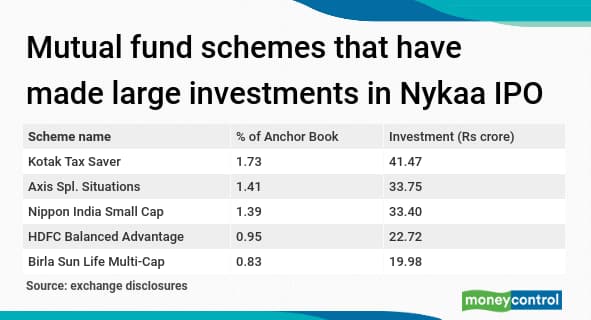

The IPO of Nykaa, an online multi-brand beauty and personal care platform, got Rs 798 crore worth of investments from domestic mutual funds. Moneycontrol spoke to some of the fund managers to understand the factors they considered while investing in Nykaa’s IPO. Due to regulatory restrictions, they spoke on conditions of anonymity.

Profitable business

The fact that Nykaa was making profits was an important investment consideration. The company reported net profits of Rs 61.9 crore and revenues of Rs 2,452 crore for FY21.

“The company has a strong business model and is making profits. It is also expanding into fashion, which is also a growing space,” says chief investment officer of a fund house.

Nykaa Fashion was launched in 2018. It hosts 1,350 brands and over 1.8 million different garments for women, men and kids. Broking analysts say that Nykaa Fashion has clocked the highest average order value among leading online fashion retail platforms in India during FY21.

The size of the online fashion market is Rs 45,000 crore, with penetration of just 5 percent. This shows the potential for growth in the space.

Not dependent on discounts, cashbacks

When it comes to e-commerce or online shopping businesses, fund managers say it is important to assess whether the company can have a long-term profitable growth.

“E-commerce companies find it difficult to make profits as, in several cases, their business models are heavily dependent on giving cashbacks and discounts to consumers. But with Nykaa, it is not the case,” says a second fund manager.

“They found that it was difficult for consumers to get genuine beauty and personal care products, especially in non-metro cities. They decided to bridge that gap, which is what has made consumers come to Nykaa,” he added.

Nykaa is also pushing its private labels in the beauty and personal care spaces, as well as in the fashion segment.

Expensive valuations, but potential of high growth

As Nykaa was early in identifying the challenges faced by consumers and building a business around those, it has become a leader with market share of 37.6 percent in online beauty and personal care.

“When it comes to internet IPOs, it is important to look for companies that are market leaders, as you don’t know what might happen five years later. However, a market leader would be better-placed to deal with government policy impact or regulatory changes than new entrants,” says a third fund manager.

Also read: Why are mutual funds making a dash for investing in IPOs?

“Being an established market leader in a consumer space that is fast-growing does suggest that the company may grow at a health rate for many more years to come. The company’s valuations are expensive due to visibility of high growth,” he added.

According to broking analysts, Nykaa is likely to trade at a huge scarcity premium versus global peers in the online beauty and personal care business. “We believe Nykaa could trade at one-year forward EV/sales of 6-8 times, purely based on its core beauty and personal care business. However, the issue is already priced at 10.2x FY24 EV/sales, factoring in a premium multiple, backed by growth in the fashion business,” analysts at Elara Securities said in a note.

So, whether Nykaa continues to grow in the fashion business and also turns it profitable would be an important factor for its future valuations, they add.

The Nykaa IPO is open till November 1, 2021, but it has already been subscribed 1.64 times, with retail investors bidding for 3.98 times of the shares available for their category.

Disclaimer: The views and investment tips by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decision.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.