index fund options outside the top-30 or top-50 stocks. Picking an index fund that tracks the Nifty Next 50 is a good idea.

So all said and done and assuming you want to invest in an index fund for the long-term, you can choose either of the indices. But take note of factors such as expense ratio, tracking error and asset size of the shortlisted index funds.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.