On May 28, Yes Bank extended the overdraft facility against fixed deposit (FD) through its digital channels - YES Mobile and YES Robot. The bank customers can avail this instant overdraft facility against FDs from their homes in this COVID-19 pandemic for short-term needs or medical emergencies in the family. You can also avail overdraft facility against FDs from the bank branch as earlier.

Some public sector banks and private banks which include State Bank of India (SBI), HDFC Bank, etc. are also providing overdraft facility against FDs online and from their bank branches, so it is not a novel offering.

What is an overdraft facility on fixed deposits?

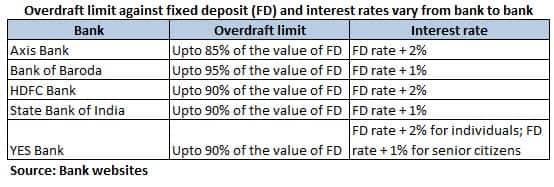

In overdraft facilities against fixed deposits you can withdraw up to 85 per cent to 95 per cent of the fixed deposit value. The bank charges an interest only on the actual amount withdrawn from overdraft and not on the entire limit of overdraft. The interest rates charged are one to two per cent above the fixed deposit rates on your fixed deposit investment.

“Overdraft facility against fixed deposits if used wisely can help you tackle your short-term financing needs smartly without liquidating the fixed deposit investment before maturity and pay the penalty,” says Harshvardhan Roongta, Principal Financial Planner at Roongta Securities.

For instance, let’s say you have an FD of Rs 1 lakh with Yes Bank earning eight per cent interest, with a maturity of three years. The bank is providing overdraft limit of 90 per cent on this FD i.e. Rs 90,000. You withdraw Rs 50,000 from the overdraft limit against this fixed deposit. So, the interest shall be payable only on Rs 50,000 of the amount and not on the entire Rs 90,000.

The interest rate charged will be two per cent above the fixed deposit rate (assuming you are a non-senior citizen). So, you will have to pay as per 10 per cent per annum interest only for the period (days or months) amount is utilised and not for the entire tenure of fixed deposit with the bank. The overdraft limit against fixed deposit (FD) and interest rates vary from bank to bank (refer to table).

Some banks such as Axis grant overdraft against fixed deposit with a cheque book, ATM card, internet banking and mobile banking facilities to withdraw as per your requirement from the limit granted and credit back in FD account. Overall, you can manage it as per your convenience.

I am a senior citizen; can I apply for overdraft facility against my FD? Yes, senior citizens having a fixed deposit and savings account with the same bank can avail overdraft facility against FD. Resident individuals (non-senior citizens) can also avail this facility. However, some of the banks for instance, Yes Bank restricts holding patterns to single holders in fixed deposits to take advantage of this scheme. So, if you are a joint holder in a fixed deposit scheme then cannot withdraw using an overdraft facility whenever required. However, if you are SBI customer with savings account and fixed deposit holder in joint name then you can apply for overdraft facility from the bank branch.

Yes Bank charges lower interest rates for overdraft against FD from senior citizens compared to other private banks (refer to table above).

What happens if I do not settle overdraft against FD prior to maturity?

In case of overdraft against fixed deposit, lien is marked on FD in favor of the bank. Lien gives the bank automatic claim over the deposit. The deposit is under banker's possession for the time the deposit has been on lien. However, interest will continue to get credited to account linked. On maturity of FD, some of the banks deduct the unpaid overdraft balance with interest charges and credit the remaining amount to your account.

In case of Yes Bank overdrafts against FD, if the amount withdrawn against FD is not settled prior to the maturity of the FD, bank shall auto renew the fixed deposit for the same tenure at prevailing rates.

It’s important to note, you cannot prematurely close the bank FD unless the overdraft against bank FD is repaid in full.

I have a tax saving fixed deposit with the bank, can I avail overdraft facility against it?

Banks do not provide overdraft facilities against tax saving fixed deposits as well as on recurring deposits.

With falling interest rates of fixed deposits should I opt for overdraft on new FDs or old FDs?

Banks such as HDFC do not offer ODs if the fixed deposit is less than six months old to mature. Also, if the FD happens to be an old one there would be a good difference in interest rates. For instance, bank FDs opened last July offered an interest rate of 7.8 per cent per annum to senior citizens for one-year tenure. The rate is now at 6.1 per cent. So, if you take an OD on old deposits, the effective rate would work out to 9.8 per cent. But for new deposits, OD interest rates would be lower.

Should you opt for overdraft against FD?

Suppose you have a financial crunch due to job-loss or cut in salary caused by COVID-19 pandemic. Then overdraft against FD is a recommended option to meet immediate financial needs or medical emergency in your family. “This is available at a lower interest rate as compared to personal loans and pre-approved loans against credit card,” says Gaurav Gupta, co-founder and CEO of the online aggregator of financial products and services MyLoanCare.in.

You should have a disciplined approach while opting for overdraft facility against FD. This is because many people misuse the funds as they are easy to withdraw against FD. Roongta warns, “Do not use the funds for speculative activities such as investing in equities as it may backfire and you suffer losses.”

If you lose in volatile equity markets, then you may have to settle the overdraft availed with interest payable from invested amount in FD and will remain with very small amount from principal.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.