The COVID-19 crisis and natural calamities such as floods in the states of Bihar, UP, Himachal Pradesh and Karnataka have nudged many among us to lend a helping hand. But if you expect income-tax deduction benefits on your donations, then from some key changes that have been made from this year. Donations only to select charitable trusts would be eligible for tax deductions.

Is the trust registered with the government?Starting this financial year, charitable trusts must register with the Income Tax Department, which will in turn offer a unique registration number.

“Your donation details, as captured by your Permanent Account Number (PAN), will feed into your pre-filled income tax return forms from assessment year 2022-23,” says Paras Savla, partner at KPB and Associates.

But the new income-tax website has been besieged with problems. Mumbai-based chartered accountant Padam Poladia says that since this is the introductory year for this mandatory registration, none of the charitable trusts are currently registered.

So, if you randomly donate to any organisation this financial year, you would not be able to claim the taxation benefit for the amount donated.

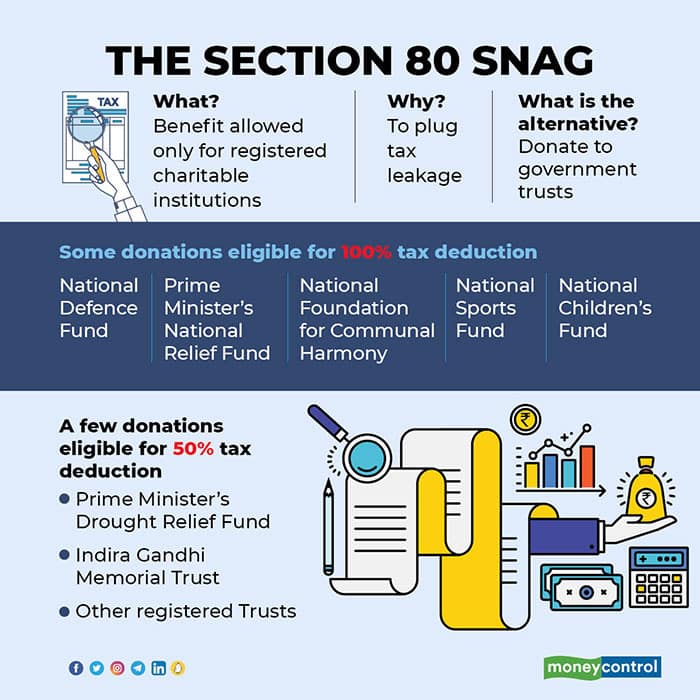

Why is registration mandatory for charitable trusts?Over the years, the government has been observing leakages caused due to fake donation claims. Sudhir Kaushik, co-founder and MD of TaxSpanner.com explains that the government “found that fake companies were formed to help individuals claim tax deduction for donations, and were being used to convert black money transactions.”

“Interest income too was not being declared by trusts and there were no means to validate whether the donation has actually been made,” Kaushik adds.

The Tax Deduction and Collection Account Number (TAN) and PAN details, along with address of the trusts, were required to claim the benefit of Section 80 (G) as electronic filing was introduced. And now, the charitable trust to which you donate must also be registered with the government.

Entities eligible for tax deductions“It is safe to contribute to the Prime Minister's / Chief Ministers' relief fund. The individual taxpayer who is making the donation will be eligible for deduction of the contribution made,” suggests Soni.

Other charitable trusts run by various government bodies, too, are still eligible for offering you Section 80G tax deduction benefits.

“Many institutions are facing challenges of non-renewal due to glitches in income tax website, which is expected to get resolved in the coming weeks,” says Abhishek Soni, co-founder and CEO at Tax2win.in.

Full 100 percent can be claimedYou can only claim a part of the tax benefit, unless the registered fund is eligible for 100 percent tax deduction benefit. The government has listed select funds (check graphic) eligible for 100 percent tax deduction equivalent to the charity amount, while others are eligible for deduction of only 50 percent of the donation amount.

“Another condition to claim the 80 G benefits is that one can claim either 100 percent or 50 percent of the amount donated, subject to it being up to 10 percent of the gross total income,” says Savla.

Let’s say a person earning Rs 5 lakh donates Rs 1.20 lakh. If the donation that can be claimed for tax deduction stands at 50 percent of the amount, she could claim Rs 60,000 under 80G benefits. But, as she can claim only 10 percent of her gross income as deduction, the 80 G benefits permitted would be Rs 50,000 alone.

If pre-filled form fails?The details of donation would be captured from charitable trusts and would be pre-filled in your tax returns. As this is a major revamp in the taxation portal, there are chances that your donation made in the past would not reflect in your income tax return forms.

What should you do if the donation is not reflected in your returns? “We can add details of donations made in the income tax return manually if not reflected in pre-filled return forms and claim benefits,” says Soni.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.